The JSE was muted on Wednesday while global peers remained mixed as traders take in the global economic outlook. Hawkish rhetoric from central banks has sparked concern that aggressive inflation-fighting would push many countries into an economic recession.

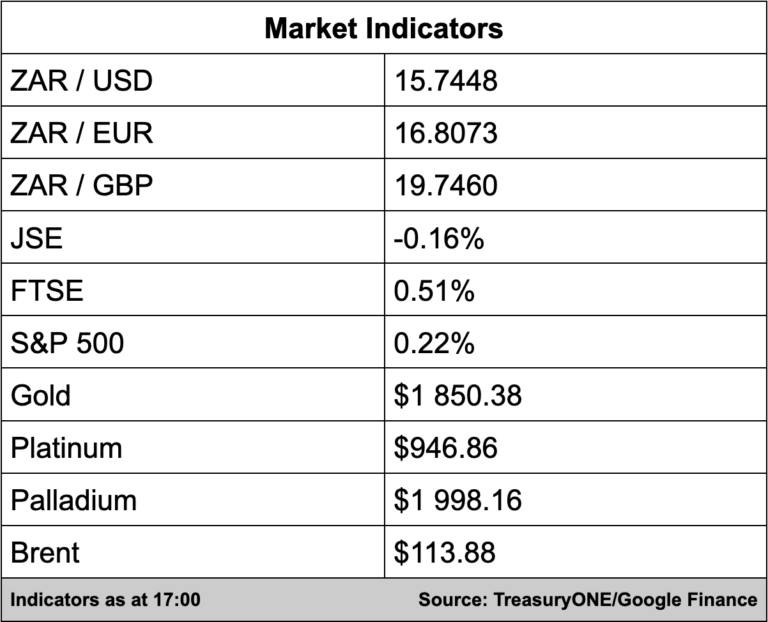

The local bourse lost a tiny 0.16% with the All Share Index at 67,585 points with the top 40 trading flat at 61,176 points.

In company news, Tiger Brands (4.27%) said revenue increased by 2% to R16.8 billion for the six months to end-March, the company said in a trading update. Group operating income decreased by 5% to R1.5 billion while the group operating margin declined to 8.9% from 9.6% previously.

Mediclinic (4.61%) said group revenue increased by 8% for the full year to end-March, in a trading update. The increased revenue was driven by growth in client activity while revenue is up 5% on pre-pandemic levels.

In the currency markets, the rand traded firmer this morning with the local unit breaking through the R15.60/$ mark briefly but since then it has traded softer to close above this morning’s opening level of R15.69/$.

“EM’s are mostly trading without any intent apart from the Turkish Lira, which is still on the back foot. We do have the release of the minutes on the Fed May meeting later tonight and could provide further guidance for the market on the Fed’s stance to curb inflation,” comments forex trading house TreasuryONE.

On the commodity front, gold lost 0.9% and closed above $1,850 while platinum and palladium are slightly down from this morning at $939 and $2,000 respectively.

“Copper is down 1% as the demand for metals remains low, with the Chinese lockdowns still driving the narrative. The price of Brent Crude is trading 0.8% up for the day but still at similar levels to this morning, while WTI is quoted just below $113,” says TreasuryONE.