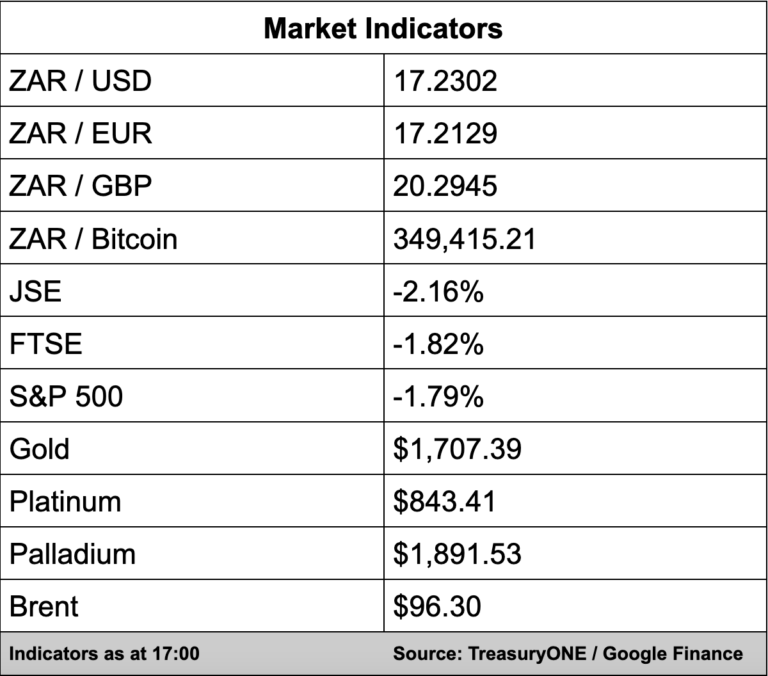

The JSE slumped over 2% as the local bourse traded down for the fourth consecutive day with the All Share Index closing at 64,713 points. Global peers haven’t fared much better with investors expecting more aggressive tightening on the horizon.

On the currency front, the US dollar broke through the parity level against the euro and is currently trading at 0.9988 to the eurozone currency.

“The final push that the US dollar needed was the US PPI number that came in worse than expected, with the number printing at 1.0% vs. 0.8% expected,” comments TreasuryONE.

“The number will place upward pressure on inflation, and the market has priced in an 80% chance that the Fed will hike by 100 basis points in their next meeting end of July, up from just around 10% before in the inflation print yesterday,” adds the forex trading house.

The break below represents the first time in 20 years that the greenback has broken below parity against the euro.

The local unit has been under pressure for the last month with the continued onward surge of the dollar.

“With risky assets looking vulnerable, any further news of recession and hawkish Fed talk could see the rand testing a little higher, and with the R17.20 level broken, a move toward R17.50 cannot be ruled out,” says TreasuryONE.

The rand is currently trading at R 17.23 against the euro and R 17.20 against the dollar.

On the commodity side, it’s a sea of red with recession talk and lower growth expected, the commodity markets will feel the pinch through diminishing demand.

Gold is trading at $1,706 per ounce after briefly breaking below the $1,700 level. Brent crude is 4% down on the day and trading at $96.00 a barrel.

“The longer we have talked of recession and lower growth, the greater the pressure will be on commodity prices,” comments TreasuryONE.