(Bloomberg) — Investors who have been trying for two years to reclaim money trapped in H2O Asset Management have had a new problematic investment dumped on their books: a ride-hailing app whose valuation has tumbled 75%.

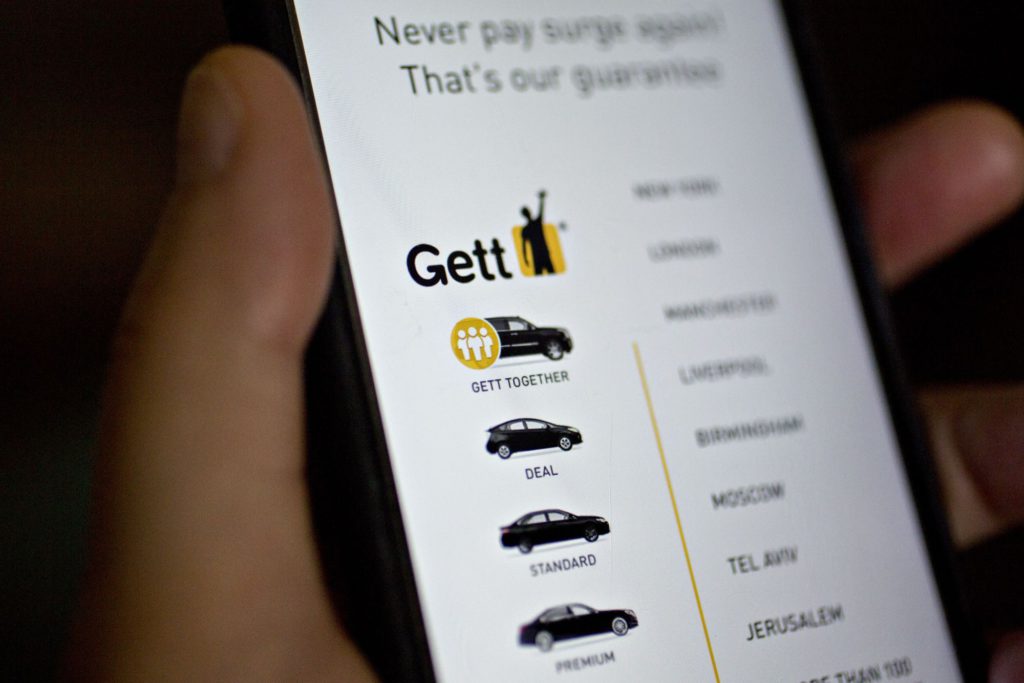

German entrepreneur Lars Windhorst — as part of an ongoing attempt to repay money owed to the money manager — in January agreed to hand over notes linked to London-based hailing app Gett, according to a letter published on the firm’s website last week. H2O clients are owed about 1 billion euros ($1 billion) from assets that were frozen by the French regulator.

Back in January the Gett notes, which pay out if the company goes public, were valued at $106 million because the company was about to list through an already announced deal with a Special Purpose Acquisition Company, or SPAC. But that deal has since been shelved and the company’s valuation slashed to around $250 million from more than $1 billion.

The note adds to complications for investors still waiting for H2O’s outsize bet on Windhorst to come good. In 2019 the money manager saw billions leave its suite of funds after a Financial Times article detailed the scale of investments in companies linked to the entrepreneur. A year later the money manager was forced to freeze the funds by the French Market Regulator, reopening them only after sidepocketing the Windhorst notes.

A spokesperson for Windhorst’s investment firm Tennor Holding declined to comment. An H2O spokesperson confirmed details of the Gett investment but declined to comment further on the sidepocketed funds.

Russia Exposure

Gett has expanded rapidly since it was founded by Moscow-born Israeli entrepeneur Dave Waiser in 2011. It drew backing from Volkswagen AG and billionaire Len Blavatnik’s investment firm Access Industries. Windhorst took an undisclosed minority stake in the business when he contributed to a funding round, according to a person familiar with the matter.

The aborted SPAC deal, backed by Rosecliff Venture Management LLC, would have valued the company at around $1 billion. The firm was initially set up as a ride-hailing app, but now offers an aggregation service using existing ground transportation platforms.

In March this year the firm announced it was not going to follow through on the SPAC deal and that it would exit its Russian business, one of its three main markets. Waiser, who had been chief executive officer, moved on and was replaced by Matteo De Renzi.

A spokesperson for Access declined to comment. Representatives for Gett and VNV didn’t respond to requests for comment.

Evergreen

Windhorst had initially attempted to pay back H2O through a company called Evergreen. To help fund the potential deal, Evergreen issued a bond, sold in part to high-profile German investors, including fashion retail magnate Friedrich Knapp and health care entrepreneur Ulrich Marseille.

The buy back, which was intended to take place in several steps, stumbled as the French regulator ordered H2O to freeze redemptions from some of its funds because of valuation difficulties, while Windhorst was also unable to arrange sufficient financing.

Read more: H2O’s Crastes Faces Solo Future for London Fund Manager He Built

Tennor then reached another deal with H2O to restructure the outstanding bonds instead of buying them back. The new transaction includes the issuance of 1.45 billion euros of notes due next year to retire debt linked to companies owned by Tennor, according to a statement from Windhorst to business partners and clients last year.

Tennor was declared insolvent in the Netherlands in 2021, a ruling later reversed on appeal. At the end of 2021 H2O wrote down those notes by around 40% and acknowledged how little had been paid back so far and the Dutch court decision.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.