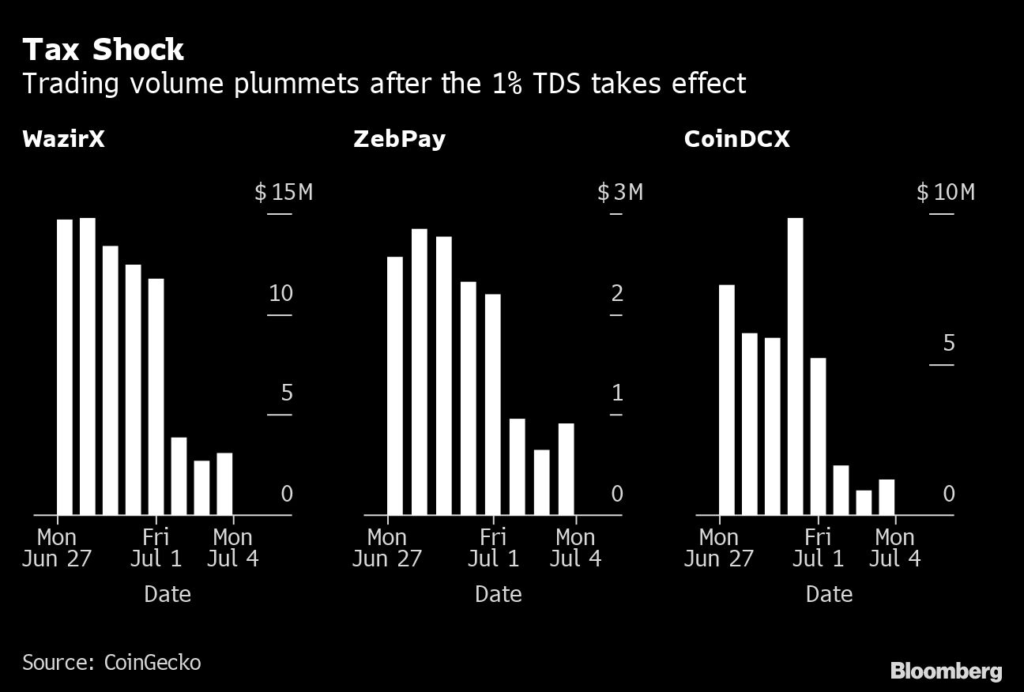

(Bloomberg) — Warnings from Indian crypto exchanges that a controversial new transaction tax would erode trading are coming true, with volumes evaporating since the levy took effect.

Three exchanges — ZebPay, WazirX and CoinDCX — suffered declines of between 60% and 87% in the value of daily trading immediately after the 1% tax deductible at source became effective on July 1, data from CoinGecko show. A fourth, Giottus, saw trading sink 70%, its chief executive said.

Those steep declines came from already depressed trading levels, as a combination of plunging prices, unfavorable tax treatment and difficulty getting cash onto exchanges combined to depress the once-hot market.

Binance-backed WazirX, for example, did $3.8 million worth of trading on July 2, the day after the tax known by the acronym TDS took effect, CoinGecko data show. In early July last year, it would have taken less than two hours of trading to reach that mark. (Crypto exchanges trade 24 hours a day, seven days a week).

While long-term crypto holders are still buying and selling, market makers and high-frequency traders are “gone,” said WazirX Vice President Rajagopal Menon. Traders are also doing more peer-to-peer trading and migrating to so-called decentralized exchanges, he said.

The government introduced a tax regime for digital assets in February, consisting of the TDS and a flat 30% tax on income from crypto investments. It also banned offsetting of losses on such assets, treating them differently from stocks and bonds.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.