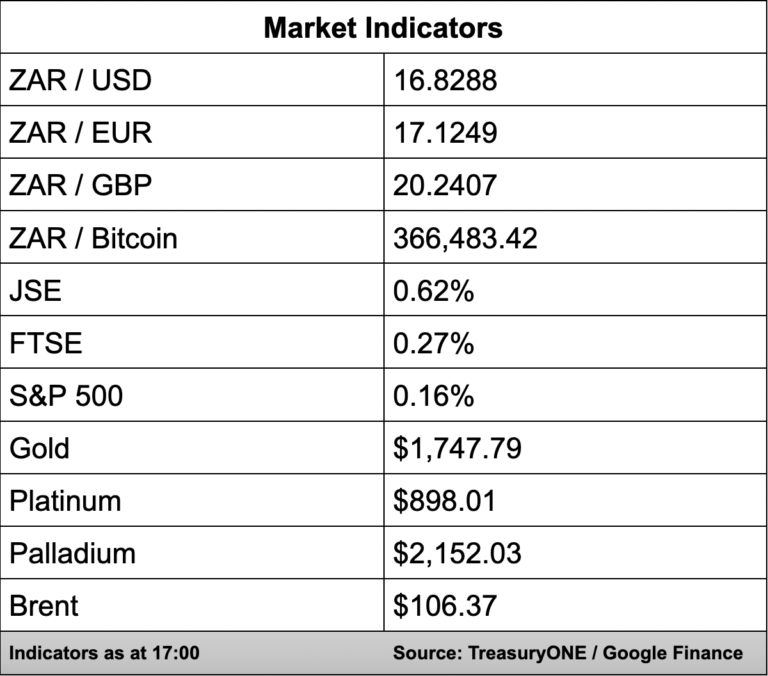

The JSE closed the week positively while the rand continued to tumble against the might of the dollar, climbing to near R17.00 against the dollar ahead of the release of the June US non-farm payroll numbers.

The local bourse closed 0.62% higher with the All Share Index at 68,327 points.

This week has seen the dollar surge to record levels for the year and, in certain cases, heights that have not been reached in many years.

“We have been singing the tune that recession fears, inflation, and interest hikes expected by the FOMC are currently the main market drivers and will be on the tip of everyone’s tongue for quite a long time to come.

“The non-farm payroll number did complement the dollar immediately after it was released but was shrugged off shortly after,” comments TreasuryONE.

The US jobs numbers printed at 372,000 jobs added, compared to the 268,000 expected by the market while unemployment remained unchanged at 3.6%.

In the emerging market space, the rand traded as high as R16.96/$ just before the jobs numbers were released after opening at R16.36/$ on Monday morning, representing a near 4% loss for the week.

“Sustained load-shedding is likely to keep the rand away from a full recovery back towards last week’s lows, but we need to remain vigilant on the move we see in the dollar as the main driving force,” says TreasuryONE.

On the commodity front, there has been much volatility with concerns over a slowdown in demand weighing on the metal and energy sectors. Oil has rebounded back from below $100 and is currently quoted at $105 a barrel.

“Gold is not currently seen as a safe haven and fell well below the $1,800 mark. Palladium had a stellar day, rebounding a massive 7% as commodities continue to trade in a see-saw fashion. Palladium remains relatively range-bound around the $900 mark, while copper is quoted at $7,850,” says TreasuryONE.