The JSE broke a four-day losing streak while global peers remained mixed following Monday’s sell-off. By mid-morning, the bourse had gained over 1% while during earlier trade in China, tech stocks rebounded after a renewed pledge from Beijing to step up growth.

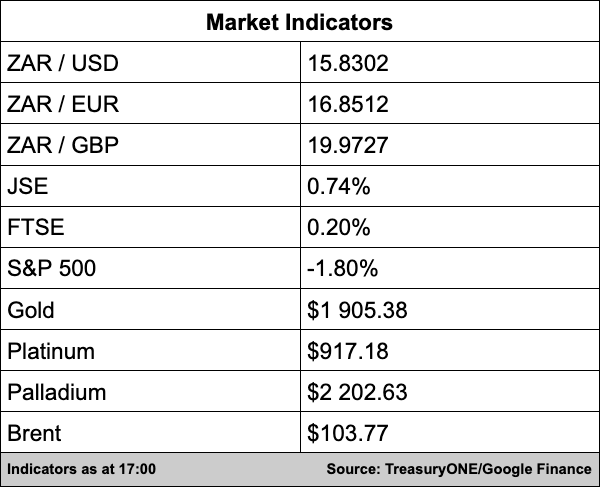

The All Share Index added 0.74% to sit on 70,264 points while the Top 40 added 0.70%.

But with ominous signs coming from Beijing that a looming Covid-19 lockdown for the Chinese capital is ahead, the Shanghai Composite lost more than 5% in its worst session for almost 15 months.

Emerging market stocks bounced for the first time in nine sessions on Tuesday but gains remained fairly limited with concerns over a coronavirus lockdown in China and hawkish comments from the US Federal Reserve.

The rand didn’t fare much better on Tuesday and couldn’t replicate the JSE’s positive sentiment ahead of the public holiday tomorrow.

“The rampant dollar continues to weigh in on the rand, and we could be looking at a close above R15.80/$ this evening. The local unit has lost a further 1% today after opening around R15.68/$ and now trades back at levels we last saw during the first week of January,” comments TreasuryONE.

When the local market reopens on Thursday there could be interesting levels on either side says TreasuryONE with liquidity being few and far between during our local Freedom Day celebrations.

On the commodity front, prices have stabilised in the metal sector with palladium the only big mover after losing over 9.4% yesterday. Platinum is currently down slightly from this morning, while gold is trading up 0.5%.

Brent Crude also recovered from yesterday’s lows after concerns over demand led to oil prices falling and is quoted at $103.70 per barrel.

In a trading update, private hospital group Netcare (-0.51%) said it had an earnings bump for the six months ended March 31 with an increase of between 8.5% and 9%. The hospital group had been impacted by Covid-19 as patients feared going to the hospital but the group has since seen an improvement in occupancy rate following the fourth wave of the pandemic.

Medical and health peers Mediclinic and Life Healthcare Group lost 0.03% and gained 1.56% respectively.

Meanwhile, Telkom (5.00%) has added former Samsung Africa CEO Sung Hyuck Yoon to its board as a non-executive director. In a trading update, Telkom said Sung “has a proven track record of turning around difficult business situations and significantly growing both new and existing business categories.”

Telkom has so far underperformed on the JSE this year compared to its mobile peers and has lost 18% on the stock exchange for 2022 while MTN has lost 3% and Vodacom has gained 10% for the year, reports Business Day.