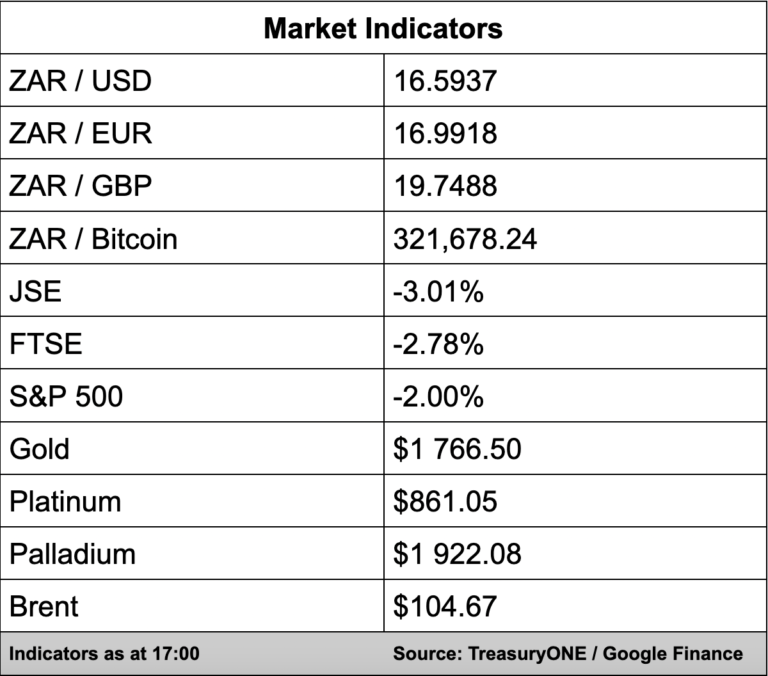

The JSE slumped 3.01% while the euro hit its weakest level against the US dollar in twenty years as oil prices eased with recession fears outweighing supply-demand concerns.

The All Share Index closed at 65,006 points.

US stocks tumbled on the first day of trade following Independence Day celebrations with equities deep in the red early in the first trading session in the US. Investors are worried about the upcoming earnings season against the backdrop of inflation and knock from central bank tightening.

In the currency markets, the euro traded at its weakest against the dollar since 2003 with the dollar firmly on the front foot during the morning session. Every currency felt the brunt of the dollar with the rand pushing back above the R16.40/$ level.

Nampak’s (2.56%) lenders agreed to a deadline extension of April 1, 2023, for the packaging manufacturer’s debt burden of R1 billion.

The largest gainers today included bourse heavyweights Naspers and Prosus at 4.55% and 3.74% respectively. While Tsogo Sun (3.68%), Hyprop (1.55%) and Growthpoint (1.94%) rounded out the top five.

Alphamin (-8.98%), Glencore (-8.33%), and Anglo American(-8.09%) were the biggest losers on Tuesday.