(Bloomberg) — JD.com Inc. and Baidu Inc. are among Chinese firms that may follow Alibaba Group Holding Ltd. in applying for a Hong Kong primary listing, as they seek to attract mainland investors and hedge against the risk of being kicked off US exchanges.

Over the past year, Chinese companies from Li Auto Inc. to XPeng Inc. have increasingly opted for a dual-primary listing in both the US and Hong Kong. While this is more costly, the elevated status allows their stocks to be included into the city’s trading links with Shenzhen and Shanghai bourses, giving direct access to a legion of mainland investors.

That’s a huge benefit to tech shares struggling to lure global investors as regulatory risks still loom large. Stock benchmarks of Chinese tech firms traded in Hong Kong and the US have fallen more than 55% from their 2021 peaks.

Chinese companies “are likely using the Hong Kong listing as a relief valve,” Brian Freitas, an analyst for independent research platform Smartkarma, wrote in a note. Firms with secondary listings in the city “could look to convert that to a dual-primary listing before they are forced to do so.”

Of the 24 Chinese firms listed on both New York and Hong Kong exchanges, eleven have either a primary status in the Asian city or are taking steps toward that goal, based on data compiled by Goldman Sachs Group Inc. The rest have opted for secondary.

Among the most recent convert was Zai Lab Ltd. in June, which was subsequently included in stock connect schemes in July. Bilibili Inc. plans to switch status in October.

Alibaba Seeks Primary Hong Kong Listing to Woo Chinese Money

The clock is ticking for some 200 Chinese firms to avoid a congressionally imposed 2024 deadline for kicking businesses off the New York Stock Exchange and Nasdaq Stock Market unless American regulators get full access to inspect their audit work papers.

Securities and Exchange Commission Chair Gary Gensler said last week it’s unclear if American and Chinese authorities will reach a deal on the matter but added that talks between the two sides had been “constructive.”

While Beijing is reportedly exploring a new way to sort its US-listed firms to help them meet American regulatory requirements, a so-called homecoming listing to Hong Kong or potentially mainland China remains a straightforward backup option for the companies and authorities.

Given rising tensions with Washington, Beijing may also find it easier to help grow and manage the nation’s influential tech firms by moving their main listing venue to Hong Kong, especially as it further tightens its grip on the city.

“I think it hopefully shows that the very strong regulations on the tech sector are starting to soften a little bit,” said George Sun, head of global markets for Greater China at BNP Paribas China Ltd., in a Bloomberg TV interview. “It allows some of these companies that were in the headlines to get back into business and be re-centered here in Asia.”

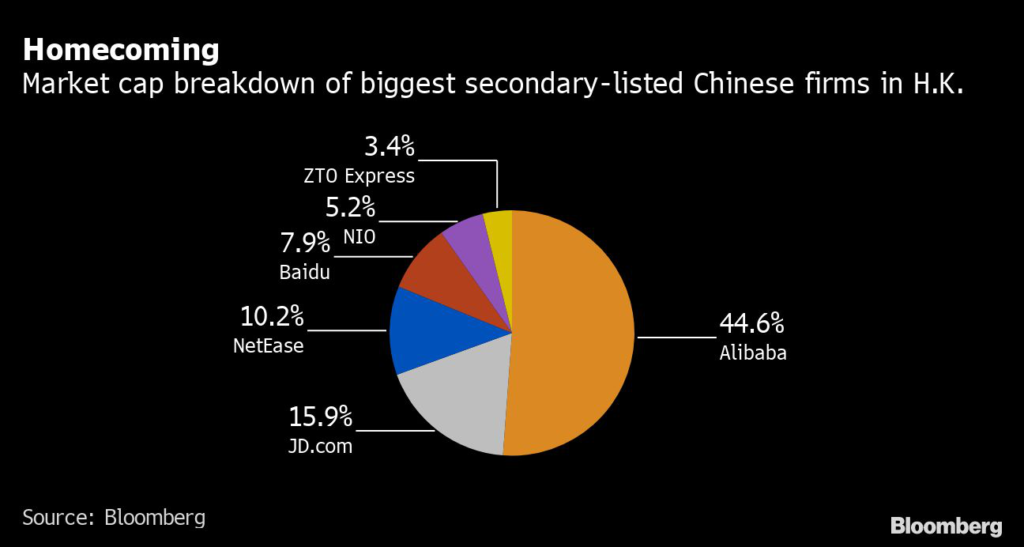

Here’s a list of US-traded Chinese firms that currently have secondary listings in Hong Kong, ranked by their market capitalization:

(Updates with analyst comments and a new chart)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.