(Bloomberg) — At first glance, the implosion of vaunted fashion startup Zilingo Pte looked jarringly sudden.

When the Singapore tech darling suspended its 30-year-old chief executive officer Ankiti Bose over complaints about alleged financial irregularities, it was March. Within weeks, creditors were recalling loans, more than 100 staff had left, and Bose found herself fired, though she denies any wrongdoing. The company’s survival is now in question.

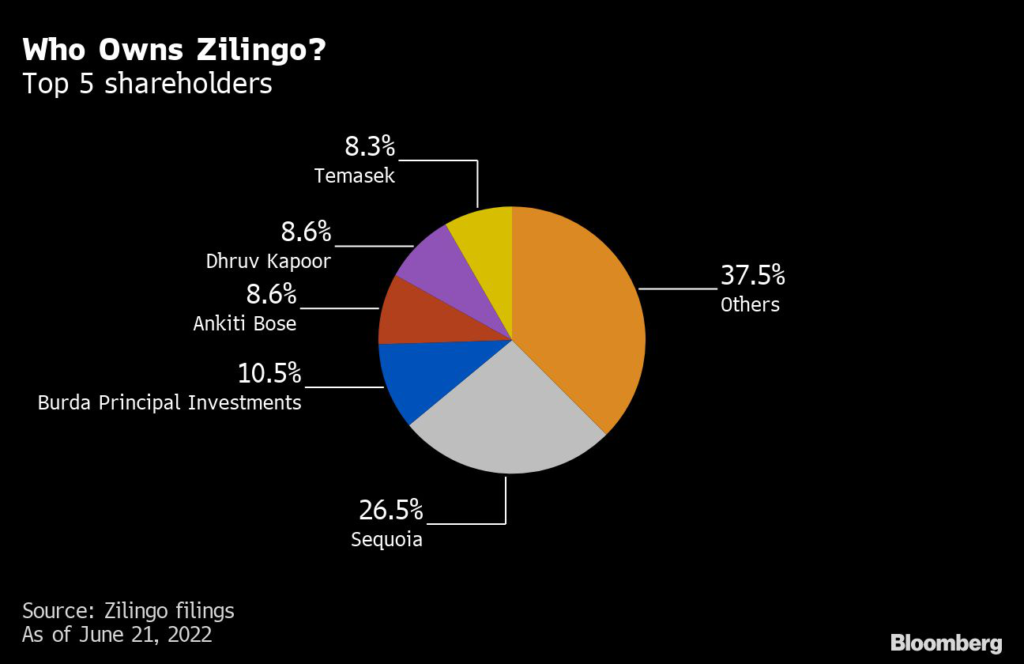

The Zilingo meltdown has rattled the tech industry in Southeast Asia and beyond. The startup had raised more than $300 million from some of the region’s most prominent investors, including Temasek Holdings Pte and Sequoia Capital India, the regional arm of the Silicon Valley firm that backed Apple Inc. and Google. Bose was a celebrity who crisscrossed the globe to speak at tech gatherings from Hong Kong to California.

Interviews with more than 60 people, including current and former staff, merchants, investors, entrepreneurs and friends of the key players, suggest that Zilingo struggled for years under Bose’s leadership. Bose’s management style alienated employees and undermined the business, according to staff who worked under her. The startup veered from one strategy to another in pursuit of sales, including a $1 million promotional trip in Morocco, loans to customers and a short-lived push into the US. At one point, she became fixated on “crazy growth” to catch the attention of Japanese tech titan Masayoshi Son, according to two former employees with direct knowledge of the matter.

At the heart of the company’s breakdown lies the soured relationship between Bose and her longtime supporter, Shailendra Singh, head of Sequoia India. Allies for years, they fell out as financial pressures mounted. Singh lost faith in the management skills of the young founder he had championed, while Bose believed Singh betrayed her by pushing her out of her own company, according to people familiar with their relationship, who requested anonymity as the talks were private. The clash grew so acrimonious that Sequoia’s lawyers demanded in a May legal notice that Bose stop making allegations that could tarnish Sequoia’s reputation, the people said.

