(Bloomberg) — Even the cold winds of a crypto winter can’t keep luxury brands away from nonfungible tokens.

Kering SA’s Gucci and LVMH’s Tiffany & Co. this week added to the throng of high-end brands diving further into the cryptosphere, launching NFT-related projects. For Gucci, it’s adding another crypto to the wheelhouse of currencies it accepts as payment, while Tiffany will use NFTs as a digital passport to make custom physical jewelry for crypto aficionados.

The companies described these initiatives as “the future” and “yet another step” in their exploration of web3, a moniker given to next-generation internet technologies.

But the market conditions for these launches seem less than ideal.

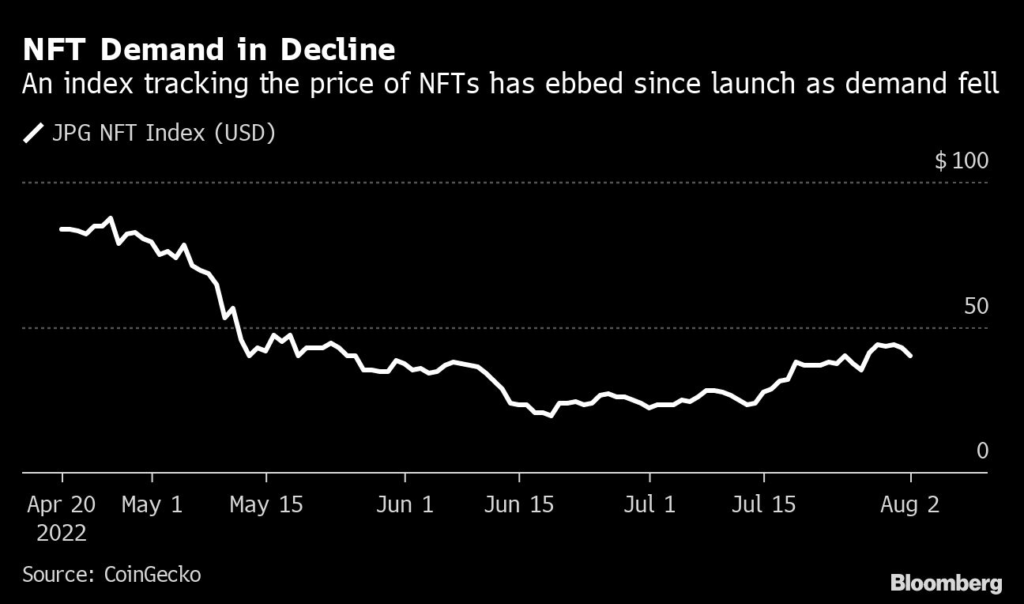

Demand in the NFT market has slumped in recent months, with resale value performing poorly alongside wider industry turmoil that has wiped around $2 trillion from the crypto sector’s total value. Still industry executives said many large consumer companies continue to see NFTs and web3 technologies as a promising way to engage with customers.

“Brands have this opportunity to have a new kind of relationship with their customers,” said Ian Rogers, former chief digital officer at LVMH and now chief experience officer at crypto hardware firm Ledger. “What you are going to see over the next few years is a lot of experimentation as people figure that out.”

Read more: CryptoPunks Lurk in Tiffany’s Little Blue Box: Bloomberg Crypto

Ledger itself has launched a marketplace for NFTs which it hopes will become the home for drops from leading brands and artists. It also previously collaborated with LVMH’s Fendi, creating Fendi-branded tech accessories designed to house Ledger’s USB stick-sized wallets.

The partnerships work both ways, with pricing data showing that endorsement by big brands can be beneficial for crypto projects too.

Following Tiffany’s July 31 announcement that it would offer “NFTiff” collectible passes that could be redeemed by owners of CryptoPunk NFTs for a custom pendant, the digital artwork collection’s floor price rose more than 9% to 74.69 Ether, or roughly $123,000, according to data from NFTPriceFloor.

And after Gucci’s tweet on Tuesday about accepting ApeCoin as a form of payment at some of its boutique stores in the US, the token pared an earlier 4% slump to trade nearly flat by 5 p.m. in London, according to pricing data from CoinGecko. The Bored Ape Yacht Club collection of NFTs, created by ApeCoin issuer Yuga Labs, also rose Tuesday, climbing 5.2% on Tuesday to 84.19 Ether.

By contrast the broader JPG NFT Index, which tracks the prices of a small number of blue-chip NFT projects, was down 5.4%.

“I’m hearing lots of brands are actually happy the price speculation has fallen away,” said Simon Taylor, head of strategy and content at crypto fraud prevention startup Sardine. “Brands that were concerned about being seen to make a quick buck are now less concerned. The recent launches show belief in the utility of NFTs to engage their consumers and customers to do new things digitally.”

Read more: The Disastrous Record of Celebrity Crypto Endorsements

Gucci will be the first brand to accept ApeCoin in US stores and plans to expand that reach across the rest of its North American presence this summer, company spokesperson Claudio Monteverde said in an email Tuesday.

The Italian fashion house had posted a job advertisement for a “Web3 Manager” in January, seeking someone with experience in digital assets to help drive sales in digital art and NFTs. Monteverde confirmed that the position has yet to be filled, as “the team is still evaluating some options.”

A permanent team dedicated to the metaverse, a virtual world that includes different technologies, was formed by Gucci more than a year and a half ago, he added. Evolved out of the brand’s earlier gaming strategy, Monteverde said the Dream Big unit could be seen as akin to “a startup exploring new areas of opportunity” for the business.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.