The JSE traded stronger on Monday along with its global peers as the attention shifts to monetary policy decisions by the European Central Bank (ECB) and SA Reserve Bank this week.

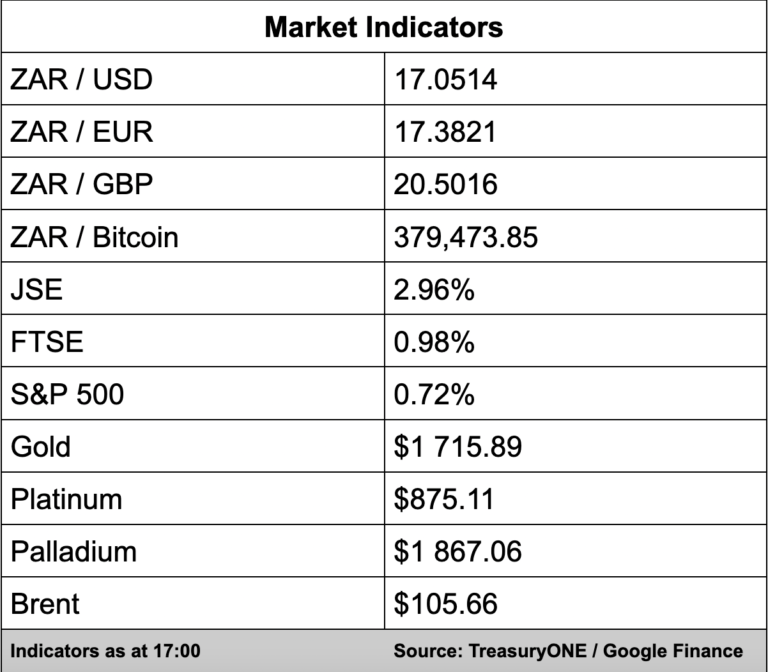

The local bourse added 2.96% with the All Share Index at 67,016.14 points.

Global financial markets were unsettled last week by inflation numbers from the US while this week there will be a focus on what central banks are going to do to curb rising inflation.

In the currency markets, the dollar has given back some ground after bulldozing all-comers last week with the euro back above the parity level at 1.0185 while the pound is 1% stronger today.

“Emerging markets like the Mexican Peso and Korean Won have shown recovery from last week’s low, but the rand seems to be stuck around the current levels,” comments TreasuryONE.

The local unit traded in a 20-cent range for the day but has closed weaker than where it opened this morning. The rand is disconnected from the market at the moment compared to its other EM peers.

“As Thursday ECB and MPC meetings draw closer, it could be that the market is waiting on the outcome of the MPC before we fall in line and stage a decent attempt to recover back to levels more favourable for importers,” says TreasuryONE.

On the commodity front, it’s been green across the board for both the metal and energy sector.

“Gold has not seen that much of a pullback yet and is still hovering above the $1,710 mark. Platinum, palladium, and copper are experiencing good fortune today, with the latter being up over 3%,” says TreasuryONE.

Oil prices have also experienced a good trading session with both Brent crude and WTI up 4%, with supply concerns weighing in after the Nord Stream 1 still not re-opened to Europe.