(Bloomberg) — With Bitcoin down over 70% from its November all-time highs, experts search for signs of a bottom as the staunchest of long-term holders are feeling pressured to halt their selling.

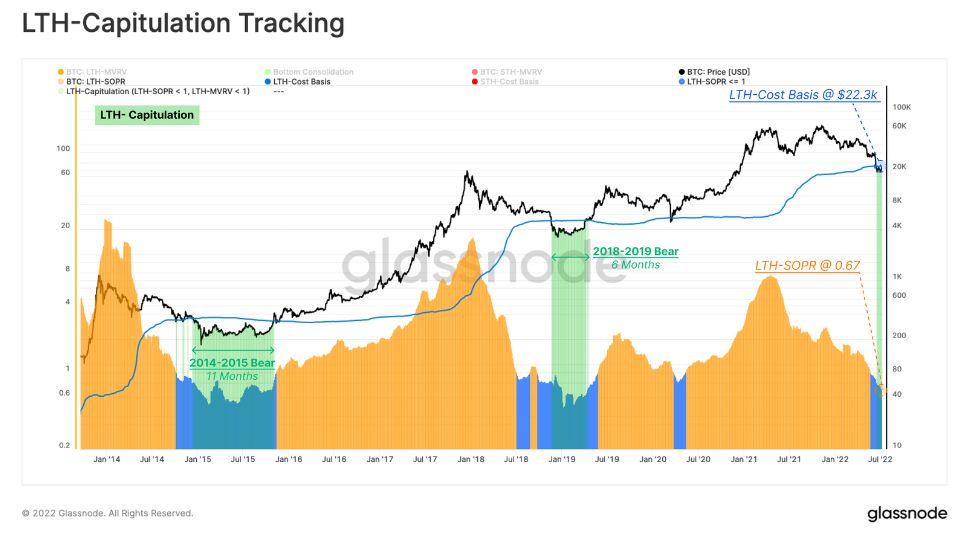

Bitcoin, the largest digital asset by market value, is hovering around $19,000, down from roughly $69,000 at the end of last year. Longstanding investors spending their coins are locking in a 33% loss, data from Glassnode indicates.

“There is an increased probability that a long-term holder (LTH) capitulation is underway,” the crypto research firm’s analysts wrote in a report.

That could signal a redistribution of coins to new buyers is near. “Bottom formation is often accompanied by LTHs shouldering an increasingly large proportion of the unrealized loss,” the analysts said. “In other words, for a bear market to reach an ultimate floor, the share of coins held at a loss should transfer primarily to those who are the least sensitive to price, and with the highest conviction.”

Elsewhere, an influx of smaller transactions from smaller entities seems to be growing, signaling a potential recovery in demand and speculation, according to the firm’s research. Meanwhile, Bitcoin miners, which can be thought of as an influential source of selling pressure during bear markets, have slowed their spending of late.

Still, none of these gauges are a definitive read on the market and finding the bottom may prove elusive. During prior bear markets, the supply held by short-term holders was just 3% to 4%, according to Glassnode. Now, with short-term holders still owning roughly 16% of the Bitcoin supply, it could be some time before the coin is largely redistributed to price-insensitive, more confident holders to calm volatility.

“Bitcoin investors are not out of the woods yet,” said Glassnode.

Calling a bottom on any asset is a fraught venture. Stock-market investors, facing 20% losses this year, are similarly looking for signals the worst of the selling has passed. Bitcoin continues to trade largely in tandem with US equities, and with tech stocks in particular.

“At the moment, Bitcoin is correlating downward with other risk assets but there isn’t any fundamental reason for it to do that,” said Quantum Economics Founder and Chief Executive Officer Mati Greenspan. “Once it breaks correlation with the stock market, Bitcoin’s price will better reflect its true value.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.