Zilingo’s turmoil highlights an apparent lax internal corporate governance culture that’s not uncommon in the startup industry. For two years, the company failed to file annual financial statements, a basic requirement for all businesses of its size in Singapore. Auditor KPMG LLP has yet to sign off on Zilingo’s FY20 results. While it’s not unusual for startups to miss these deadlines, which can result in a fine of up to S$600 ($430), it is typically a warning sign that firmer action may be needed by the board.

Yet, investors including state-owned firms Temasek and EDBI, put more funds into Zilingo at the end of 2020. Shareholders that together own a majority stake of the company only formally acted against Bose after whistleblower complaints were filed earlier this year.

Tech Warning

The saga has also become a warning for the region’s tech community, which is assessing the fallout of global economic shocks from Covid, to the war in Ukraine and global inflation.

“Whatever happened at Zilingo, there will be a lot more dramas in the next couple of years as the big worldwide recession impedes hot shots from raising money,” said veteran investor Jim Rogers, chairman of Rogers Holdings Inc. in Singapore. “I’ve seen this rodeo before.”

Bloomberg News reviewed dozens of internal documents, emails, texts and other media from Zilingo, and Bose sat for two extensive interviews, one before and one after her dismissal from the company on May 20. The board’s decision to fire her wasn’t abrupt, but rather the culmination of years of tension, according to the documents and people with direct knowledge of the matter.

“Board members were concerned about the company’s performance over the last few years and sought to share suggestions to address the company’s performance including cash burn,” Zilingo and its board said in a statement to Bloomberg News. “In March 2022, investors received complaints about serious financial irregularities which appeared to require investigation. With the support of the majority investor shareholders, an independent forensic investigations consultancy was appointed to look into the said complaints. After a comprehensive process lasting almost two months, including numerous opportunities for Ms. Bose to provide documents and information, the company subsequently terminated Ms. Bose for cause based on the findings of that investigation.”

Bose said the process to terminate her was an “unfair witch hunt” and denied that she was given numerous opportunities to respond to allegations. She said she hasn’t seen the investigation report, which wasn’t made public. On the board’s suggestion to implement changes, she said the team cut the cash burn by 70% between the end of 2019 and the end of 2021. “It was not easy, we did not succeed at everything,” she said in July. “It was chaotic and painful, but we did do it and we made the best effort we could.”

Read: Zilingo’s Fired CEO Responds to Questions of Mystery Payments

Zilingo’s origin story is part of Southeast Asia’s startup lore. Bose came up with the idea as she wandered through Bangkok’s Chatuchak market, where 15,000 stalls offer goods from across Thailand. She and co-founder Dhruv Kapoor wanted to build a platform that would allow such small merchants to sell to consumers across Southeast Asia.

Singh was instrumental from the start. He and Bose had worked together at Sequoia and he was happy to support one of the firm’s own. Singh had started his career in Sequoia’s Silicon Valley office, learning at the side of veteran investors Michael Moritz and Doug Leone. Singh had transformed Sequoia Capital India over 16 years into the region’s biggest venture capital firm with some $9 billion of assets under management and 36 unicorns on its scoresheet across India and Southeast Asia.

He invested in Zilingo’s seed round in 2015, when Bose was 23 years old, and in every fundraising since. “We think the world of her,” he told a fellow VC in 2016, in an email seen by Bloomberg News.

But like many upstarts, Bose and Kapoor faced challenges almost from the beginning. Their consumer-focused fashion site struggled because of the thin margins and low average income in Southeast Asia, a fragmented region with different languages and currencies. By late 2017, they decided to reposition Zilingo into a business-to-business platform, where small manufacturers and wholesalers could sell goods directly to small retailers in the region.

In 2018, Zilingo raised $54 million from investors. The company decided to splurge $1 million to whisk nine social-media influencers to Morocco for a three-day extravaganza, complete with camel rides, a hot-air balloon trip, yoga lessons and gourmet dinners.

