(Bloomberg) — Marathon Digital Holdings Inc. posted a first-quarter loss after taking an impairment change related to self-mined Bitcoin.

The net loss for the three months ended March 31 was $13 million, or 13 cents a share, compared with net income of $83.4 million, or 87 cents, in the 2021 quarter, the company said in a statement. While revenue jumped to $51.7 million from $9.2 million, the amount was below the average estimate of analysts surveyed by Bloomberg. Bitcoin’s price fell 1.2% in the first quarter, and it traded about 20% lower than at the end of year-earlier period.

While the company has secured large quantities of mining machines from manufacturers and raised capacity, it is among the miners who are struggling to find a home for their machines or the so-called data centers.

Marathon cited regulatory bottlenecks for delaying the deployment of mining rigs in its new site in Texas for 45 days. The Las Vegas-based company doesn’t plan to concentrate operations in Texas, Chief Executive Fred Thiel, chief executive said on a conference call.

“In Texas while it’s very open to mining, there comes a point where enough is enough and the load on the grid just becomes too much and we don’t want to be in a position where we have everything in Texas,” Thiel said.

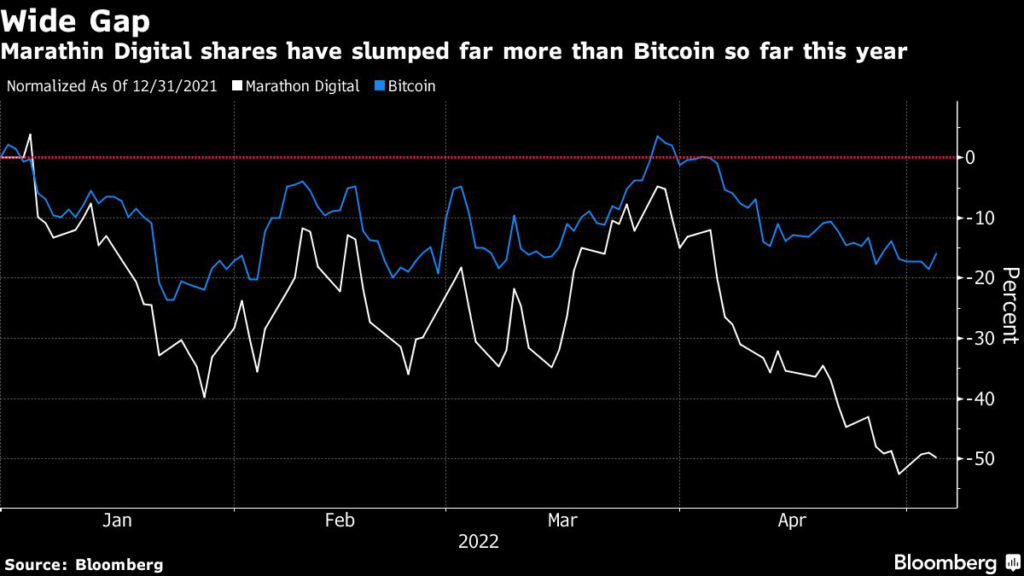

Shares have been cut almost in half since the start of the year, underperforming the world’s largest digital asset.

The Bitcoin mining industry is facing a persistent lack of infrastructure that can host mining machines since China banned crypto mining last May. The U.S. has become one of the major destinations for millions of mining rigs migrating from China. Both exiled Chinese miners and local mining companies in the U.S. are scrambling to build out data centers and upgrade power transmission systems to plug in their machines. However, lead time for such construction has been significantly extended by supply chain issues due to the coronavirus pandemic.

“The company has over 60,000 rigs on hand that are not connected to infrastructure,” Lucas Pipes, a B. Riley analyst with a “buy” rating on the company said in an interview prior to the earnings report. “Marathon would be the first to say things aren’t going as quickly as they’d like.”

Read More: Texas Bitcoin Miners Seek Cheap Power, Land and a Place to Stay

COMMENTARY AND CONTEXT

- The current-year quarter also includes a $5.5 million charge for the decrease in the fair market value of the company’s investment fund

- Adjusted EBITDA for the quarter totaled $39.4 million, an increase of $33.3 million from the prior-year period

- As of March 31, 2022, cash on hand was $118.5 million

- Total liquidity available to the company, defined as cash on hand plus available revolving credit facilities, was $218.5 million

- Additionally, Marathon held approximately 9,374 Bitcoin with an approximate fair market value of $427.7 million at March 31

- Produced a record 1,259 Bitcoin, a 556% increase from 192 Bitcoin in the first quarter of 2021 and a 15% sequential increase from 1,098 Bitcoin in the prior quarter

(Adds company comment in the fourth paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.