Former US President Donald Trump has been thrown a Twitter lifeline after owner in waiting Elon Musk gave the first indication of how he would run the social media company by signalling that he would unban Trump from the platform.

Tesla and Space X CEO Musk called the original decision to ban Trump from Twitter “morally wrong” and further slammed the decision as “foolish.”

At a Financial Times conference on Tuesday, Musk said “Perma bans just fundamentally undermine trust in Twitter as a town square where everyone can voice their opinion.” The SA-born billionaire has previously indicated he wants Twitter to become a place of unbridled free speech with few limitations on what a user could tweet.

Trump, for his part, vowed that he would not return to Twitter even if he was unbanned but there is little to indicate Trump’s position is one of moral high ground and more an indication that he has invested a large sum in his own social media network, Truth Social.

But as the 2024 US presidential elections approach and rumours persist that Trump may try to launch a bid for re-election to the White House, he may find that he needs a wider audience available on Twitter as opposed to the very niche one being built on Truth Social.

Not to mention, Truth Social has had a very poor launch while two top executives who share Trump’s conservative worldview have already resigned taking with them much needed tech expertise.

Meanwhile, Musk could submit a second bid for Twitter owing to a slump in the bluebird social media network’s share price and the recent release of financials, which show weak performance.

There is every chance that Musk would want to pay less than the agreed-upon price of $54.30 a share, which values the company at $44 billion and has been accepted by the company’s board.

Twitter shares are currently trading at 11% below Musk’s bid and lost 1.51% on the New York Stock Exchange on Tuesday to trade at $47.26 a share.

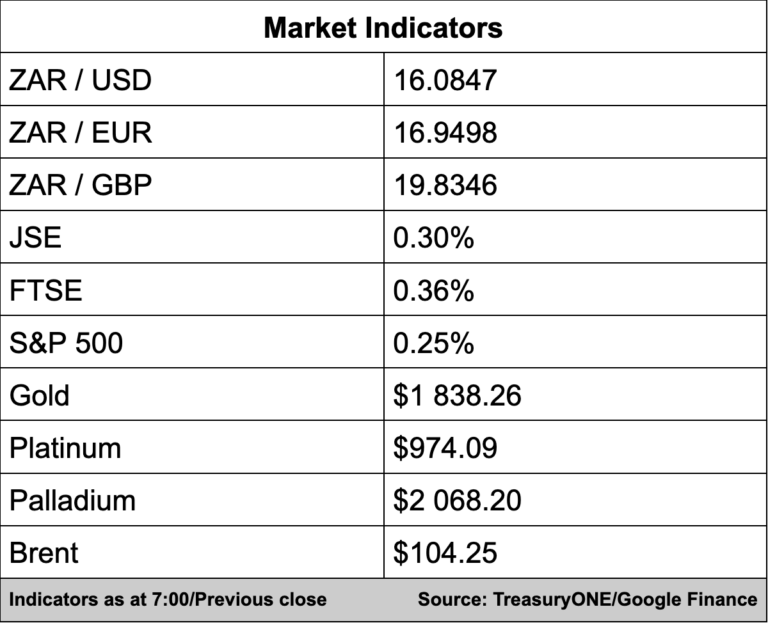

In the currency markets, there was little change overnight with the rand and other emerging market currencies trading sideways ahead of today’s US CPI print, which is expected to come out at 8.1% year-on-year.

The rand is currently trading at R16.08/$.

“Earlier this morning, we saw that China’s inflation surged by 2.1% during April as higher energy costs and a pick-up in demand for fresh produce led to rising food prices.

Equity markets in the east have all closed higher this morning, with the Shanghai Composite and Hang Seng closing around 1.7% higher,” comments TreasuryONE.

On the commodity front, gold is trading at $1,838, platinum at $977, and palladium is trading flat from yesterday at $2,070.

“Base metals are still under pressure, with lower demand from China keeping the prices under pressure.

A recovery in demand could be on the cards, with Shanghai reporting a 51% drop in its infection rate,” says TreasuryONE.

Oil prices are on the rise this morning with OPEC+ agreeing to another modest increase in production but warning that the globe is short-on oil-producing capacity.

Brent crude is 2.35% up and is currently trading at $104 a barrel.

Here’s a round-up of what we’re reading:

SA Business

Few details, no deadline on SAA purchase deal leaves public spending watchdog in the dark – Daily Maverick

Ramaphosa makes a fresh pledge to cut red tape for mining sector – Daily Maverick

Court orders Steinhoff to share forensic probe into accounting fraud with media – Fin24

Global Business

China Inflation Exceeds Forecasts as Lockdowns Roil Supplies – Bloomberg

Ukraine sanctions: What pain lies ahead for Russia’s economy? – BBC

Emirates CEO defends airline’s decision to continue flying to Russia, says it’s ‘connecting people’ – Business Insider

Tech

End of an Era: Apple Discontinues Its Last iPod Model – Bloomberg

FIFA Video Game Will Be Renamed After EA Licensing Deal Ends – Bloomberg

LTE and 5G speeds compared for Vodacom and MTN – MyBroadband

Markets

Dollar Down but Near Two-Decade High as Investors Await U.S.

Inflation Data – Investing.com

Asian stocks open mixed as investors fret over oil prices – AFP

Gold Down, Ahead of U.S.

Inflation Data – Investing.com