(Bloomberg) — US stocks rose as a rally in tech shares gathered strength and the latest corporate results helped shore up investor confidence.

The S&P 500 rose 0.7%, reversing losses of as much as 0.4%. The tech-heavy Nasdaq 100 extended gains above 1% as megacaps Amazon.com Inc. and Microsoft Corp. rose. Netflix Inc. jumped after it reported better-than-feared earnings, underpinning rallies in streaming peers Walt Disney Co. and Paramount Global.

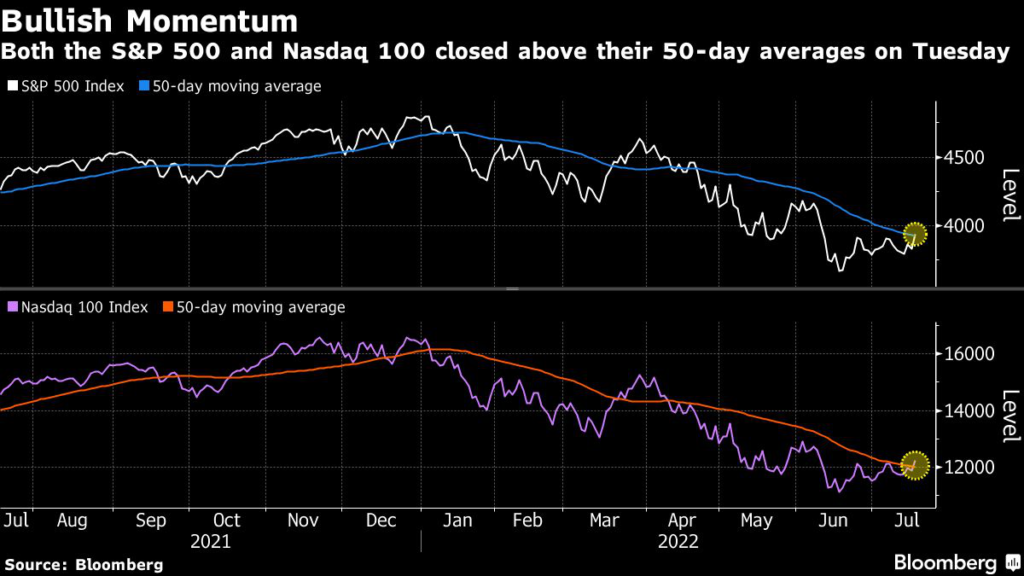

Stocks are advancing for a third day in four amid optimism over the earnings season and growing speculation markets may have bottomed out. While that debate continues, with Sanford C. Bernstein strategists saying markets have yet to see full capitulation, rates markets have discarded bets the Federal Reserve will hike rates by a full percentage point next week, bolstering optimism the central bank will take a more measured approach to policy tightening.

“The fact that companies are showing a certain resilience to the current environment is reassuring market operators who have now started betting on a less aggressive monetary tightening than initially expected,” said Pierre Veyret, a technical analyst at ActivTrades. “Even if we’re not out of the woods yet, more and more traders now tend to believe the worst is behind for equity markets this year.”

Treasuries advanced as growing concern that Europe may lose access to Russian gas added to recession fears. Risk sentiment took a hit on news the European Union is preparing for a scenario where Russia halts gas exports to retaliate against sanctions over its invasion of Ukraine.

The EU proposed that the bloc cut its natural gas consumption by 15% over the next eight months to ensure that any full Russian cutoff of natural gas supplies won’t disrupt industries over the winter.

Read more: EU Proposes 15% Cut in Gas Consumption on Russian Supply Concern

West Texas Intermediate crude oil slipped back to $103 a barrel. Bitcoin hovered above $23,000 after climbing out of a one-month-old trading range.

How far will the Fed go in this hiking cycle? It takes one minute to participate in the confidential MLIV Pulse survey, so please click here to get involved.

Key events to watch this week:

- Earnings this week include Tesla

- Bank of Japan, European Central Bank rate decisions. Thursday

- Nord Stream 1 pipeline scheduled to reopen following maintenance. Thursday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.8% as of 11:52 a.m. New York time

- The Nasdaq 100 rose 1.8%

- The Dow Jones Industrial Average rose 0.2%

- The Stoxx Europe 600 fell 0.2%

- The MSCI World index rose 0.7%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro fell 0.2% to $1.0208

- The British pound was little changed at $1.1986

- The Japanese yen was little changed at 138.15 per dollar

Bonds

- The yield on 10-year Treasuries was little changed at 3.02%

- Germany’s 10-year yield declined two basis points to 1.25%

- Britain’s 10-year yield declined four basis points to 2.14%

Commodities

- West Texas Intermediate crude fell 0.7% to $103.50 a barrel

- Gold futures fell 0.3% to $1,722.90 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.