(Bloomberg) — MicroStrategy Inc.’s first-quarter loss widened after the company took a $170.1 million impairment charge to write down the value of its Bitcoin holdings. Revenue declined.

The enterprise software-maker run by Michael Saylor, which has made holding Bitcoin on its balance sheet as part of its business strategy, was told earlier this year by the U.S. Securities and Exchange Commission that it couldn’t strip out Bitcoin’s wild price swings from the unofficial accounting measures it had touted previously to investors. Bitcoin slipped 1.2% in the quarter, and traded about 20% lower than the price at the end of the year-earlier period.

The net loss for the three months ended March 31 was $130.8 million, compared with $110 million in the 2021 quarter. Revenue declined 2.9% to $119.3 million. That’s the lowest quarterly revenue since MicroStrategy started its Bitcoin investment strategy in August 2020. It had posted modest revenue gains for four consecutive quarters in 2021.

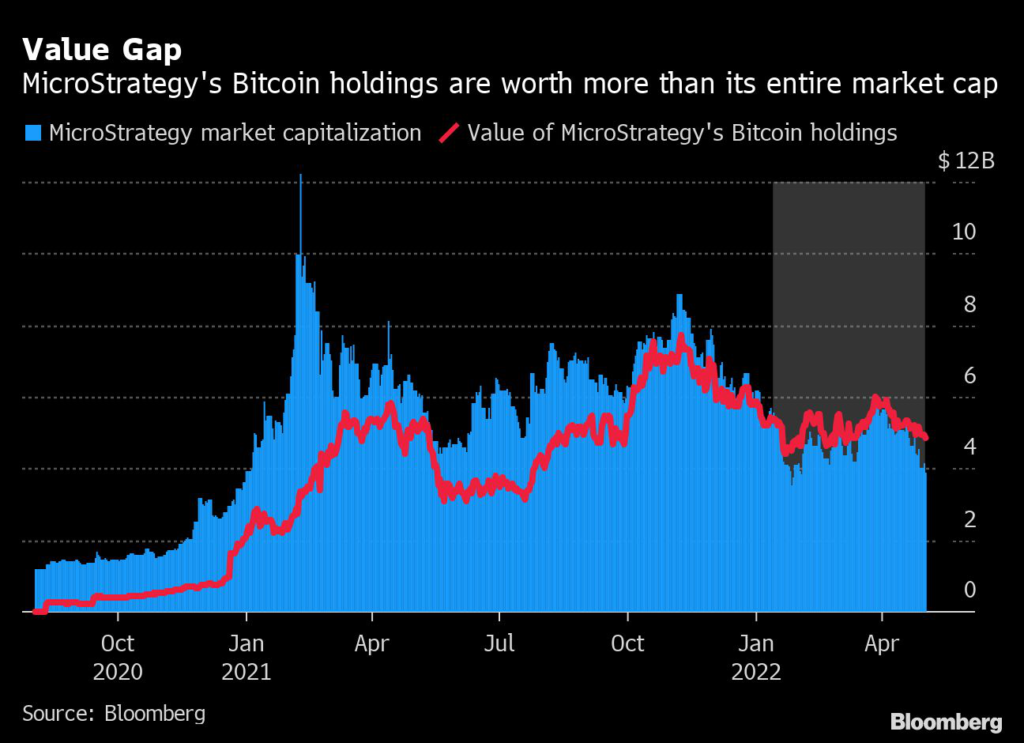

Shares of Tysons Corner, Virginia-based MicroStrategy fell 2.2% in post-market trading. The stock has dropped about 37% this year, widening the gap between the value of the company’s stock and the value of its Bitcoin stockpile.

In the first quarter, MicroStrategy bought 660 Bitcoin, compared with 20,856 in the same period last year, according to filings. The company only added to its stockpile in April after securing a Bitcoin-backed loan. The company hasn’t sold any Bitcoin, the chief financial officer said on a conference call.

MicroStrategy also named Andrew Kang as CFO as of later in May, replacing Phong Le, who will continue to serve as president. Kang was previously executive vice president and chief financial officer of fintech lender GreenSky Inc.

(Adds comment from conference call.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.