It was a massive flop, according to an early employee with direct knowledge of the event. The goal of #ZilingoEscape was to bring in 1 million new users, one for each $1 spent. The final tally was about 10,000, the person said. Bose declined to comment specifically on the campaign, but said it was part of the company’s $10 million annual marketing budget.

This appears to have become a pattern for Bose. With cash in Zilingo’s coffers, she would dive into new initiatives to supercharge growth even if the immediate financial benefits were questionable. In one example, Bose suggested Zilingo subsidize a 2% to 4% discount for transactions, effectively paying merchants to trade with each other. She cheered on the team as gross merchandise value hit $1 million for the first two months, even though Zilingo was getting no fees from the merchants, said a person directly involved.

In 2018, Bose came up with the idea of giving out loans to suppliers and vendors who needed capital. It took off, so in the coming months Bose cranked up the pressure. She told the team to give out more loans each month on a running basis, the person said. But no one could have predicted the pandemic, or the toll it would take on startups like Zilingo, and much of the debt had to be written off.

Yet Bose’s star was rising in the industry. In early 2019, Zilingo raised $226 million, lifting its valuation to $970 million. The charismatic CEO wooed tech gatherings with her vision of how startups like hers were a new model for the emerging world.

“We are about to shake things up quite a bit,” Bose said at a panel discussion in Singapore, flashing a wide smile and drawing applause from the audience.

Inside the company, she drove staff relentlessly. In one instance, Bose messaged a senior lieutenant early on a Sunday morning and called about a dozen times. When the employee didn’t pick up immediately, she told the lieutenant: “You obviously don’t care about the company enough.”

Publicly, the company seemed to be going from strength to strength. In July 2019, James Perry, former managing director and Asia-Pacific head of technology investment banking for Citigroup Inc., joined Zilingo as its first chief financial officer.

It was a coup for Bose, some 20 years Perry’s junior. Bose said in an interview with Bloomberg News in 2019 that Perry’s experience and respect in the financial world would compliment her “young and crazy” self and give confidence to investors. “He’s James Perry, he’s a god in finance,” she said.

In the investment world, her big target remained Son, whose SoftBank Group had upended venture capital by making huge bets on unproven startups. Bose told her deputies that Zilingo needed to achieve rapid growth to catch Son’s attention, one of the deputies said.

Bose met Son twice that year, once in Jakarta and a second time in Tokyo, according to people familiar with the matter. She explained her vision for Zilingo, but Son never backed her. Neither did KKR & Co., which was considering investing in the startup at the time, the people said. A SoftBank spokesperson declined to comment.

In October 2019, Zilingo announced it would spend $100 million to expand into the US, establishing offices in New York and Los Angeles. Bose’s idea was to take advantage of President Donald Trump’s trade war by offering American retailers a way to avoid tariffs by finding producers outside China. Less than a year later, the company shut its US operations.

By the end of 2019, Singh and other directors had told Bose several times to slow the cash burn. But Singh wasn’t getting regular financial reports from Bose, and it wasn’t till a board meeting in November that the directors learned that the company was actually going through some $7 million to $8 million a month, more than they had expected. Singh picked up the phone and had a tough conversation with Bose, according to people with knowledge of the conversations.

Guzzling Money

It turns out that the company was guzzling money. The $226 million Zilingo had raised from investors in early 2019 was gone in less than two years.

In 2020, the pandemic battered the business and Bose saw an opportunity to supply personal protective equipment, inking a deal in April to supply 10 million KN-95 masks, valued at $22.5 million, to India. Six months later, Zilingo was embroiled in a legal battle with the Indian government, which claimed the company had failed to deliver 3.2 million of the masks on time. The company didn’t comment on the lawsuit, which is still ongoing.

In September, Perry left Zilingo to rejoin Citigroup.

Inside the company, former employees paint a picture of a boss who ruled by fear. She allegedly told some staff they’d have no second chance in the startup industry because of her powerful connections. She would publicly shame employees and declare that she had to do everything herself to save the company, one person said. Another described her as a narcissist who would throw anyone under the bus if it meant saving her own reputation.

