(Bloomberg) — Legislation to provide $52 billion in grants and incentives for US semiconductor manufacturing and to secure the supply chain for wireless communication is likely to get a Senate vote on passage next week, according to people familiar with the discussions.

In addition to the chips money, a draft bill circulated by Senate leadership also includes a handful of measures with broad bipartisan support. Among them are as 25% investment tax credit for manufacture of semiconductors and tools to create semiconductors, $500 million for an international secure communications program, $200 million for worker training and $1.5 billion for public wireless supply-chain innovation, according to a copy of the text obtained by Bloomberg.

The bill is a drastically scaled back version of the US Innovation and Competition Act that passed the Senate last year based on legislation originally introduced by Senate Majority Leader Chuck Schumer and Indiana Republican Todd Young. It primarily consists of the semiconductor funding introduced by Democratic Senators Mark Kelly and Mark Warner and Republicans John Cornyn and Tom Cotton.

Schumer has told senators to expect a possible procedural vote on Tuesday to begin debate. The House also would have to pass legislation before it could go to President Joe Biden’s desk. A senior Democratic aide said the version put before the Senate would reflect an agreement with House leadership.

Cornyn, who last week backed Republican leader Mitch McConnell’s threat to withhold support for a more expansive version of the legislation while Democrats pursued a party-line tax and climate bill, tweeted Sunday that the problem was “solved” after Democrat Senator Joe Manchin effectively blocked action on the biggest parts of that legislation.

McConnell’s office didn’t immediately respond to a request for comment.

Missouri Senator Roy Blunt, a member of the GOP leadership, said Monday that he expects Republicans will support moving forward with debating the legislation as long as Democrats don’t try to restore additional pieces of the original legislation.

The bill text also includes a provision that would bar companies who receive assistance from the US government from any “material expansion of semiconductor manufacturing capacity in the People’s Republic of China” or another foreign country of concern for 10 years after the award date. That restriction would also apply to new investments in Russia, according to a person familiar with the matter. It would not apply to “legacy” chips, as older technology is called.

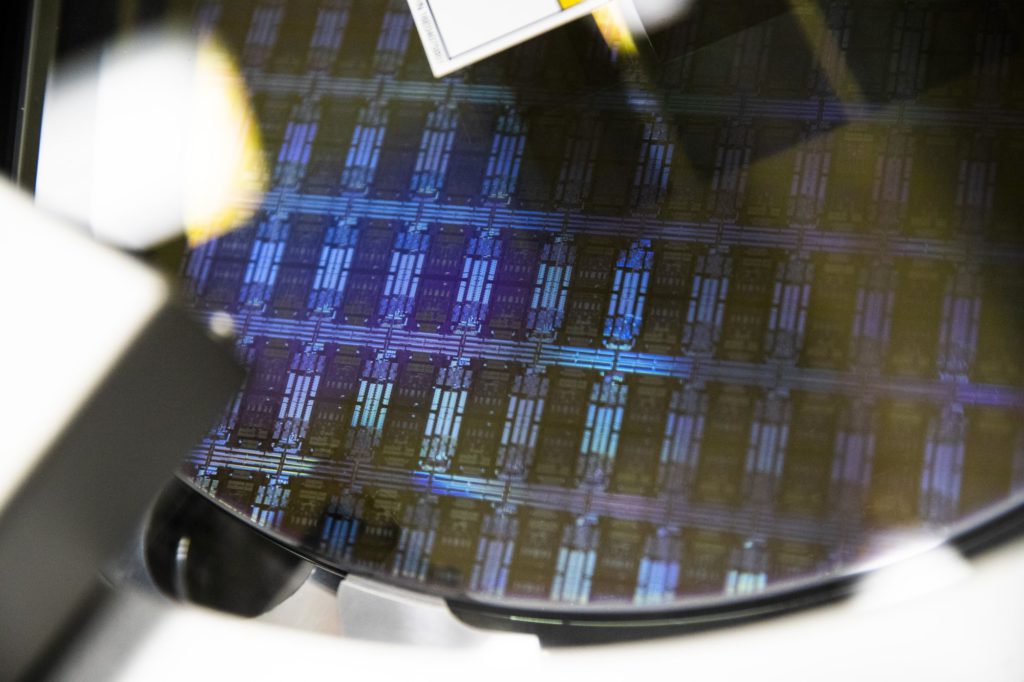

The semiconductor incentives have been a top priority for the Biden administration as well as chip manufacturers such as Intel Corp.and companies that are heavy users of chips. While the global semiconductor shortage has eased somewhat, there is still limited production for certain chips used in automobiles and home appliances.

Jettisoning the rest of the larger bill would leave an uncertain path for provisions applying new sanctions on China, funding scientific research and education and providing trade benefits to workers displaced by international competition.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.