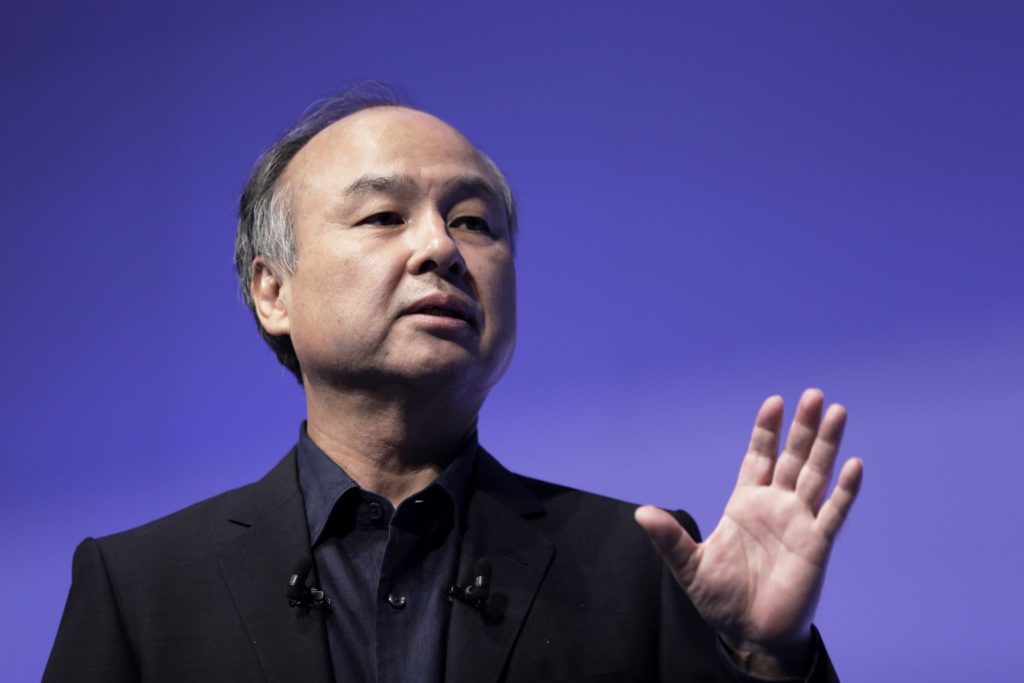

(Bloomberg) — Masayoshi Son’s decision to get into trading public stocks just backfired.

The founder of SoftBank Group Corp. set up a controversial side venture in 2020 called SB Northstar, which was aimed at using the company’s excess cash to make some money picking stocks. Son took a personal 33% interest in the unit, while the company held the rest of the equity.

With tech stocks crashing in the last quarter, Northstar has gotten hammered. SoftBank said it would recognize a loss of 670 billion yen for the last fiscal year, while Son is on the hook for 315 billion yen ($2.44 billion).

“SB Northstar has incurred significant losses,” the company said in a statement, as it reported earnings for the fourth fiscal quarter. The unit now “is scaling down its business to reallocate funds to investments under SoftBank Vision Fund 2, which is currently the primary focus of SBG.”

SoftBank reported a record annual loss at its Vision Fund unit as a global selloff in tech shares pummeled the value of public holdings like Coupang Inc. and Didi Global Inc. The Vision Fund unit swung to a loss of 2.64 trillion yen for the year ended March 31, down from a record 4.03 trillion yen profit in the previous year.

The Vision Fund’s portfolio dragged the Japanese company’s overall annual net loss to 1.7 trillion yen, from a 5 trillion yen profit a year ago.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.