(Bloomberg) — David Wright knows a thing or two about bear markets.

His Sierra Tactical All Asset Fund barely lost anything in 2008 as the global financial crisis caused the worst market panic since the Great Depression.

Its loss during the Covid rout of 2020 was also relatively small. Wright, who is based in Santa Monica, California, says another private fund he runs didn’t lose a penny when the dot-com bubble burst two decades ago.

But none of those periods compare with what’s ahead, according to Wright.

Stocks and bonds have already fallen hard in 2022. Much more is coming, the 78-year-old said in an interview.

“I believe we are in the biggest bear market in my life,” said Wright, co-founder of Sierra Investment Management, which oversees about $10 billion.

“This is just the second inning. A lot more to come.”

There are no shortage of bears making similar claims these days. Between the Russia-Ukraine war, the aggressive tightening by the Federal Reserve, soaring inflation and Covid lockdowns in China, there are plenty things to worry about.

The S&P 500 has already lost 12% this year, while the Nasdaq Composite cratered into a bear market after sliding more than 20% from its peak in November. Key bond benchmarks are down more than 10%.

Mostly Cash

But what’s unique about Sierra is its aggressive approach to shed risk.

The $869 million Sierra Tactical All Asset Fund — a so-called fund of funds that invests in mutual funds and exchange-traded funds, held less than 3% in U.S. stocks at the end of April. More than half of the fund is in cash.

Fixed-rated bonds accounted for only 1% of its holdings, while commodities made up more than 9%. The rest of the portfolio is spread across assets including floating-rate bonds, foreign stocks and master limited partnerships.

It’s paying off this year.

The fund has lost 2.3% in 2022, beating 91% of its peers tracked by Bloomberg.

What’s underpinning Wright’s bearishness isn’t the Fed, inflation or the war. It’s the zealous behavior of investors during the past few years that sent everything from meme stocks to cryptocurrencies soaring.

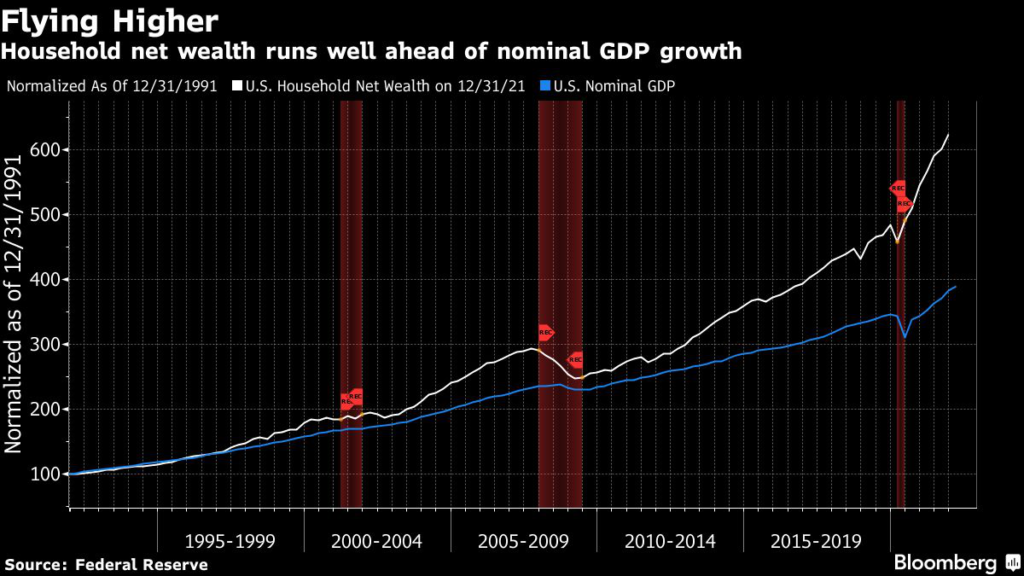

The stock market gains helped U.S. household wealth balloon to a record $150 trillion, or more than six times the size of the American economy, according to data compiled by the Fed.

“There’s no other country on earth that has staked so much of their net wealth in stocks,” said Wright, who co-founded Sierra Investment with Kenneth Sleeper in 1987.

“But we are at a very big peak of complacency.”

Using computer models, the Sierra fund, which Wright manages with Sleeper and Douglas Loeffler, sets trailing stop losses for its holdings. Once prices fall to those preset levels, the fund liquidates the holdings and moves to cash or other assets that are trending up.

It targets retirees and other investors who want to minimize risk.

Such a conservative approach helps it limit losses in a market downturn. But it also hurts performance when the market goes straight up — which it mostly has since the 2008 crisis.

The fund returned 2.4% annually over the past five years, compared with an average gain of 5% among its peers, according to data compiled by Bloomberg. A portfolio made of 60% stocks and 40% bonds has returned 9% a year during the same period.

Wright didn’t specify the amount of losses he thinks are ahead, but pointed out that significant retreats in the 1970s and 1980s didn’t end until the market’s price-to-earnings ratio dropped below 10.

Currently, while the S&P 500’s 12-month trailing P/E ratio has dropped to 21, from 32 in March 2021, it is still above the average of 19 over the past two decades.

“Young people have no clue what the downside might be, what causes drawdowns and how far it can go,” said Wright, one of the top 100 independent financial advisers, according to Barron’s.

(Adds Wright’s location in 2nd paragraph, updates the fund’s size in 6th paragraph and the performance of its peers in 11th paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.