The JSE dropped significantly during morning trade on Wednesday while global peers were also down as markets awaited the US consumer price index (CPI) data but the local bourse began to tick up during the afternoon session along with its global peers.

US inflation slowed to 8.5% for the year through July, not a conclusive sign that price increases have turned a corner. The big question on everyone’s mind now will be how the US Federal Reserve will react to the news.

The New York Times writes investors are speculating that the Fed will likely “slow down its rapid rate increases.”

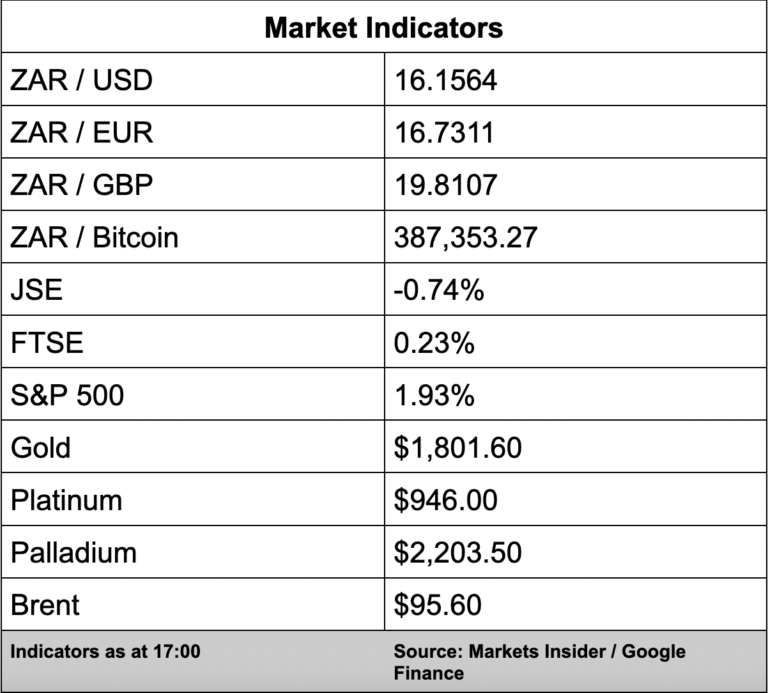

Back on the local front, the JSE recovered some of its losses during the afternoon session to close 0.74% down with the All Share Index at 69,745 points.

In the currency markets, the dollar weakened significantly against the rand following the release of the US CPI numbers with the local unit trading nearly 3% stronger against the greenback at the time of writing.

In company news, Nedbank (-0.45%) reported strong earnings results for the six months to the end of June with an interim dividend jumping above pre-covid levels.

The banking group reported a 27% jump in headline earnings to R6.7 billion driven by strong revenue growth of 11% to R30.5 billion, which has been supported by a growing client base. The bank declared an interim dividend of 783 cents, which is 81% higher year on year and back above the 2019 pre-pandemic half-year dividend.

Banking peers Standard Bank (-0.33%) also closed in the red while Absa (0.98%), FirstRand (0.27%), and Capitec (1.56%) finished in the green.