The JSE traded lower for the third consecutive day as global peers were also in the red while US inflation data came out higher than expected.

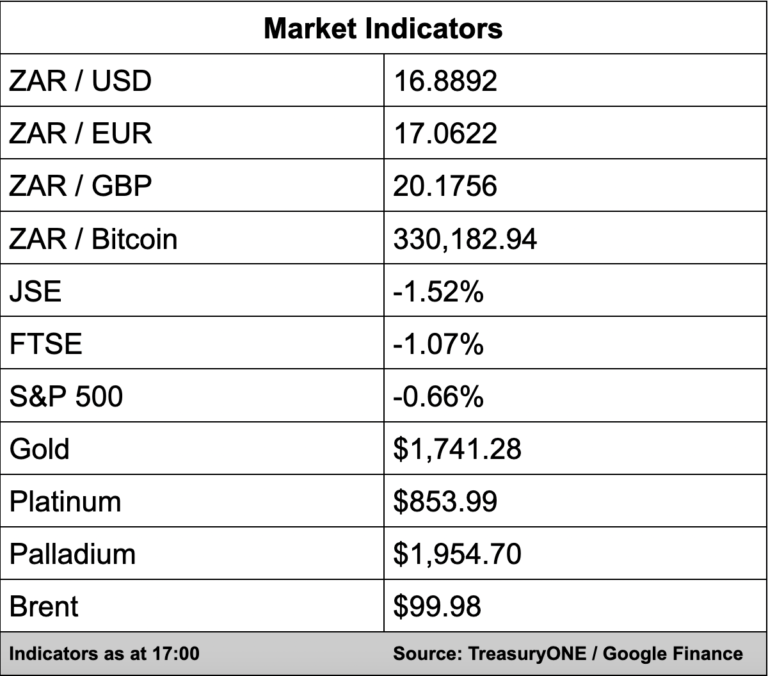

The local bourse traded 1.52% weaker with the All Share Index at 66,143 points.

“The US inflation number printed at 9.1% vs 8.8% expected. The energy portion was the biggest contributor to the number with higher gas prices being the catalyst,” comments TreasuryONE.

On the currency front, the rand was immediately impacted and lost 25 cents in minutes as it weakened to R17.17 against the greenback but has since battled back to drop below the R17/$ mark and is currently trading at R16.89/$.

Before the inflation print, the dollar pushed the euro to parity and the pound to 1.1828 shortly after the release of the data. Since the print, the tables have turned says TreasuryONE, with the euro back above 1.01 and the pound at 1.1939.

“This inflation print has sent markets scrambling; therefore, it is difficult to predict where the markets want to go, and we need to let the dust settle first,” says TreasuryONE.

The forex trading house says it is difficult to call which way the commodity market wants to push.

The gold price shot up to $1,708 following the inflation print and is currently at $1,742. Platinum is up 0.5% while palladium is down over 4%. Copper has lost another 0.5% and is currently at $7,300.

Brent crude is trading at around $100 a barrel.