(Bloomberg) — Stocks and US equity futures wavered Monday amid concerns about a dimming economic outlook and possible recession.

European stocks pared losses after their best week since May, as energy shares fell with oil and bank stocks rose. S&P 500 and Nasdaq 100 futures fluctuated, while China’s property shares pushed higher amid a report that officials plan a fund to support struggling developers.

Treasury yields advanced, paring a sliver of last week’s drop, and a dollar gauge was little changed.

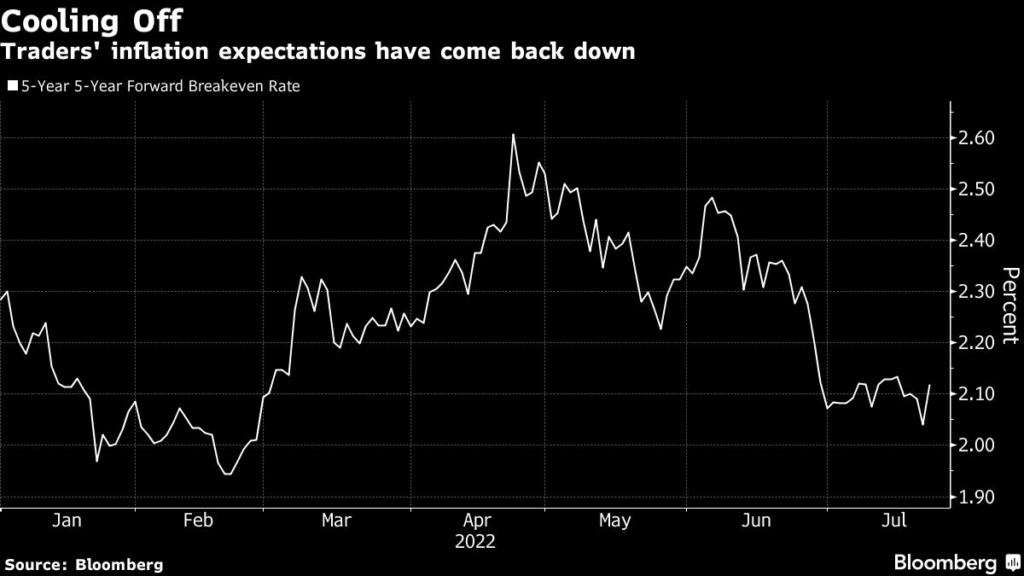

Investors are monitoring weaker economic data amid expectations the Federal Reserve will inflict more pain on the economy to get inflation under control and as European Central Bank Governing Council member Martins Kazaks said there may be more big increases in interest rates.

German business confidence deteriorated to the worst level since the early months of the pandemic on growing concerns that record inflation and limited energy supplies from Russia will throw Europe’s biggest economy into a downturn.

The Federal Reserve policy decision this week, along with earnings from the likes of Google’s Alphabet Inc. and technology titan Apple Inc., will help to clarify the outlook for a one-month-old rebound in stocks.

“We still see further downside for risky assets as recession fears accumulate and central banks remain committed to fighting inflation at the expense of growth,” wrote Eric Robertsen, chief strategist at Standard Chartered Bank Plc.

Swaps tied to Fed meeting outcome dates indicate another 75 basis-point interest-rate hike Wednesday. Expectations for the peak in the policy rate have moderated to about 3.4% roughly by year-end. Cuts are then expected in 2023.

Bear-Market Blues

“We don’t think that this bear market is going to end until there’s some evidence of nearing a bottoming of economic data or a pivot by the Fed toward a more dovish stance,” Nadia Lovell, UBS Global Wealth Management senior US equity strategist, said on Bloomberg Radio.

Retreating business activity and mixed earnings performance from major firms left US shares in the red on Friday. Treasury Secretary Janet Yellen said she doesn’t see any sign that the US is in a broad recession. Former Treasury Secretary Lawrence Summers said a soft landing is highly unlikely.

Elsewhere, wheat climbed as commodity markets evaluated a Russian missile strike on Odesa’s sea port that threatened to test a fledgling agreement to unblock Ukrainian grain exports from the Black Sea.

Here are some key events to watch this week:

- Alphabet, Apple, Amazon, Microsoft, Meta earnings due this week

- Bank of Japan minutes, Tuesday

- IMF’s world economic outlook update, Tuesday

- EU energy ministers emergency meeting, Tuesday

- Fed policy decision, briefing, Wednesday

- Australia CPI, Wednesday

- US GDP, Thursday

- Euro-area CPI, Friday

- US consumer income, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

- The Stoxx Europe 600 was little changed as of 9:43 a.m. London time

- Futures on the S&P 500 rose 0.2%

- Futures on the Nasdaq 100 rose 0.3%

- Futures on the Dow Jones Industrial Average rose 0.2%

- The MSCI Asia Pacific Index rose 0.5%

- The MSCI Emerging Markets Index was little changed

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0216

- The Japanese yen fell 0.2% to 136.33 per dollar

- The offshore yuan rose 0.2% to 6.7544 per dollar

- The British pound rose 0.2% to $1.2020

Bonds

- The yield on 10-year Treasuries advanced four basis points to 2.79%

- Germany’s 10-year yield advanced two basis points to 1.05%

- Britain’s 10-year yield was little changed at 1.94%

Commodities

- Brent crude fell 0.7% to $102.50 a barrel

- Spot gold rose 0.1% to $1,729.72 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.