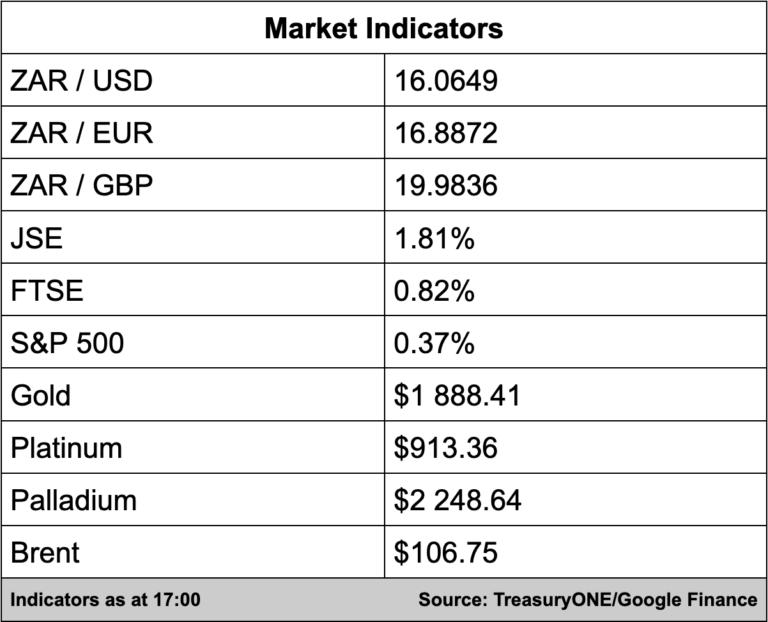

The rand weakened past the R16/$ mark for the first time since January as it continues to lose ground against a resurgent US dollar. At one point during mid-April, the local unit was trading around the R14.50 level.

The rand has weakened for nine consecutive days now and has lost over 10% since April 19 with the local unit currently trading at R16.11/$. It has not been alone in its weakness with other emerging market currencies losing some ground today.

Safe-haven assets like the dollar are attracting investors with volatile trading across major assets brought on by crises on several fronts including the war in Ukraine, soaring inflation, higher interest rates, and Covid-19 lockdowns in China.

“Given the extent of the Rand rally thus far, all the indicators are pointing to some consolidation, but it’s difficult to call a level as the momentum is not in the rand’s favour. We have seen the two best-performing EM’s of the year as the weakest currencies in the last two weeks (rand and Brazilian real), and the overreaction of the pair has brought all EM currencies in line with one another,” comments TreasuryONE.

On the commodity front, gold is trading at $1,884, platinum at $912, and palladium at $2,253 per ounce. Brent crude is also edging higher at $106.63 per barrel, and given the recent move in the rand, it will not bring relief at the petrol pumps next month.

The JSE firmed on the back of China announcing it would provide more economic support to its market with a step up in infrastructure construction following a top economics meeting led by President Xi Jinping.

The bourse added 1.81% with the All Share Index at 71,535 points while the Top 40 added 1.92%.

Pharmacy retailer Clicks (-0.33%) said half-year earnings have increased by 26% with sales jumping up 13.6% over the six months to end-February.

Clicks’ headline earnings per share rose from 370.6 cents in the 2021 half-year, to 466.9 cents in 2022.

CEO Bertina Engelbrecht said the rest of the year will be subdued with consumers facing increased financial pressure and load shedding continues to play havoc with the retailer’s operations.

Pharmacy retailer peer Dis-Chem (2.35%) expects its earnings to increase between 24.5% and 29.5% for the year despite economic challenges.

In a trading update released on Thursday, the retailer said, “The group is pleased with the performance of its businesses considering the constrained consumer environment, the challenges that were posed by the pandemic as well as the civil unrest that was experienced in July 2021.”