(Bloomberg) — The man who created Wall Street’s favorite fear gauge is throwing his support behind Grayscale Investments LLC’s bid to turn the world’s biggest Bitcoin fund into an exchange-traded product.

Robert Whaley, who created the Cboe Volatility Index in 1993, said in a May 25 letter to the Securities and Exchange Commission that officials should approve the firm’s application to convert the $20 billion Grayscale Bitcoin Trust (ticker GBTC) into an ETF.

He joins thousands of other letter-writers after Grayscale launched a campaign to solicit comments to the SEC.

Whaley’s argument centers on the fact that the SEC allowed the ProShares Bitcoin Strategy ETF (BITO), the first US Bitcoin derivatives-backed fund, to launch in October, while repeatedly denying applications for physically-backed crypto ETFs.

He compared the returns of the Chicago Mercantile Exchange’s index of Bitcoin futures, which BITO tracks, to those of the CoinDesk Bitcoin Price Index, which GBTC would follow, from January through May 25 and found that the two are “near perfect substitutes.”

Future-based ETFs have to factor in the cost of continuously rolling forward contracts as they expire, which only strengthens the case for a spot Bitcoin ETF, Whaley wrote.

“Futures-based Bitcoin ETFs like BITO are a much more costly and inefficient way for investors to access Bitcoin compared to what would be a more transparent and well-designed spot-based Bitcoin ETP like GBTC,” Whaley, a finance professor at Vanderbilt University in Nashville, wrote in the letter.

“Because the Commission has already approved futures-based Bitcoin ETFs, it must implicitly be comfortable with a spot-based Bitcoin ETP like GBTC.”

Accounting for delays, the SEC has until early July to make a decision on the application, which was filed in October.

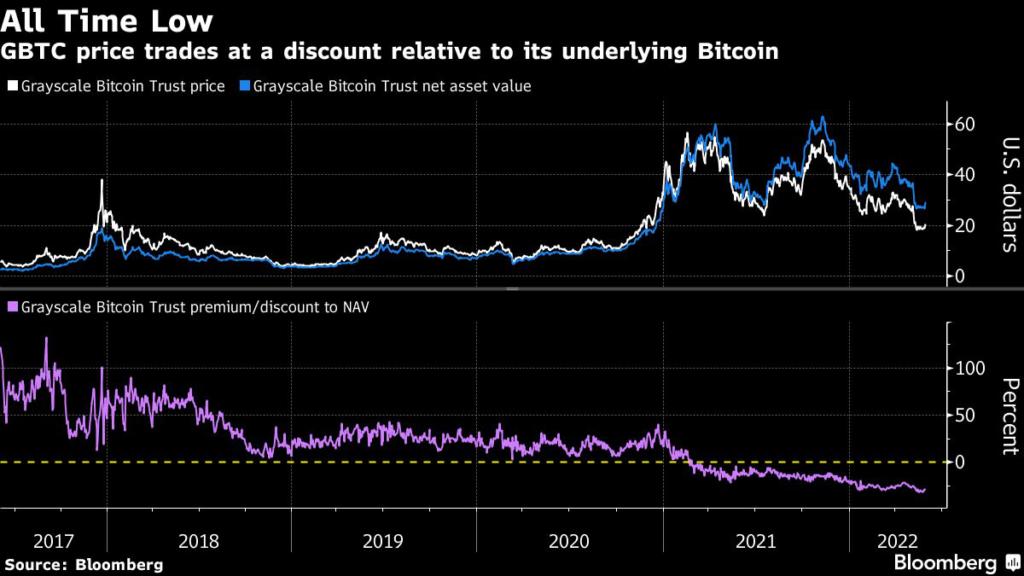

Grayscale met with the SEC last month on the topic. Since GBTC is a trust, not an ETF, shares can’t be redeemed as demand cools — leaving GBTC at a discount relative to the Bitcoin it holds. Converting the trust into an ETF would unlock as much as $8 billion in value, should the discount be repaired, Grayscale said last month.

Should the SEC reject the application, the company wouldn’t rule out a lawsuit challenging the decision, Grayscale Chief Executive Officer Michael Sonnenshein said in March.

There’s little indication that the regulator’s stance has changed — just in the last week, it denied an application from One River Asset Management to launch a spot Bitcoin ETF.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.