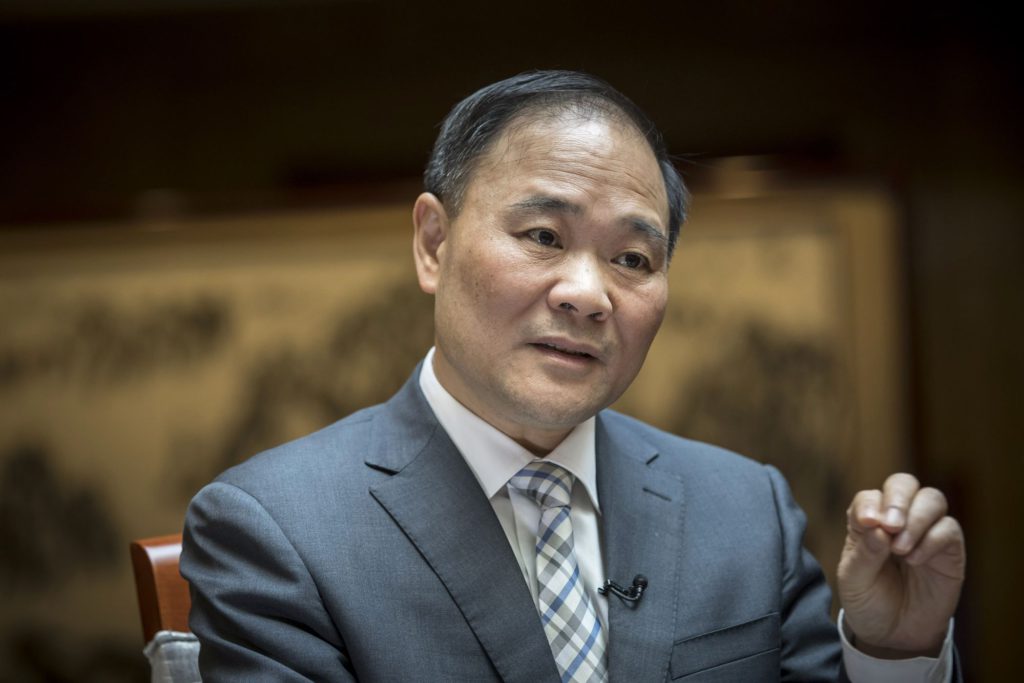

(Bloomberg) — ECARX Holdings Inc., the automotive tech firm backed by billionaire Li Shufu, agreed to go public through a merger with blank-check company COVA Acquisition Corp. in the largest Chinese listing in the US since Didi Global Inc.

The deal values the combined company at about $3.8 billion, according to a statement Thursday, which confirmed an earlier Bloomberg News report.

The transaction includes a $45 million investment from Li’s automobile giant Zhejiang Geely Holding Group Co., Luminar Technologies Inc. and Lotus Technology. Geely is an existing investor in ECARX.

Read more: Chinese Tycoon Li Shufu in Fundraising Push to Boost Auto Empire

ECARX would be the largest Chinese company to list in the US following Didi’s spectacular failure.

The ride-hailing giant is set to delist from the New York Stock Exchange after proceeding with its IPO last June over Chinese regulators’ objections and becoming a victim of the country’s cybersecurity crackdown.

Didi has lost about 90% of its market value since its debut.

Digital Cockpits

ECARX, founded in 2017 by Geely’s Li and Ziyu Shen, develops software and hardware such as digital cockpit and infotainment systems for cars.

It serves both combustion-powered vehicles as well as automated and electric cars. Its clients include 12 car brands such as Geely, Lotus, Mercedes-Benz Group AG and smart.

“We are getting bigger and we want to be an international company,” Shen, ECARX’s chairman, said in an interview.

“We want to have a very strong international expansion in the next five years.”

ECARX plans to announce partnership with two new global OEM clients in the next six months, according to Shen.

The electrification of cars will be an opportunity for ECARX and contribute about 15% of this year’s revenue, he said.

Jun Hong Heng, chairman of COVA Acquisition, said ECARX is well positioned for the next decade.

The company could raise additional funding when there’s extra interest, according to Heng.

Driverless Cars

“It struck me that this is a very unique opportunity, with the product and the substantial revenue that ECARX has, which is very rare for autotech companies,” he said in an interview.

The merger is expected to close in the fourth quarter, according to Thursday’s statement.

UBS Group AG and Morgan Stanley advised ECARX on the deal, while Cantor Fitzgerald acted as capital markets adviser to COVA Acquisition.

COVA Acquisition raised $300 million in its 2021 IPO to find an acquisition target in the technology industry in Southeast Asia or the US, according to a filing to the Securities and Exchange Commission.

The SPAC is led by Heng, founder of San Francisco-based Crescent Cove Advisors, which backs high-growth technology, media and telecommunications ventures in the US and Southeast Asia.

Crescent Cove was an early investor in Luminar, a driverless-car startup founded by entrepreneur Austin Russell.

Luminar went public through a SPAC deal in 2020.

(Updates with confirmation from first paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.