Asked in an interview in Singapore before she was fired about the culture under her leadership, Bose uncharacteristically paused and stared out of the window as the sun set over the city.“I was 23 when I started the company,” she said eventually. “I liked having control at the beginning. Of course I made mistakes and learned from them. By the time we got to the stage where we had all these senior people, I don’t think I was a control freak.”

In her most recent interview with Bloomberg in July, Bose reiterated that she has not done anything wrong. In future, she said, “I’m going to be a lot calmer, a lot more empathetic and understanding of how people work together. That has been a big learning for me. Managing people, managing relationships, managing communications — I think all of this is coming down to that.”By November 2020, Zilingo had barely enough cash to last a month. A group of existing investors including Sequoia, EDBI, Sofina, Temasek and SIG stepped in to rescue the company by purchasing $25 million of convertible notes.

In January 2021, Singh and Bose met at the Four Seasons Hotel’s alfresco cafe as they did from time to time to talk shop. Singh suggested Bose consider stepping aside. He said Ananth Narayanan, founder of brand-building service Mensa Brands and ex-CEO of fashion platform Myntra, could be a potential successor. The two men had met recently and, when Narayanan said he was looking for a new opportunity, Singh had thought of Zilingo.

Bose was shocked. “Not yet,” she said.

She went home and, that night, sent a series of emotional texts to Singh, saying his suggestion was a gender-related issue and pouring her heart out. She said her departure would make her look bad, as though the firm needed to be saved by someone else. Singh said it was just a preliminary idea and there was no need to discuss it again. He urged her instead to focus on improving metrics, finding a new CFO and fundraising, according to people familiar with the meeting and texts seen by Bloomberg.

Bose ended the chat by saying they should work together toward the best possible outcome, and Singh replied with two thumbs-up emojis. It was 2:29 a.m.

The mounting pressure was also testing the relationship between Bose and co-founder Kapoor, the chief technology officer. They had clashed over the future of the company the previous month when the company was scrambling to stay afloat.

“I am scared honestly that we will not hit our goals,” she texted Kapoor several hours after the chat with Singh. “When something is wrong the blame falls on me, but everyone’s there to take credit for the good,” she wrote, adding, “I don’t like being hated for busting my ass at all.”

Bose spent most of the year trying to pull in more funds. In July 2021, the company took mezzanine debt of $40 million from Indies Capital Partners Pte and Varde Partners, but subsequent efforts to raise money from private equity and venture capital firms failed. One issue was a concern from potential investors that users were making fake transactions in key markets to bilk Zilingo’s subsidies. Executives from two firms told Bloomberg News that they decided not to back Zilingo after they found evidence of merchant fraud in Indonesia, the country that accounted for more than half Zilingo’s GMV in the financial year 2021.

There was no suggestion that Zilingo was involved in the suspected fake transactions. Some existing investors, including Burda Principal Investments Ltd., Temasek and Sofina, questioned Bose about the company’s unaudited financial reports, according to people familiar with the matter. But Bose was providing monthly financial updates to the board, and they were lenient as Zilingo was busy with fundraising at the time, one of the people said.

In March this year, Bose received an ominous text on her phone: “Storm is coming your way.” A few days later she was asked to join a meeting with investors at Burda’s shophouse office on Singapore’s Boat Quay, according to people familiar with the details of the meeting. There, Singh and the two other shareholders dealt her a stunner. They said Zilingo’s board had received complaints about alleged mismanagement and financial misrepresentation and they were suspending her during an investigation. Singh urged her to be cooperative.

“We just want to save the company,” he said, according to one of the people.

Bose promised to help. As she left, she started running through the pouring rain.

“I think the tale is about what sometimes happens when you go into hyper-growth mode,” said Aliza Knox, senior advisor at Boston Consulting Group, who has held senior management positions at tech companies including Google and Twitter in Asia Pacific. In these situations, startups need to think about adding independent board members beyond “founders and funders,” she said. “Could some of the problems have been mitigated if there were a different kind of board a little bit earlier? That’s an important question to ask.”

