(Bloomberg) — South Korean memory chipmaker SK Hynix Inc. reported profit more than doubled in the last quarter after datacenter sales offset slowing consumer demand and memory prices fell less than was feared.

For the rest of the year, Hynix expects a bounceback in PC and smartphone sales in the seasonally stronger second half, but that hinges on how long China’s Covid-19 lockdowns continue, which the company said have already affected manufacturing, supply chains and consumer demand.

“The biggest demand factor would be the lockdowns underway in China,” said Chief Marketing Officer Kevin Noh. “Depending on how they unfold in the future, there will be some questions that still remain with regard to the uncertainties over demand in the second half.”

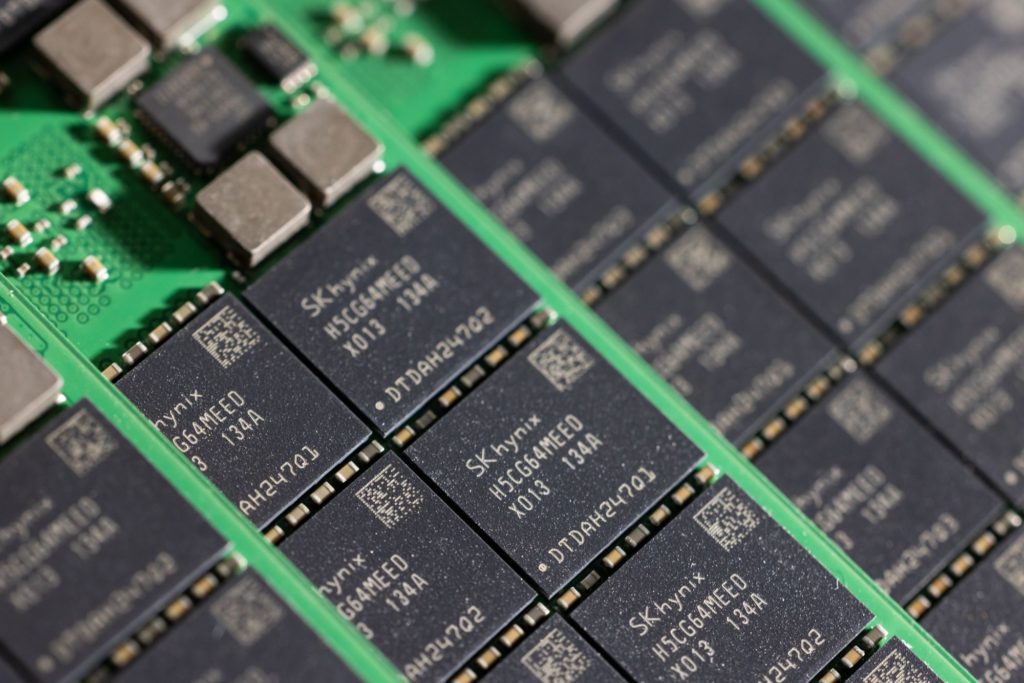

Operating profit increased to 2.86 trillion won ($2.3 billion) in the three months ended March, the Apple Inc. supplier said in a statement Wednesday. Sales rose 43% to 12.16 trillion won. The company fell shy of analyst estimates of 3.2 trillion won in profit after recording a one-time expense of 380 billion won to cover the cost of compensating customers for “performance weakness” in some DRAM products it previously sold, it said in the the statement.

Shares dropped as much as 3.2% in Seoul trading amid a wider tech selloff.

Hynix forecast annual growth of around 30% in NAND shipments and the high teens percentages for DRAM. The company expects PC and smartphone demand to remain weak — citing lockdowns as a limiting factor on how many PCs its customers can assemble — in the first half before bouncing back. It anticipates strong orders for server memory as datacenter operators are expanding at a pace similar to the cloud tech boom of 2018, the company said.

Hynix credited strong demand for computing products as a driver for its sales jump, echoing global chipmakers such as Samsung Electronics Co. and Taiwan Semiconductor Manufacturing Co. that have seen sales buoyed by strong orders from enterprise clients. The memory maker pointed to weak demand from China’s mobile market as a challenge, underscoring concern about consumer demand. Smartphone shipments this year suffered their worst drop since the Covid-19 outbreak and PC sales also slowed.

Chipmakers Argue Inventory Build-Up Signals Increased Demand

The broader memory chip industry has forecast a rebound in DRAM and NAND prices as early as the second quarter. Over the first three months of the year, prices of DRAM fell less than projections while NAND prices recovered quickly after a contamination issue reduced output from Japan’s Kioxia Holdings Corp. that tightened overall supply. But uncertainty remains as macroeconomic risks are rising and demand for personal gadgets wanes.

In addition to macroeconomic risks such as Russia’s invasion of Ukraine and soaring inflation, China’s Covid Zero policy is putting a strain on supply chains. Lockdowns and mass Covid-19 testing are slowing operations and logistics across major cities such as Shanghai and Zhengzhou, where iPhone assembler Foxconn Technology Group has facilities. Hynix has a DRAM manufacturing facility in Wuxi and recently acquired Intel Corp.’s NAND plant in Dalian.

“We are expecting a more complicated DRAM market situation for 2022,” said Kim Woon-ho, analyst at IBK Investment and Securities. “There is much anticipation that DRAM prices could rebound in the second quarter but we see a greater possibility that prices may go down.”

(Updates with share price and quote from CMO)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.