(Bloomberg) —

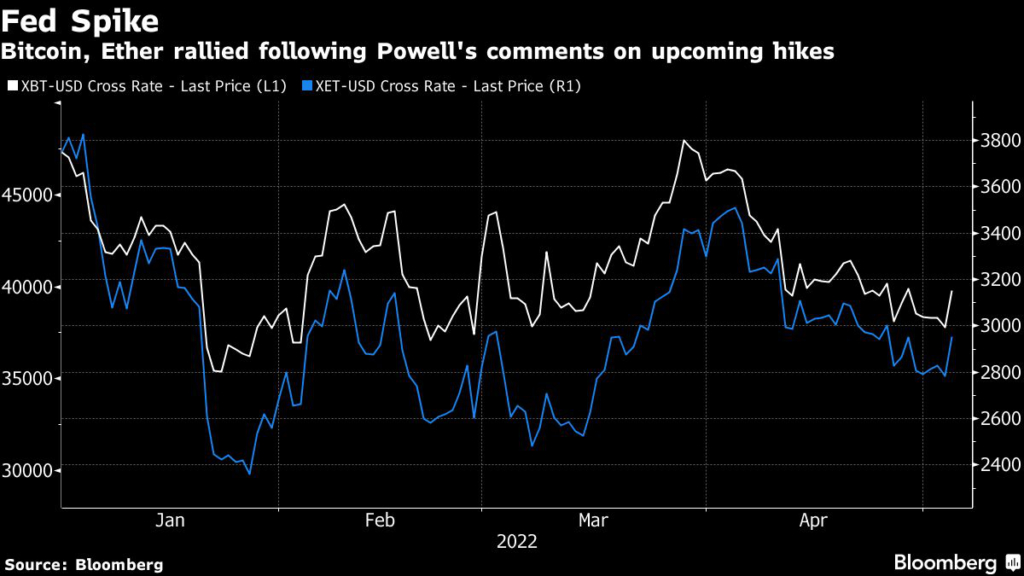

Bitcoin staged its biggest rally in nearly two months after the Federal Reserve quashed fears it will make jumbo-sized moves on interest-rate policy.

The world’s largest cryptocurrency rose as much as 5.9% to $40,007 in New York trading, while other digital assets including Ether and Litecoin also rallied. The move follows comments from Fed Chair Jerome Powell, who said the central bank wasn’t looking to increase rates by 75 basis points at its upcoming meetings, quelling fears it would move super-aggressively to tamp down inflation.

The relatively less-hawkish tone of the comments “contributes to speculative appetite, which is likely to be bullish for crypto,” said Stephane Ouellette, chief executive of FRNT Financial Inc.

The U.S. central bank’s policy-making Federal Open Market Committee on Wednesday voted unanimously to increase the benchmark rate by a half percentage point and said it will begin allowing its holdings of Treasuries and mortgage-backed securities to roll off in June. Risky assets surged after Powell said a 75-basis point increase is “not something that the committee is actively considering.”

Still, in this higher-rate environment, Bitcoin hasn’t been able to break out in any meaningful way beyond its highs at the start of the year. The coin has largely traded within a tight range over the past few months.

“The market is basically stuck in a range,” Dan Gunsberg, co-founder of Hxro Network, said by phone.

Money has been flowing out of the sector amid the malaise. Investors yanked roughly $120 million from crypto products last week, bringing total outflows over the past four weeks to $339 million, according to data tracked by fund provider CoinShares. Bitcoin last week accounted for the majority of the flows in what was its largest single week of outflows since June 2021.

Elsewhere, data from CoinGecko shows that the price of ApeCoin, the native crypto token of Yuga Labs’ APE ecosystem, was up 10% as of 4:10 p.m. in New York Wednesday after Elon Musk changed his Twitter display picture to that of a collage of Bored Apes.

Yuga Labs, creators of the Bored Ape Yacht Club collection of NFTs, recently led a sale of virtual land on “Otherside,” its metaverse project. The sale raised $320 million but also led to huge congestion and high transaction fees on the Ethereum network.

The token price of ApeCoin fell from its Sunday highs of $22 to $14.50 per token on Wednesday before jumping to $17.16 after the Tesla CEO — and Twitter acquirer — changed his profile picture.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.