Zilingo isn’t the only Sequoia-backed startup embroiled in controversy. BharatPe’s co-founder Ashneer Grover resigned from the fast-growing Indian fintech startup in March after senior leadership accused him of misappropriation of funds. Grover has denied the accusations against him, including that he stole company money to fund an extravagant lifestyle, which he said stem from “personal hatred and low thinking,” he said on LinkedIn.

A forensic team from EY India has looked into Indian social commerce startup Trell, another Sequoia-backed company, amid allegations of financial irregularities. Trell’s three co-founders did not respond to requests for comment. Co-founder and CEO Pulkit Agrawal in March sent a note to investors, questioning the nature of the forensic audit, the Economic Times reported, citing its own review of the note.

Sequoia India and Southeast Asia published a blog post in April, saying it would take “proactive steps” to drive corporate governance at startups it invests in.

Singh is feeling the heat as he evolves from startup cheerleader to champion of corporate governance. Increased scrutiny prompted some Sequoia-backed Indian founders to compare him to a forceful ruler from Indian history.

“There is art to setting up governance — the board, process and advisers — in such a way that brakes kick in automatically when something bad happens,” said Dmitry Levit, founder of Singapore-based VC firm Cento Ventures. He said many of Sequoia India’s companies are like racing cars. “If somebody tries to run a Formula One car on off-road terrain in stormy weather, it can’t absorb the shocks.”

Sequoia India said it has always cared about corporate governance. “Building world-class companies requires first-rate governance,” a Sequoia India spokesperson said in a statement to Bloomberg. “There is always more we can do to work with founders so that their companies benefit from better, more robust standards of governance, such as stronger audit oversight, clear whistle-blower processes and the need to bring independent directors on board earlier.”

Salary Questions

The zeal for governance may have come too late for Zilingo. About a week after Bose was suspended, a board director and an adviser to another shareholder questioned her about why she was drawing a monthly salary of S$50,000. Her employment contract five years ago stated it as S$8,500 and the adviser had just discovered she’d been making considerably more since 2019, according to people with knowledge of the matter. Bose said the numbers are inaccurate but did not provide her salary information.

Investigators hired by the board also questioned her about three sets of revenue numbers for FY21 that Zilingo had shared with external parties: $190 million, $164 million and $140 million. Bose explained to them that the $190 million had been circulated before the year closed and before the cancellation of masks and other orders. The $140 million was used in a due diligence report for fundraising, while the $164 million included uninvoiced revenue, according to a document seen by Bloomberg. But another document the company shared with a potential investor, seen by Bloomberg News, shows Zilingo’s net revenue for the year was about $40 million. A representative for Kroll Inc., the firm that conducted the probe, declined to comment.

Bose said in an interview with Bloomberg News in May that Zilingo has used aggressive methods for recognizing revenue, but that the calculations are standard practice for the industry and that all of its investors were fully aware of them. “These matters are well understood by all investors,” Bose said in the interview.

Zilingo “went through a tough time during Covid,” said Rohit Sipahimalani, Temasek’s chief investment officer. “There were clearly some things the board was unaware of, and when there were complaints made, they investigated into it and actions have been taken subsequently.”

Zilingo Board Said to Approve Debt Repayment to Creditors

Now, the company is in turmoil and some employees say they are worried about their future. The board in June was considering liquidating the company. After her suspension in March, Bose herself filed a formal complaint to the board, asking it to also suspend Kapoor and then-Chief Operating Officer Aadi Vaidya, a friend from college, for their poor work performance and lack of leadership. A representative of the company, Kapoor and Vaidya declined to comment. Vaidya resigned last week after seven years with Zilingo, explaining “now is the time to move on, clear my head and reset priorities.”

It’s a steep fall for Zilingo from just five months ago, when Bose’s fundraising efforts valued the company at $1.2 billion.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.