(Bloomberg) — Elon Musk’s escalating battle over bots with Twitter Inc. may be headed to one place if he tries to follow through on his threats to walk away from his $44 billion takeover offer: Delaware.

The Tesla Inc. co-founder and world’s richest person has said he’ll blow up his own $54.20-a-share offer over claims Twitter failed to fully disclose how much of the platform’s traffic is driven by spam and fake accounts known as bots.

Twitter, now trading below $40 a share, has countered that it’s providing Musk with that information and he’s obligated to complete the deal reached in April. Vijaya Gadde, Twitter’s top lawyer, told employees in May that the company could take the “pretty rare” step of going to court to enforce it.

A report by the Washington Post Thursday said Musk’s team decided that Twitter’s figures on spam accounts aren’t verifiable and that they’ve stopped engaging in some funding discussions for the deal. Twitter responded that it “has and will continue to cooperatively share information” with Musk “to consummate the transaction in accordance with the terms of the merger agreement.”

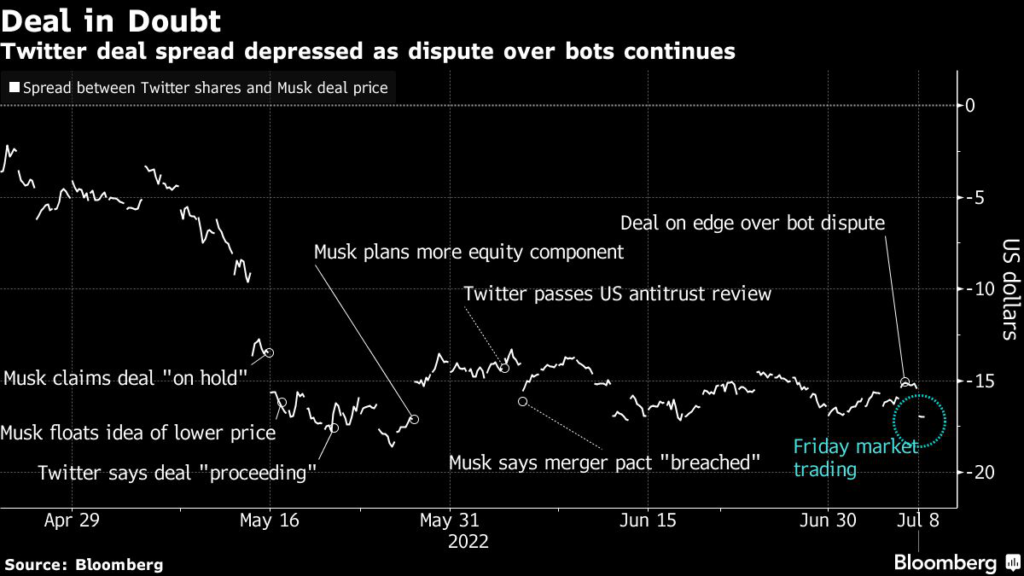

Twitter Arb Spread Blows Out on Reports Musk Deal Is ‘In Peril’

If Twitter shareholders follow the board’s recommendation and approve the buyout — probably before the summer is out — Musk refusing to complete the deal would likely be a fast track to court. Musk is slated to speak Saturday at Allen & Co.’s Sun Valley Conference in Idaho and the deal is certain to be the elephant in the room regardless of whether he addresses it directly, especially with Twitter Chief Executive Officer Parag Agrawal also present at the conference.

As with many other high-profile transactions, Twitter and Musk agreed that any legal disputes must be heard by Delaware courts, which are well versed in quickly sorting merger-and-acquisition complexities.

“I would think Twitter would have the biggest incentive to sue first,” said Jill Fisch, a University of Pennsylvania law professor who specializes in Delaware corporate law. “They want Musk to honor his commitment, but he’s more likely to say the deal is off, sue me if you don’t like it.”

But Musk, with a reputation for aggressive unpredictability, could flip that script and beat Twitter to court to put the company on the back foot, said Eric Schiffer, chief investment officer at California-based private equity firm Patriarch Organization. Musk might ask a judge to bless his decision to nix the buyout, said Schiffer, who follows Delaware merger-and-acquisition disputes.

‘Major Problem’

“It wouldn’t surprise me to see Musk move first because he already has identified what he sees is a major problem that could sink the whole thing -– the bots issue,” said Schiffer, whose fund doesn’t own Twitter or Tesla shares. “Then he could negotiate a lower price.”

