The JSE dropped over 2% in trade on Monday as a global market sell-off set in and traders digested a sharp rise in US inflation numbers on Friday, which has raised concerns about aggressive interest rate hikes by the Federal Reserve.

The fallout from the release of the US CPI numbers last week has seen emerging market currencies, stocks, and commodity markets all come under severe pressure as the panic and fear run like wildfire through worldwide markets.

“The absolute risk of recessions and stagflation has spooked markets, especially with the Fed interest rate decision later this week,” comments TreasuryONE.

Global peers tumbled to three-month lows today, dragged down by technology and travel stocks, while Asian markets closed sharply lower.

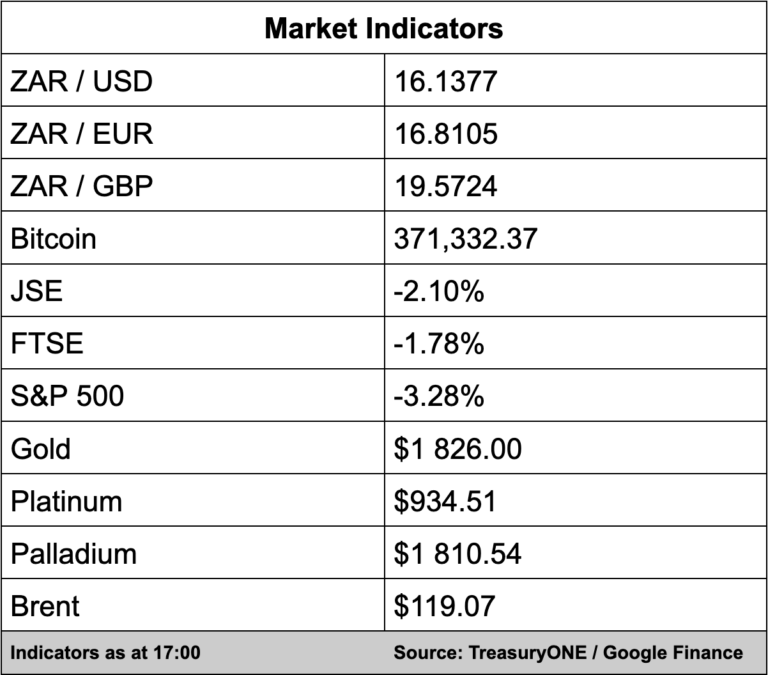

The All Share Index slumped by 2.10% to close at 66 381.03 points.

Thungela Resources and Karoo were among the biggest losers, slumping 9.84% and 8.29% respectively.

Thungela marked a full year of being listed on the JSE on June 7 and in a trading update for the six months to end-June released today, declared its first dividend of R2.5 billion.

The mining counter highlighted the increased demand for thermal coal at the start of the year as the global economy continued to recover from the effects of the Covid-19 pandemic.

While the war in Eastern Europe has weighed on demand since its onset in late February.

“The unfortunate onset of the conflict between Russia and Ukraine further contributed to tightness in supply and resulted in a refocus on energy security in Europe and beyond.

This tightness, coupled with sanctions on Russia, saw the price of the energy complex, including thermal coal, escalate rapidly,” said Thungela.

On the currency markets, the rand led an emerging market weakening today as the stronger US dollar battered the market.

“The rand started off the day trading at R15.90 but has since lost another 30 cents and touched R16.18 but has settled down to R16.14,” says TreasuryONE.

The rand has moved over R1 in two and a half days, and it would not be a surprise if the rand lost more ground in the short-term judging by current sentiment, especially if the Fed turns hawkish, comments TreasuryONE.