After dipping into the red at the backend of last week the JSE made broad gains on Monday to close the start of the new week by adding nearly 2%.

Large selloffs dominated the markets last week, which sparked fears of a recession with US markets having their worst week since 2020.

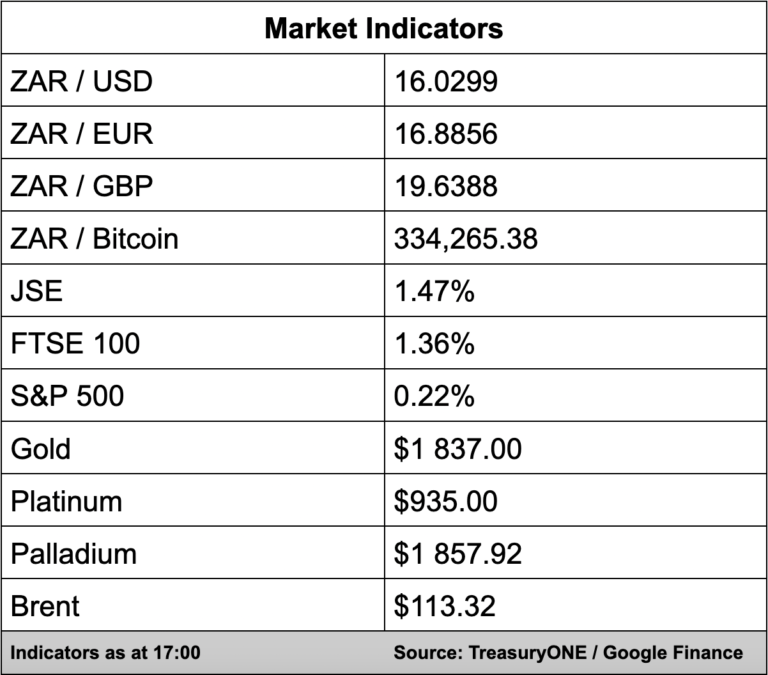

The local bourse added 1.47% with the All Share Index at 66 350.31 points.

In company news, Omnia (1.97%) saw its turnaround strategy pay off with a huge earnings jump that saw the chemical producer’s headline earnings jump from 361 cents in 2021 to 672 cents for the year to the end of March.

Omnia declared a final gross cash dividend of 275 cents, up from 200 cents in 2021. The group also declared a special gross dividend of 525 cents per ordinary share.

CEO Seelan Gobalsamy said the earnings jump reflected the company’s ongoing strategy.

In the currency markets, the rand traded sideways for most of the day staying in a tight range of between R15.96 and R16.06 to the dollar.

“This was primarily down to the US being out of the market, and there is little in the way of data, and liquidity is low on a day like today. The rand is currently trading at R16.03, and the US dollar is trading at 1.0530 against the Euro,” comments TreasuryONE.

Oil has been on the backfoot since last week with looming recessions starting to weigh on the oil price.

“Oil is currently trading at $112.54 a barrel, but we need a sustained break below $109.50 to potentially see a run lower for oil. Gold has held firm around the $1,840 level and is currently trading at $1,837 per ounce,” says TreasuryONE.

Looking to the week ahead, it is a short week in the US and there could be some volatility later in the week.

“The most significant risk we have this week is the two-day testimony by Fed chair Powell in front of Congress, (which) will start on Wednesday,” says TreasuryONE. “The thinking of the Fed will be scrutinised by the market, and movements could be swift depending on the stance and view that the Fed will take.”