The South African government’s position on the Russian invasion of Ukraine has been roundly condemned by various people and organisations but is the ANC government’s reluctance to condemn Russian aggression based on huge amounts of party funding emanating from a Russian owned mine?

A joint venture with US-sanctioned Russian billionaire Viktor Vekselberg appears to have become the ANC’s dominant source of funds. United Manganese of Kalahari (UMK) paid out a staggering R2.4-billion in dividends in 2020 following a year of favourable manganese prices in 2019.

“These figures can be inferred from the publicly available accounts of the Russian half of the UMK joint venture, a Cyprus-registered entity called New African Manganese Investments (Nami) through which the Russian billionaire Viktor Vekselberg holds shares in UMK,” reports investigative journalism firm amabhungane.

UMK is owned by Nami and Majestic Silver Trading (MST), which is part-owned by the ANC’s investment vehicle, Chancellor House.

Chancellor House increased its shareholding in MST to 43.5% meaning the next time UMK declared dividends in 2020, the governing party was in for a big payday.

The ANC received around R528 million through Chancellor House, which owned an indirect 22% stake in the 2020 dividends. The huge pay-out helped Chancellor House wipe its debt and increase its shareholding in UMK.

Large dividends are expected for 2021 as well and would mean that hundreds of millions of rands would flow freely into the ANC’s coffers.

To date, UMK has generated R848 million in indirect dividends for Chancellor House and the ANC. It places the governing party in a sticky situation if it ever wanted to condemn Russian aggression or sanction Russian oligarchs when so much Russian money is used to fund the ANC.

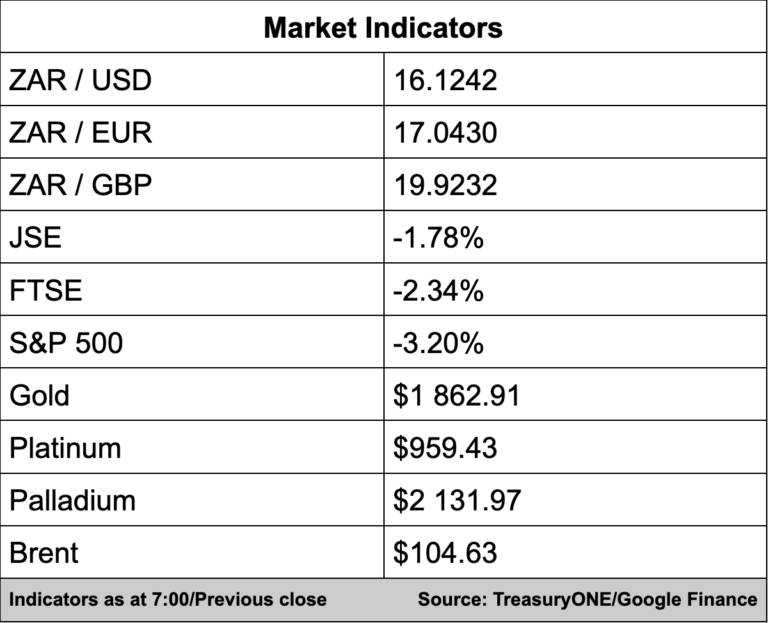

In the currency markets, the dollar is taking a breather this morning with US bond yields pulling back from higher levels yesterday. The rand touched R16.27/$ yesterday – its highest level of the year. This morning the local unit is trading firmer at R16.12/$ as emerging market currencies trade firmer as a whole with the dollar slipping against the euro and pound.

“Traders will now focus on tomorrow’s US CPI data, which is expected to show inflation has topped out at the 8.5% level. Estimates are for inflation to have increased by 8.1% YoY in April, and any number higher than that will see the dollar bounce and the rand come under further pressure,” says forex trading house TreasuryONE.

Gold and platinum closed softer last night while palladium closed slightly stronger on the day.

“This morning sees all three precious metals trading firmer on the back of the softer dollar. Gold is currently at $1,863, platinum at $964, and palladium at $2,136. The price of Brent slumped by 6.2% yesterday on demand concerns and has lost a further 1.40% this morning to be trading at $104.60,” comments TreasuryONE.

Here is a round-up of what we’re reading:

SA Business

Acsa puts emergency measures in place to maintain jet fuel supply at OR Tambo – Daily Maverick

Daniel Mminele: Eskom ‘integral’ to SA’s just transition solution – Fin24

Marmite is trickling back into SA stores – but shoppers will need to be quick – Business Insider

Global Business

Uber to cut costs, slow down hiring, CEO tells staff – Fin24

Tesla Says Shanghai Plant Still Making Cars; No Halt Notice – Bloomberg

Billionaire Spends $8 million on Bezos Space Flight and Will Donate It to a Teacher – Bloomberg

Tech

Instagram is adding NFT support ‘for creators and people’ – Business Insider

Icasa extends consultations on ‘rapidly changing’ pay-TV services market – Fin24

The World’s First 510-Ton Hydrogen-Fueled Truck Produces No CO2 – Bloomberg

Markets

Dollar Down, Investors Expect Massive Interest Rate Hikes – Investing.com

Asian stocks fall on Wall Street rout, oil prices tumble – AFP

Commodity currencies hit by tumbling oil prices, Bitcoin near 10-month low – SABC