(Bloomberg) — Carousell Pte, a Singapore-based online classifieds marketplace operator, has recently ended talks to go public through a merger with blank-check company L Catterton Asia Acquisition Corp. amid market volatility, according to people familiar with the matter.

The special purpose acquisition company, which has been conducting due diligence on Carousell over the past few months, has not been able to reach a merger agreement with the Southeast Asian business, the people said, asking not to be identified because the matter is private.

The stock market rout has made it difficult to arrange a private investment in public equity, or PIPE, the people said, where typically other investors chip in funds alongside those contributed by the SPAC itself to the merged entity. Macroeconomic uncertainty and valuation concerns are also among the factors weighing on a potential deal, they added.

A representative for Carousell declined to comment, while a representative for L Catterton Asia Acquisition didn’t immediately respond to requests for comment.

Shares of L Catterton Asia Acquisition touched their lowest level in more than five weeks in New York after the Bloomberg News report. The stock was down 0.2% at Wednesday close.

The companies were in exclusive talks to merge in a transaction that could have valued the combined entity at as much as $1.5 billion, Bloomberg News reported in January. The deal was meant to include a PIPE worth a few hundred million dollars, people familiar with the matter said at the time.

Enthusiasm for SPACs has waned amid heightened market volatility with a growing number of prominent deals fizzling out. The changing regulations from the U.S. Securities and Exchange Commission have also hurt the sentiment in the once-heated sector.

Asia’s SPAC Promise Hits a Roadblock as Market Shuts: ECM Watch

The US-listed SPAC is backed by L Catterton, the $30 billion buyout firm minority-owned by Paris-based luxury goods company LVMH and billionaire Bernard Arnault’s investment firm. Led by managing partners Chinta Bhagat and Scott Chen, the SPAC raised $250 million last year to target a combination with companies in the high-growth, consumer technology sectors across Asia. It is sponsored by L Catterton Asia’s $1.45 billion third fund.

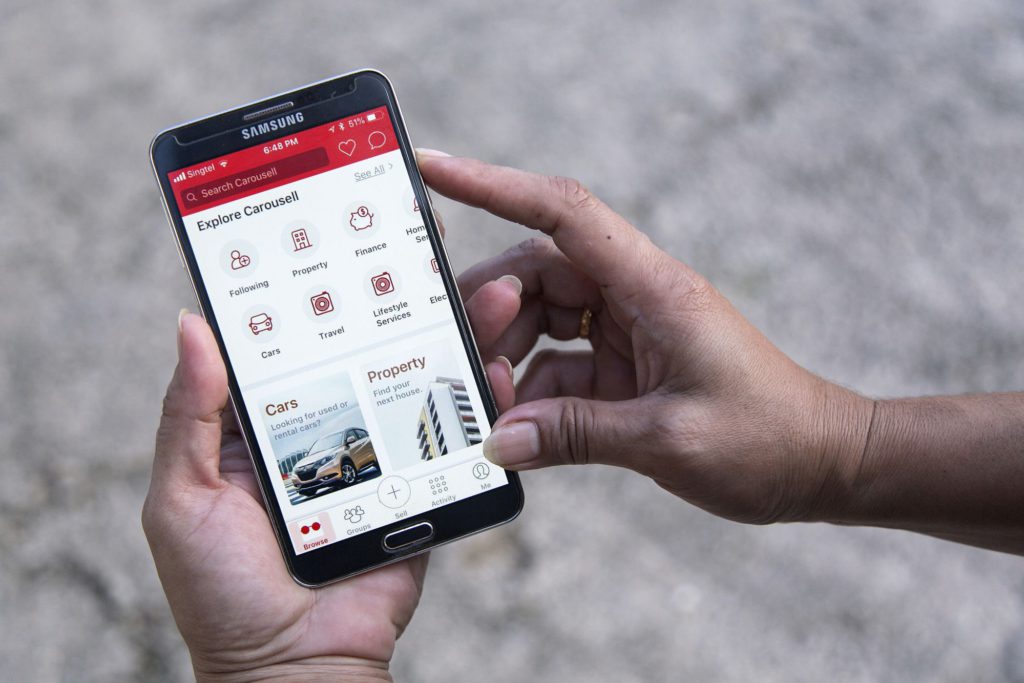

The platform Carousell was founded in 2012 and counts Telenor Group, Rakuten Ventures, Naver, and Sequoia Capital India among its backers. The firm has since expanded to eight markets across Southeast Asia, Taiwan and Hong Kong, allowing users to buy and sell a diverse range of products from cars to gadgets and fashion accessories. It runs several online marketplaces including Carousell, Chotot.com in Vietnam, Mudah in Malaysia and OneKyat in Myanmar, according to its website.

(Adds share price in fifth paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.