(Bloomberg) — Salesforce Inc. shareholders rejected a proposal for a racial equity audit in a loss for activist investors.

The resolution called for the board to authorize an independent audit into Salesforce’s impact on racial equity, which includes employees, external civil rights organizations and communities where the San Francisco-based software company operates. Stockholders rejected the bid Thursday during Salesforce’s annual meeting, the company said, without specifying the vote. Final totals on the proposal will be released later.

The company’s board opposed the proposal, saying it already discloses employee demographics, and its efforts on racial justice have resulted in “meaningful change.” The board also said Salesforce has reached a goal of 50% of US employees from “underrepresented groups,” which includes women, LGBTQ+, veterans, those with a disability and Black, Latinx and Indigenous peoples.

Proponents of the measure said the company’s “underrepresented” metric is overly broad, and that Black and Hispanic employee representation has not meaningfully improved since 2015. They cited the departure in early 2021 from the company of two prominent Black women who said Salesforce’s internal culture was much less progressive than its outward image.

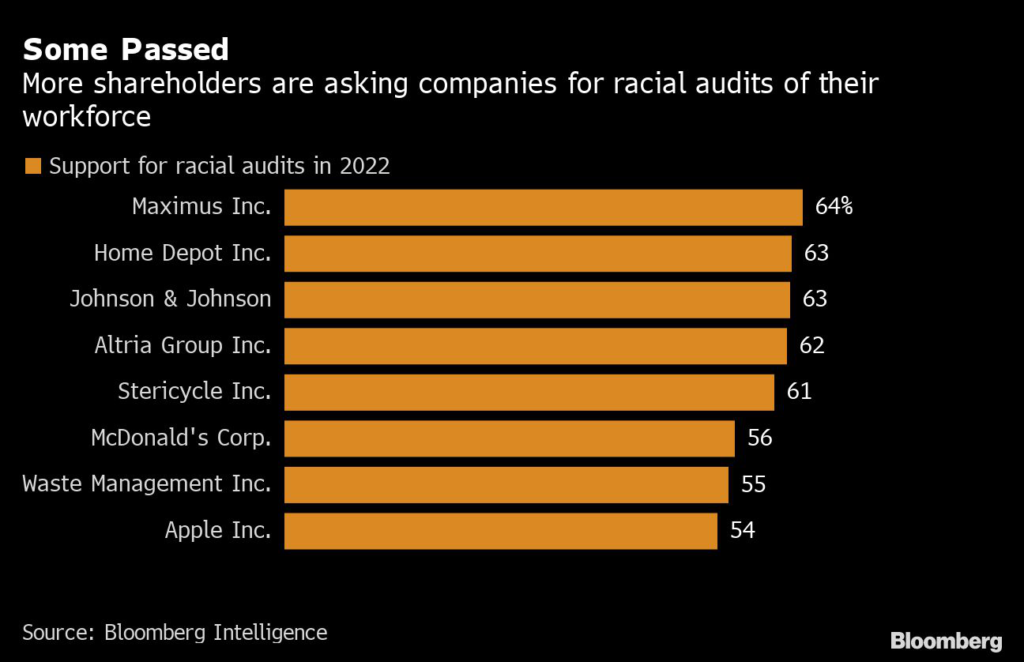

A record number of initiatives on racial justice, gender equality and gun violence have been on the agenda at shareholder meetings this year. McDonald’s Corp., Apple Inc. and at least a half dozen other companies have been asked to conduct racial audits. Several have received significant backing, and others have been adopted by companies even when the vote fails. Microsoft Corp. said Wednesday it would commit to a “civil rights” audit by a third party aimed at improving diversity and inclusion.

According to a Bloomberg analysis of 2020 disclosures, Salesforce’s share of Black and Hispanic workers in management and professional roles lagged many S&P 100 peers. In 2021, leadership was about 70% White and 70% male. Native Hawaiian or Pacific Islanders made up less than 0.2% of U.S. employees despite a corporate identity built around Hawaiian motifs.

Institutional Shareholder Services Inc., which advises investors on corporate governance votes, recommended against the proposal from the Salesforce shareholders, saying the company has sufficient disclosure and inclusion policies. ISS backing was a key factor in a successful racial audit initiative by Home Depot Inc. investors last month.

The Salesforce resolution was led by Tulipshare Ltd., a UK-based activist investor platform for retail traders. The group also initiated a proposal aimed at reviewing warehouse conditions for Amazon.com Inc. workers that received 44% of the vote during a meeting last month.

Another stockholder proposal, to create an independent board chair and oust co-founder and co-Chief Executive Officer Marc Benioff from the role, was rejected. It was initiated by The National Legal and Policy Center, a conservative group that took issue with Benioff’s public support for causes like gun control and reproductive health care access. ISS recommended in favor of the bid, saying that although the company has no specific governance issues, it can be difficult to counterbalance a board chaired by a long-time CEO and founder.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.