Slightly steadier trading sentiment saw the JSE trade firmer today as investors have come to terms with central banks’ willingness to risk recession to get on top of inflation.

There will be an eye on the US Federal Reserve minutes due out later this week while the SA inflation numbers for May are due out tomorrow.

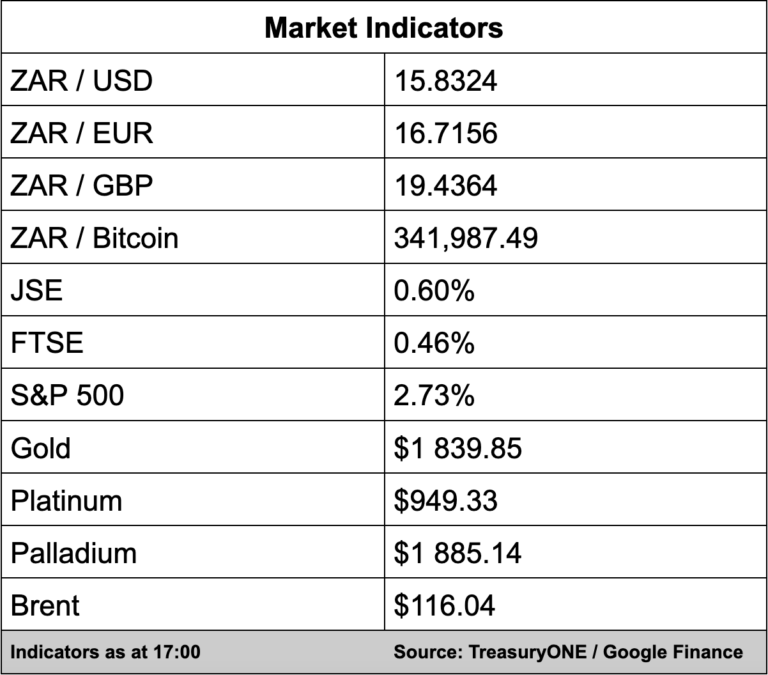

The local bourse added 0.60% with the All Share Index at 66 747.23 points.

In company news, Absa (1.68%) said it expected a jump of more than 20% in its headline earnings per share for the six months to end June, compared with the first six months of 2021. The banking group included the information in a trading update for the six months to the end of May.

The trading update reflected low double-digit revenue growth with the bank performing better in its other African regions.

Banking peers Standard Bank (0.29%), Nedbank (2.74%), First Rand (0.20%) all gained while Capitec (-0.92%) bucked the trend.

Construction firm Raubex Group (-1.77%) made an offer to buy out the remainder of mining firm Bauba Resources (-2.00%) and delist the business from the JSE. Raubex already owns 61% of Bauba and has made an offer of 42 cents a share for the rest of the shares it does not own.

On the currency front, “the dollar is trading weaker across the board as the US markets are back in the playing arena this afternoon,” comments forex trading house TreasuryONE.

“The rand is leading the way in the EM space, with the local currency trading firmly on the front foot this afternoon. At the current levels of R15.85/$, we are trading much stronger than any of our counterparts if we look at the past month, but still a mammoth 65c away from the stronger levels we saw earlier this month. Not much news out of our local market as we continue to track the dollar,” says TreasuryONE.

Meanwhile, commodities rebounded on Tuesday with gold the only metal trading flat for the day.

“The renewed surge in Covid cases saw the metal prices fall sharply since Friday, with palladium falling close to the $1,800 mark. Today’s session saw the metal gain 2.4%, while platinum is up 2.3%. Crude prices are climbing this afternoon, with supply and demand continuing to weigh up against each other,” comments TreasuryONE.