(Bloomberg) — Robinhood Markets Inc. dazzled investors with a vision for growth: Entice millions of traders to buy stocks for free, and then sell them on other financial products to be introduced down the line.

So far, that story is eluding the Menlo Park, California-based startup. User adoption has stalled, new offerings aren’t yet taking off, and investors are bracing for more losses when Robinhood reports first-quarter results late Thursday.

It’s already been a rocky week for the company. On Tuesday, it cut 9% of staff, roughly 340 employees. Customer experience and marketing were among the departments hit, according to people familiar with the matter, while the crypto team — the great hope for the future — was largely spared.

Robinhood exploded in popularity during the pandemic as new investors used its app to trade through wild market swings, including run-ups in meme stocks and cryptocurrencies. It amassed a stunning 22.7 million users by the end of 2021. But trading activity, which makes up the bulk of its revenue, is starting to wane, and nothing it’s tried so far has reversed its decline. The stock, one of last year’s hottest public debuts, is down 75% since.

“There’s some cynicism that there really is going to be more to come for this company,” said Julie Chariell, a Bloomberg Intelligence analyst for financial technology. “I don’t think people will start to be believers until the company rolls out steadier products, not tied to the whims of trading volumes.”

Casey Becker, a representative for Robinhood, declined to comment, citing the quiet period for publicly traded companies prior to releasing earnings.

Wall Street is expecting another grim quarter. The average analyst estimate calls for an adjusted net loss of $336 million in the period, according to data compiled by Bloomberg. Revenue is expected to be $353 million, the data show. Robinhood lost $423 million in the final three months of 2021, on revenue of $363 million.

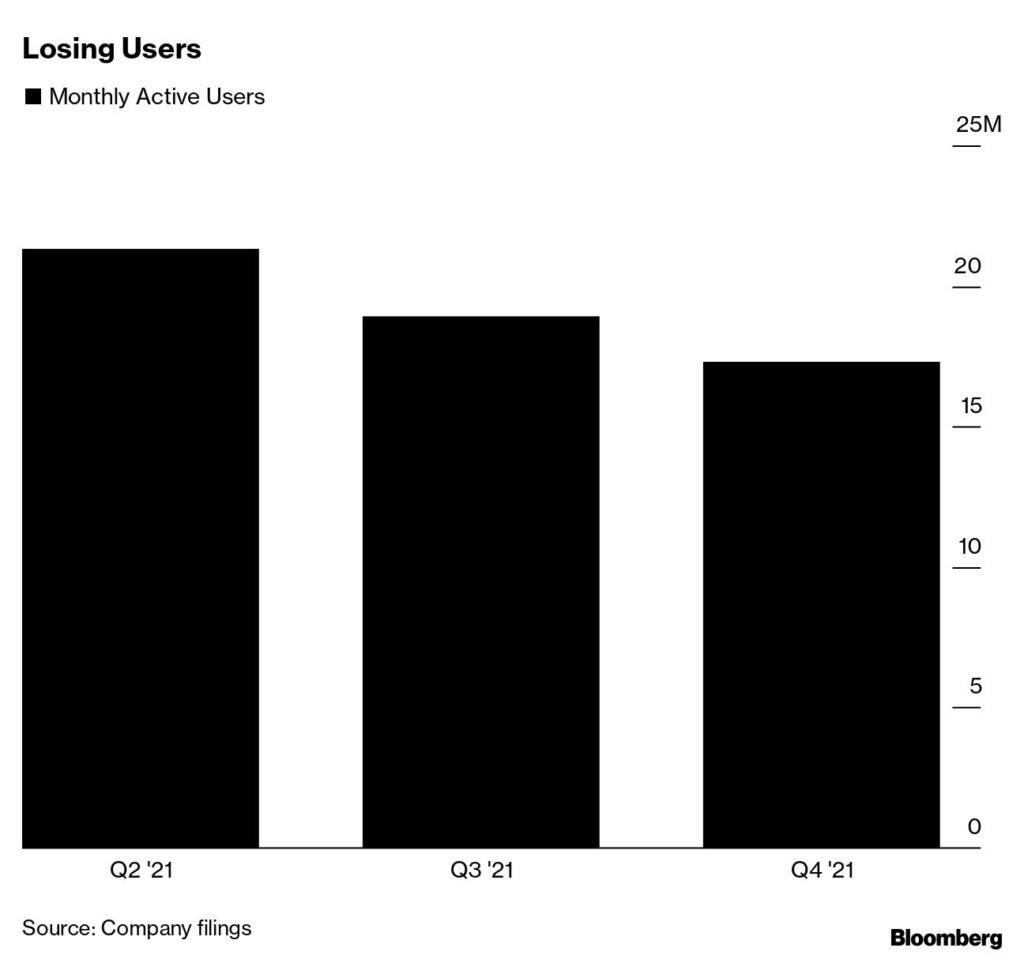

Against that backdrop, investors will be zeroing in on key areas including monthly active users, assets under custody and average revenue per user.

Not all analysts are prepared for the worst. Devin Ryan, director of financial technology research at JMP Securities, said it would be unwise to “over-read” into the job cuts.

“Robinhood does not appear to be on the defensive despite the choppy environment, and is executing on the plan laid out when it became a public company,” Ryan wrote in a note to clients.

As it struggles to regain momentum, Robinhood seems to be tying itself more closely to virtual currencies — a stark departure from 2020, when it focused on equities trading. This month saw it list four crypto assets, including the meme fan-favorite Shiba Inu coin. Earlier this month, it agreed to buy U.K.-based crypto platform Ziglu Ltd.

The dive into crypto hasn’t yet been enough. Robinhood’s monthly active users slipped 8% sequentially in the fourth quarter.

“There’s no denying the business is shrinking,” said Chariell. “People are going back to work, people aren’t trading as much, and the market is under a lot of pressure. All these things combine to say the business is not going to grow as it did before — at least for the foreseeable future.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.