Global shares were mixed on Monday following a surprise interest rate cut from China. The Chinese central bank cut key lending rates to revive demand as the economy unexpectedly slowed down in July with the factory and retail activity affected by the government’s zero-covid policies and the continuing property crisis.

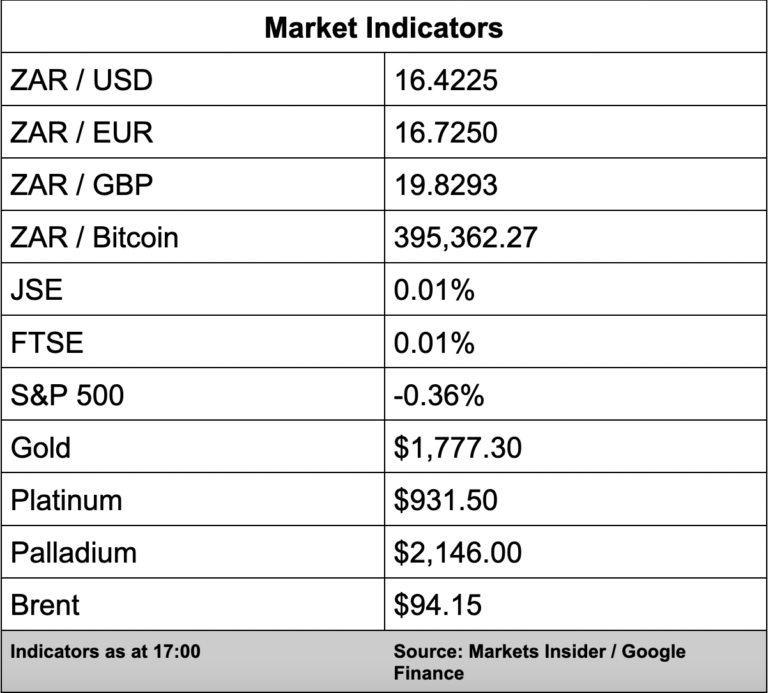

Following the news oil prices slumped 2% lower and are currently trading near 4% lower with brent crude oil at $94.15 a barrel.

Up until the rate cut from China, investors have been dealing with a hawkish sentiment from the US Federal Reserve and European central banks’ who continue to tackle inflation aggressively via interest rate hikes.

Meanwhile, on the local front, the SA Reserve Bank has also taken to hiking the repo rate significantly throughout the year.

The JSE eked out a tiny 0.01 gain to see the All Share Index close at 70,741 points.

Absa (1.15%) reported a 30% jump in headline earnings for the six months to the end of June while the bank’s half-year dividend has more than doubled to 650 cents a share.

Absa group chief executive Arrie Rautenbach said the bank continued to gain market share in targeted areas such as home loans but the bank has lost some of its primary banked clients. These are clients who deposit their salaries with Absa.

Look out later this week as banking peer Standard Bank (0.70%) is due to release its earnings results.

Thungela Resources (3.05% declared an interim dividend of R8.2 billion, or R60 per share, following a record half year in which profit rocketed on the back of strong export coal prices.