After all, Musk’s public displeasure with the deal may just be posturing to push the social-media platform’s leaders into cutting the price, Schiffer said. “The valuation is off, given what’s going on in the markets,” he said.

Notably, the contract specifies that Musk can be ordered by a judge to complete the deal rather than merely pay a breakup fee to end the agreement. That’s as long as Twitter upholds its end of the agreement.

Twitter has said in regulatory filings that fewer than 5% of its daily active users qualify as spam or fake accounts. Musk contends such bots make up as much as 20% of the company’s user base. In an interview last month at the Qatar Economic Forum, Musk repeated his stance that the transaction can’t be completed before that issue is cleared up.

While vowing to turn over all the information it has on the bots to Musk, Twitter has said it can’t specifically identify all such accounts.

Determining whether a user account is automated or tended by an actual person can be hard to do, and identifying bots is an industry-wide problem that other companies like Facebook parent Meta Platforms Inc. also deal with. Twitter allows some bot accounts on the service, further complicating the issue. Bots that posted available vaccine appointments, for example, were popular in early 2021.

‘Weasel Out’

Still, a higher proportion of bots than disclosed might give Musk what he needs to justify walking away, said Larry Hamermesh, a University of Pennsylvania corporate law professor. Musk could argue Twitter’s data dump about the bots violates the buyout agreement’s representations and warranties about truthfulness, he said.

“The more robots there turns out to be, the easier it will be for Elon to weasel out of it,” he said.

It’s unlikely anything will be filed by Twitter or Musk until shareholders vote on the offer, Hamermesh said. Twitter is still waiting for the US Securities and Exchange Commission to sign off on protocols for that election. Once investors have their say, “then the flag drops” on the suits, he said.

Any suit by Twitter or Musk over enforcing or voiding the deal will be heard by a Delaware Chancery Court judge. The state is the corporate home to more than half of U.S. public companies, including Twitter, and more than 60% of Fortune 500 firms. There, chancery judges — business law experts — hear cases without juries and can’t award punitive damages.

In recent years, the court has handled high-profile cases over scuttled multibillion-dollar buyouts involving corporate heavyweights such as health insurers Anthem Inc. and Cigna Corp., and popular consumer companies like Tiffany & Co. and LVMH, the French-based parent of the maker of Louis Vuitton bags.

Musk came away pleased from his last visit to Delaware after a chancery judge found he didn’t improperly force an overpriced buyout of renewable-energy provider SolarCity.

Suing Musk

Twitter investors have already fired opening court salvos related to Musk’s offer. In May, a group of Twitter shareholders sued Musk in federal court in California, accusing him of deliberately driving down the platform’s stock price as part of an effort to renegotiate the buyout. The suit seeks class-action status on behalf of all the company’s investors. Musk hasn’t responded to the suit.

Another lawsuit was filed against Twitter last month in Delaware state court by an individual investor with five shares seeking access to internal files about spam accounts. The company hasn’t responded.

Ultimately, Musk will have to clear a high bar to escape the deal based on his bot claims.

Delaware law favors enforcing agreements free of fraud and it’s hard to get a judge to say a deal should be invalidated, said Charles Elson, a retired University of Delaware finance professor and the former head of the school’s Weinberg Center for Corporate Governance.

Rare Case

“You have to show some really troubling stuff to get a judge to agree there has been a material adverse event that justifies canceling a transaction,” Elson said. “There’s only been one case in which that was clearly found.”

That case involved Fresenius SE’s $4.3 billion buyout bid in 2018 for rival drugmaker Akorn Inc. A Delaware judge blessed Fresenius’ decision to walk away from the deal after finding Akorn executives hid an array of problems that cast doubt on the validity of data backing up approval for some drugs and profitability of its operations.

No matter what happens in the legal arena, the jockeying over Twitter has left some deals lawyers marveling over Musk’s chutzpah and predicting he’ll get his price cut.

“Even after Twitter’s statement that it is sticking to its guns, the board might well be tempted to take a haircut in an effort to end what is, I think, perhaps the weirdest major-merger process in the last 50 years, if not ever,” said Robert Profusek, head of the merger-and-acquisition department at the Los Angeles based law firm Jones Day.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.