Global markets were in a buoyant mood following the Fed’s rate hike yesterday with London, Paris and Frankfurt equities markets all up between 1.3% and 2% during morning trade on Thursday.

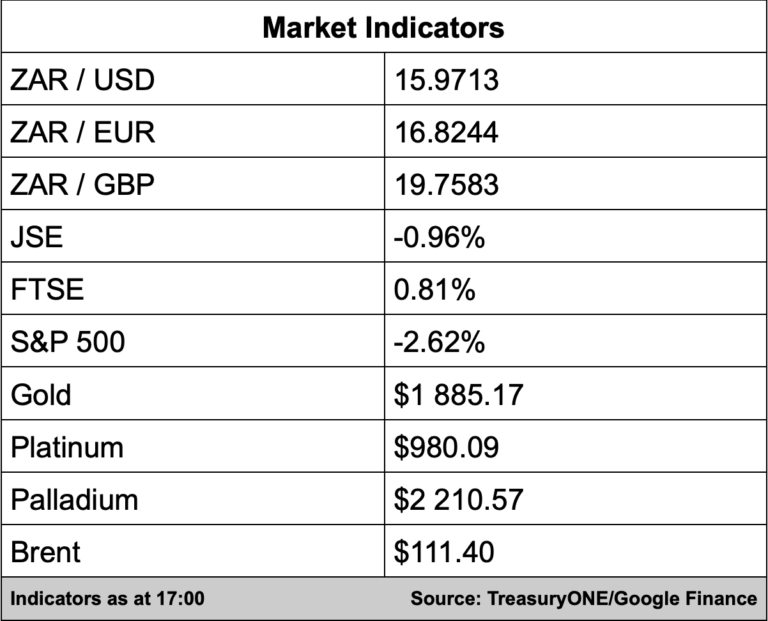

But while the S&P 500 surged nearly 3% yesterday as investors cheered the Fed’s decision, it was short-lived as the stock market index’s three-day rally was halted today during early trade as “concern over persistently high inflation and slower economic growth resurfaced,” reports Bloomberg.

The JSE traded positively early on but ultimately fell into the red during the afternoon session to see the bourse lose 0.96% while the Top 40 lost 1.06%.

Sibanye-Stillwater slumped 7.90% after the company said core profit had slipped 31% year on year in its first quarter.

Meanwhile, management accused unions of using the two-month-long strike at its gold mines as leverage for upcoming wage negotiations at its platinum mines, reports Bloomberg.

“Sibanye Chief Executive Officer Neal Froneman said the unions were trying to show strength after rejecting the company’s latest offer to boost the wages of gold workers by 850 rand ($54) a month. That equates to an increase of 7.8% — compared with South Africa’s March inflation rate of 5.9% — but the unions are asking for 1,000 rand.”

Mining peers Anglo American Platinum (-0.39%) and Impala Platinum Holdings (-2.40%) are some of the companies about to enter pivotal wage negotiations after announcing record dividends following a commodities boom.

Paper and manufacturing firm Mondi’s earnings surged 63% year on year for the three months to the end of March 2022, the manufacturer’s share price added 5.03%. Excluding its Russian operations, earnings increased by 70 per cent, Mondi said it would be selling its Russian assets following the exodus of other companies from Russia following its invasion of Ukraine.

Paper manufacturing peers Nampak added 1.08% and Mpact lost 0.34%.

“What we thought was a dovish Fed last night, at a second glance, was not as dovish as the market initially believed. With the Fed pricing in several big hikes, it seems that the Fed is ahead of the curve of all major Central Banks,” comments TreasuryONE.

“This has caused a renewed resurgence in the US dollar and has left EM currencies faltering.”

The Rand gave back 3% during trade today, which undid all of yesterday’s momentum and then some with the local unit currently trading at R15.93/$ and looking vulnerable with a breach of the R16.00/$ level highly likely.

On the commodity front, prices were looking pretty good until the US came into the market bringing with it a mixed bag after that.

“Gold is just about on the front foot, trading at $ 1,885, while platinum and palladium are trading in the red at $ 979 and $ 2,204, respectively. The worry at the moment is the Brent Crude price, which has jumped above the $110 a barrel level and is currently trading at $ 111.30 per barrel,” says TreasuryONE.