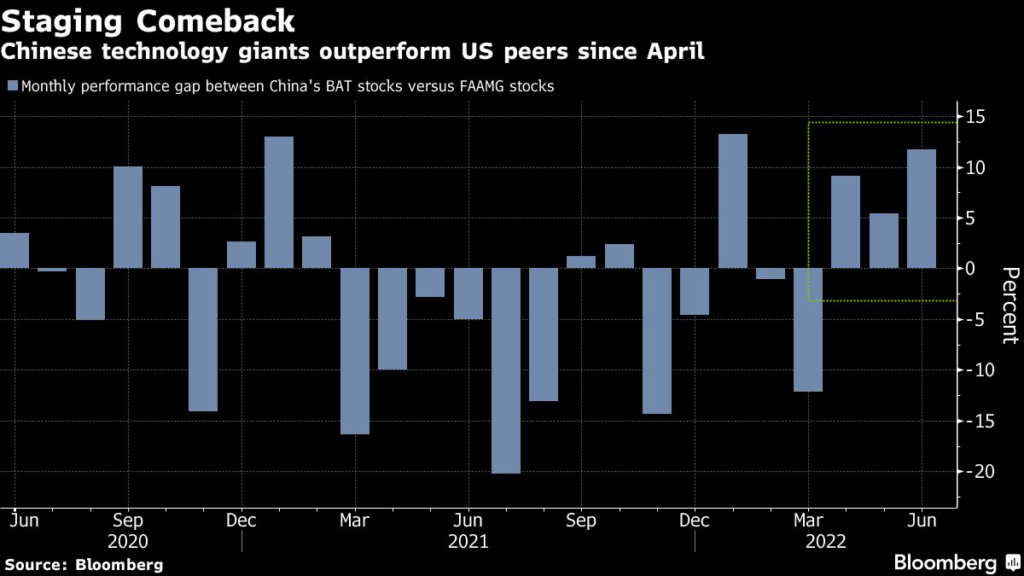

(Bloomberg) — An easing of China’s regulatory crackdown is lifting the shares of the nation’s giant technology companies, helping them to finally outperform their US counterparts after a dismal year.

An equal-weighted basket of China’s three internet giants — Baidu Inc., Alibaba Group Holding Ltd. and Tencent Holdings Ltd. — has rallied 37% since mid-March, according to calculations by Bloomberg. In contrast, a portfolio of their US peers — Meta Platforms Inc., Amazon.com Inc., Apple Inc., Microsoft Corp. and Google parent Alphabet Inc. — has declined 11%.

The turnaround has gathered momentum in recent weeks after Alibaba and Baidu posted better-than-expected quarterly results and regulators sent strong signals the crackdowns are nearing an end.

The Wall Street Journal reported that Beijing is about to conclude its probe of tax-hailing Didi Global Inc. and authorities approved a second batch of video games this year following a monthslong freeze. Chinese financial regulators were said to have started early stage discussions on a potential revival of Ant Group Co.’s initial public offering. The China Securities Regulatory Commission said it wasn’t conducting such work.

“A lot of negatives have been already factored in at the current valuations,” said Summer Xia, equities strategist at UBS Global Wealth Management Chief Investment Office. “We think recent positive policy signals could imply a short-term relief from the regulatory overhang. Investors are likely to focus more on the mid-to-long term growth prospects with these near-term risks being addressed.”

On the other hand, U.S. technology stocks have been hit hard this year as the Federal Reserve raises interest rates to rein in soaring inflation.

The trio of China giants, known as the BAT stocks, is set to outperform the US cohort for the third consecutive month, the longest such string since the epic tech rout in China began in February last year. The Nasdaq Golden Dragon Index of U.S.-listed Chinese companies has rebounded 43% since mid-March, versus a 6% drop for the Nasdaq 100 Index. The HXC index is on track to close up for its fourth consecutive week, its longest rising streak since January 2020.

China Tech Stocks Rise as Investors See End to Regulatory Woes

“What is different this time around is that the government seems more determined to encourage positive economic growth in 2022 with specific policies, versus 2021 or start of the year, when they didn’t seem too desperate to promote growth,” said Louis Lau, a fund manager at Brandes Investment Partners. “Chinese Internet companies appear more attractive in valuation than US tech peers.”

Tech Chart of the Day

E-commerce stocks have slumped this year as the pandemic-driven boom faded because of surging inflation and concerns of a recession that are weighing on consumers. While Shopify Inc. leads the pack with a year-to-date plunge of 73%, Amazon.com Inc. and eBay Inc. are faring the best — down about 30%. The sector has underperformed the Nasdaq 100 Index, which is down 25% for the year.

Top Tech Stories

- Amazon.com Inc. is planning to withdraw from a heated competition for the rights to stream Indian Premier League cricket matches, according to people familiar with the matter, ceding one of the world’s most popular sporting contests to rivals from Walt Disney Co. to Mukesh Ambani’s Reliance Industries Ltd.

- Advanced Micro Devices Inc., the second-biggest maker of computer processors, expects revenue to grow 20% annually over the next three to four years as it attempts to take more market share from Intel Corp.

- Apple Inc. plans to expand the lineup of laptops using its new, speedier in-house chips next year, aiming to grab a bigger share of the market, people with knowledge of the matter said.

- The UK kicked off a fresh probe into the Google Play app store over suspicions of anticompetitive conduct as the antitrust watchdog wrapped a sweeping study of Alphabet Inc. and Apple Inc.’s dominance of mobile systems.

- The share price slump that’s erased about $100 billion from the market value of Taiwan Semiconductor Manufacturing Co. this year means little to the legion of analysts who see the stock as a screaming buy.

- Denso Corp., one of the world’s top automotive semiconductor manufacturers and a key supplier to Toyota Motor Corp., may consider spinning off its chip business, the company’s chief technology officer said Friday.

- Just Eat Takeaway.com NV’s US unit Grubhub is attracting preliminary interest from private equity firms including Apollo Global Management Inc., according to people with knowledge of the matter.

- Ericsson’s governance woes continued to pile up after the US Securities and Exchange Commission started a probe into the company’s handling of a corruption scandal in Iraq.

(Adds stock move in seventh paragraph)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.