The JSE traded weaker on Thursday morning as the market braced for the anticipated 75 basis point repo rate hike, which the SA Reserve Bank confirmed in the afternoon. But the local bourse closed in the green following the afternoon session.

Earlier on, in a surprise move, the European Central Bank joined the US Federal Reserve and the Bank of England (BOE) in the fight against inflation by hiking its base rate by 50 basis points while economists believed it would be a smaller hike of 25 basis points.

It was the first time in 11 years that the ECB raised interest rates after eurozone inflation climbed to 8.6% last month.

The Fed could increase its main interest rate by as much as 75 basis points next week while the BOE will also hike rates again in August.

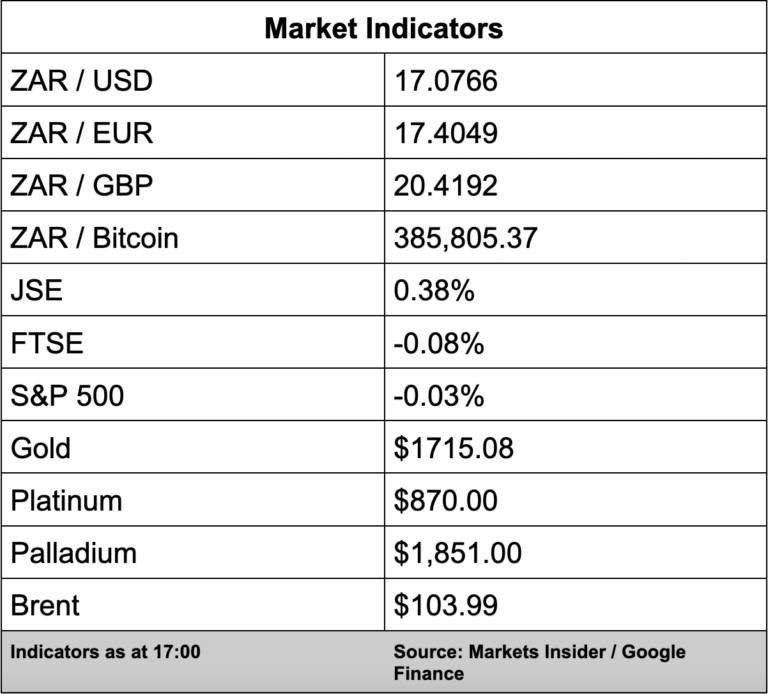

Back on the JSE, the local bourse gained 0.38% despite the big repo rate hike with the All Share Index at 67,907 points.

In company news, Vodacom (1.65%) said in a trading update for the quarter ended June 30, that the service revenue for its South African business climbed 3%. The increase in service revenue was helped by growth in its customer contract, which now sits at 6.5 million.

Mobile contract customer revenue increased 5.8% to R5.5 billion.

Telecom peers MTN added 1.80% while Telkom declined 0.62%.

Anglo American subsidiary, Kumba Iron Ore (-3.47%) said its earnings had dropped significantly on the back of lower commodity prices during the first half of the year.

In a trading statement, the mining counter said headline earnings for the half-year ended in June are likely to be between R10.87 million and R12.03 million, a decrease of between 48% and 53% from the first half of last year.