What happens when a company loses 99% of its value on the Johannesburg Stock Exchange in a single day only for it to recover almost all of its losses that very same day?

It’s a question the Financial Sector Conduct Authority (FSCA) will ask after it launched a probe into possible share price manipulation in AYO Technology Solutions securities.

AYO, linked to businessperson Iqbal Survé, opened at R3.50 on Tuesday but plunged down to just 3 cents a share following a single trade of just 100 shares, which gave the company a market valuation of just R10.3 million.

Later that day AYO miraculously recovered its share price back to R3.50 a share following two trades amounting to 2,400 shares.

Daily Maverick asked the JSE what had happened with AYO’s share price and received this response, “At this stage we have no reason to suspect any market abuse.

The drop in the price to 3 cents when the market opened and the rebound to R3.50 seem to be a function of a very wide bid-offer spread and a thin order book… The less liquid shares with wide bid-offer spreads are going to experience this type of price volatility from time to time.”

But AYO are not satisfied and immediately asked the JSE to investigate thus bringing us to the FSCA probe.

AYO says the huge fluctuation “appears to be a deliberate manipulation of its share price” while the shares made no significant movements during trade on Thursday and remain at R3.50 a share.

The FSCA said on Thursday it had “registered an investigation into possible price manipulation in AYO securities.” The regulator is responsible for investigating any irregular trading practices, including volatile price movements of a sharp nature.

AYO told the regulator and the JSE in the past that it believed certain journalists have been working in collusion with other bodies to shorten the share price of the tech firm.

AYO was listed on the JSE back in 2017, at the time, the Public Investment Corporation (which manages government pensions) invested R4.3 billion in the business.

The PIC paid R43 a share for a 29% stake in the company.

Tuesday’s slump comes just three months after the JSE took rare action against two former AYO directors, Mbuso Khoza and Telang Ntsasa, who served on AYO’s audit and risk committee.

The public censure of the two directors came after the JSE fined AYO R6.5 million after publishing “false and misleading” financial results shortly after its December 2017 listing.

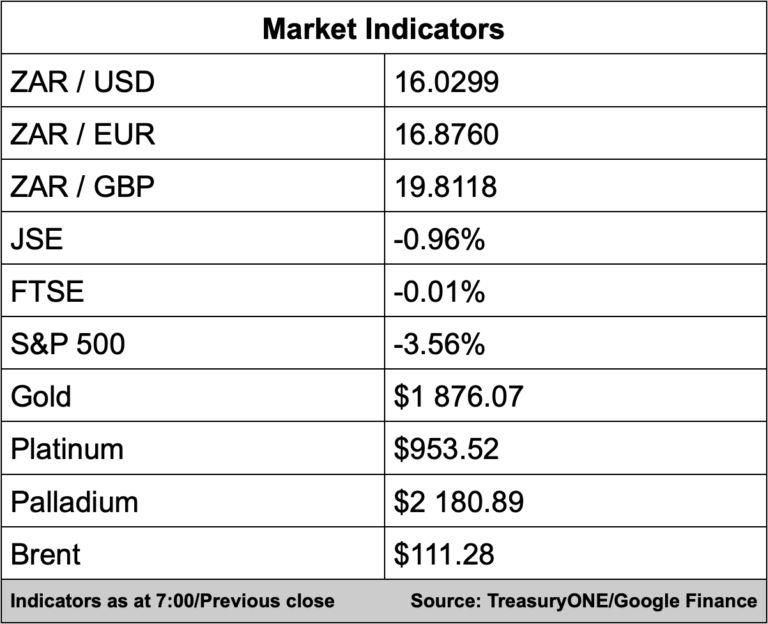

Equity and currency markets were thrown into turmoil yesterday, wiping out all of Wednesday’s gains as investors rushed into the Dollar.

“The Dollar was supported by the fact that US interest rates are likely to hit 2.75% by year-end while rate hikes in the Eurozone and the UK would be slower.

The BOE hiked rates by 25bps yesterday but warned of the risk of a recession in the UK, triggering a 2.0% collapse in the Pound. EM currencies were also hammered, with the Rand falling by 4.13% to R16.08 at one stage before closing 3.52% weaker at R15.99 last night,” comments TreasuryONE.

The local unit is currently trading at R16.03/$.

Commodities also struggled against the stronger Dollar with gold closing at $1,877 after having traded as high as $1,909 earlier in the day while platinum and palladium both ended lower.

Brent crude oil is currently trading at $111 a barrel.

Here’s a round-up of what we’re reading:

SA Business

Only way to solve Eskom, Transnet problems is to work as SA Inc, conference hears – Engineering News

Past wrongs at SAA will be dealt with even after Takatso takes over, AG vows – Fin24

Sibanye Says Unions Using Gold Strike to Leverage Platinum Deal – Bloomberg

Global Business

Major aircraft lessor Avolon says Boeing has ‘lost its way’ – Reuters

Cocaine found in coffee sent to Nespresso plant – BBC

Why are Shell’s profits so high? – The Independent

Tech

UK government sets out plans to rein in Big Tech – BBC

Elon Musk secures £7bn from new investors to pay for Twitter takeover – Sky News

Only 150 transactions were made on day one of Coinbase’s NFT marketplace – Mashable

Markets

Dollar Up, Investors Await Latest U.S.

Jobs Report – Investing.com

Asian markets tumble on Wall street rout, pound slumps – AFP

Wall Street Staggers With ‘Vicious’ $1.3 Trillion Stock Selloff – Bloomberg

(Photo by Gallo Images/Sydney Seshibedi)