South Africa’s GDP came out better than expected and grew by 1.9% in the first quarter of 2022 an improvement on Q4 in 2021, which saw the economy grow by 1.2%. The good news means real GDP is now slightly higher than it was pre-Covid 19, and this is the second consecutive quarter of expansion with eight out of ten sectors recording growth in production.

Currency Market

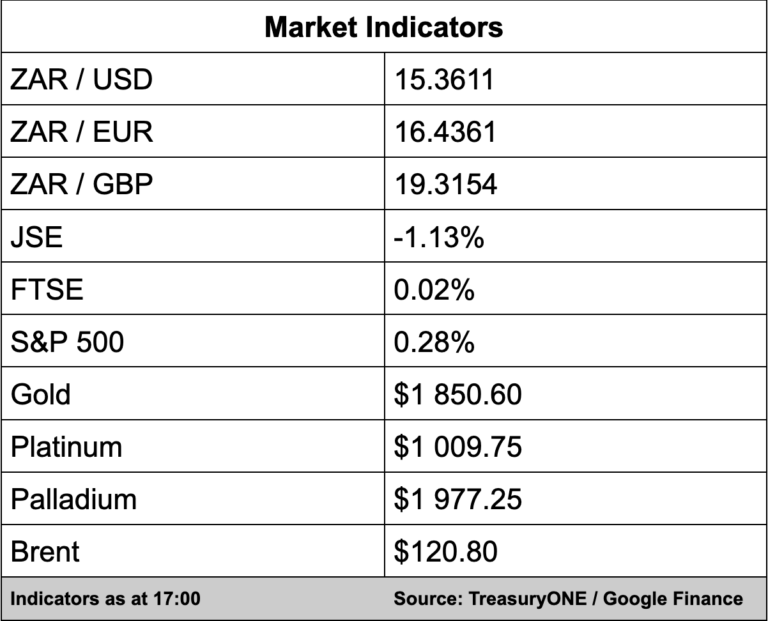

Following the news, the Rand was on the front foot and traded down to R15.40/$ and is still trading in a wider range of between R15.30 to R15.50 and remains on the front foot.

“We remain decoupled from other EM’s who are either flat for the day, or weaker like the Brazilian Real which is currently trading softer by 2%,” comments TreasuryONE.

The local unit is currently trading at R15.36/$.

Commodities

Commodities are still trading in a see-saw trading fashion, with platinum and palladium giving up their gains from yesterday during the early morning hours.

Platinum is currently quoted at $1,005 while palladium is on $1,980. Gold is slightly up from this morning and trading hands on $1,850. Brent crude has extended its gains above $120 and is currently up 1% for the day.

Stock Market

The JSE traded weaker on Tuesday as investors mulled over soaring inflation and deteriorating global growth prospects weighing on sentiment. Global peers were mixed with investors uncertain over how aggressive interest rate hikes will have to be to get a handle on inflation, reports Business Day.

The local bourse lost 1.13% with the All Share Index closing at 70,318.23 points.

Company News

In a trading update for the year to end-March, chemical manufacturer Omnia said it expected headline earnings per share will increase between 70% and 90% while total earnings per share are expected to fall between -12% and 8%.

Following the release of the update, the company’s shares immediately slumped over 5% before closing Tuesday 3.7% down.

Magda Wierzycka co-founded asset manager, Sygnia (3.83%), said growth in its retail client base helped with a record financial performance in its half-year to end-March. Sygnia boasts its highest profit of R139.1 million, up 31.5%, which allowed the wealth manager to increase its dividend by 45.5% to 80 cents.