(Bloomberg) — SoftBank Group Corp. is considering listing some of its stake in chip designer Arm Ltd. on the London Stock Exchange, switching from an earlier plan to only use the US market, according to people familiar with the matter.

If it decides to also list in the UK, the Japanese company will likely still conduct its initial public offering in New York, according to the people, who asked not to be identified because the matter hasn’t been made public. The size and timing of the sale hasn’t been finalized and plans for the listing still may change, according to the people.

Arm, which SoftBank acquired in 2016, is based in Cambridge, England. Arm was one of the UK’s most important technology companies before the purchase and still has the majority of its operations there. An IPO that would list only in the US would be a blow to the UK government and capital market.

Prime Minister Boris Johnson has led overtures to senior SoftBank management in a attempt to convince them to list ARM in the UK, according to people familiar with the matter. Earlier this week, Chris Philp, the UK’s Minister for Tech and the Digital Economy, told reporters that the government was working with the company to ensure there would be a listing in Arm’s home country.

However, a secondary UK listing comes with limitations, including ARM’s exclusion from the FTSE 100, where it once was the largest tech company in the index.

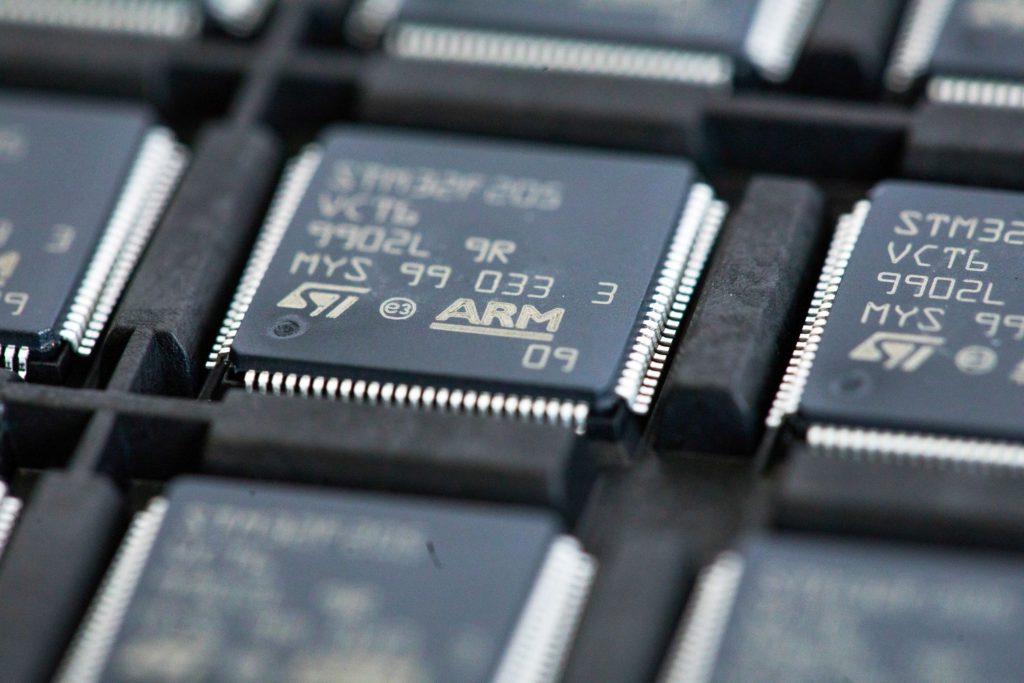

Arm sells and licenses technology that’s used by semiconductors in everything from smartphones to super computers. The pervasiveness of its products has made its planned IPO a closely watched event in the $550 billion chip industry.

The chip technology provider’s path to becoming a publicly traded company again has been complicated by the slump in semiconductor shares this year. Investors have sold chip-related equity, concerned that a huge run-up in industry earnings sparked by shortages will end with a supply glut as demand slows and more production is brought on line.

SoftBank founder Masayoshi Son said he plans to sell a portion of Arm before the end of the company’s financial year next March.

Tokyo-based SoftBank is seeking a valuation of at least $60 billion for Arm, Bloomberg has reported. It’s aiming for a higher amount than it would have gotten from its proposed sale of the chip designer to Nvidia Corp. That deal collapsed in the face of opposition from regulators.

JPMorgan Chase & Co., Barclays Plc, Banco Santander SA, BNP Paribas SA, Credit Agricole Corporate and Investment Bank and Goldman Sachs Group Inc. are among 11 lenders that SoftBank has lined up for an $8 billion term loan secured by Arm shares, the Japanese company confirmed earlier this month.

Son acquired Arm for about $32 billion and gave it the resources to go on a hiring spree, aiming to crack new markets such as the server chips used in data centers.

The Philadelphia Stock Exchange Semiconductor Index has lost 32% this year, a worse performance than that of the S&P 500 and other benchmarks. Prior to that pullback, the chip index had more than tripled since 2017.

(Updates with additional context in paragraph four.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.