The JSE dipped into the red during the afternoon session having initially lifted in the morning along with global peers as investors poured over strong corporate earnings coming out of the US.

Earlier in the day inflation came out at 7.4% year on year for June, which was a little higher than the expected 7.3%.

Slightly earlier, UK inflation came out at a 40-year high of 9.4%.

TreasuryONE says the SA Reserve Bank will definitely hike the interest rate by 50 basis points tomorrow and a bigger hike could be on the cards given the inflation numbers.

The SARB will need to be seen as reining in inflation now that we have gone about the 6% target band, comments the forex trading house.

All eyes will be focused on the European Central Bank and the SARB tomorrow as they announce their rate hike decisions.

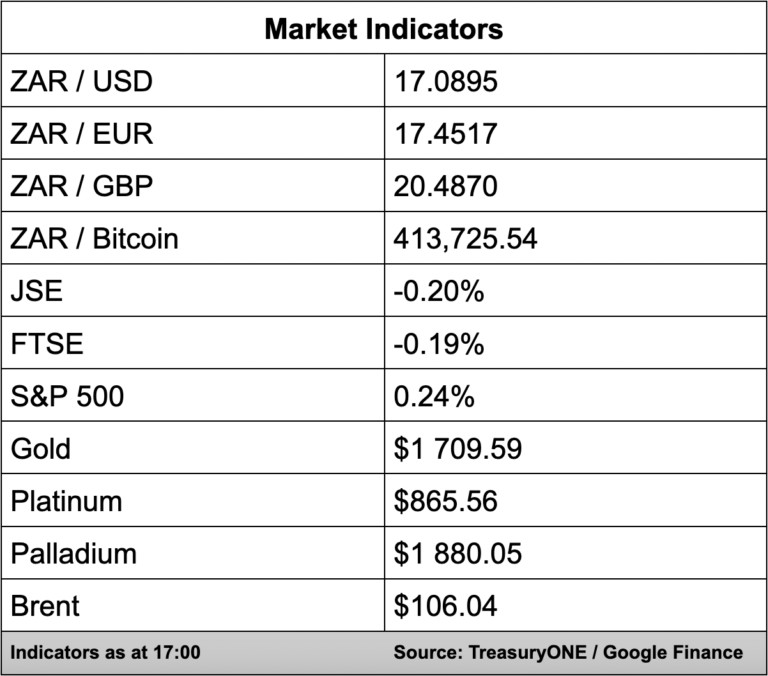

The rand has been relatively quiet today but did trade 0.5% weaker following the inflation print.

The local unit is trading between R17.04 and R17.19 versus the US dollar. The SARB meeting will be the key driver for the market tomorrow while the ECB will be the primary driver on the international front.

“The dollar showed signs of strength by breaking below 1.02 against the Euro, but with the focus remaining on the ECB meeting, we have not seen any change in sentiment for now,” says TreasuryONE.

“Not much to comment on commodities today, with the big movers being copper and oil.

The move seen in both commodities is something we have become accustomed to in recent times, as supply and demand factors move through the market,” adds TreasuryONE.

Back on the JSE, the All Share Index dropped 0.20% to close at 67,652 points.

In a trading update, Nedbank (0.21%) said it expects headline earnings per share to jump between 23% and 28% for the six months to end June 30.

The banking group said this would result in a range of between R13.33 and R13.88 per share compared to the prior period’s R10.84.

The results for the period will be released on August 10.

Banking peers Absa (0.80%) and FirstRand (0.17%) were both in the green while Standard Bank (-0.68%), Capitec (-0.03%), Investec (-3.63%).

The top gainers on the bourse today were Vivo Energy (6.71%), Dis-Chem (3.12%), and Alphamin Resources (3.09%).

The biggest losers were Karooooo (-6.76%), Bytes Technology (-5.75%), and The Foschini Group (-4.63%).