The JSE opened to positive Asian markets this morning but drifted into the red during trade on Wednesday with investors eyeing the US Federal Reserve minutes out later this evening.

Investors will closely scrutinise the minutes as they gauge where the Fed will go next for interest rates in the world’s largest economy. Recent economic data has arrested fears of more hefty rate hikes on the way but US policymakers have made it clear that there is still a need to rein in inflation.

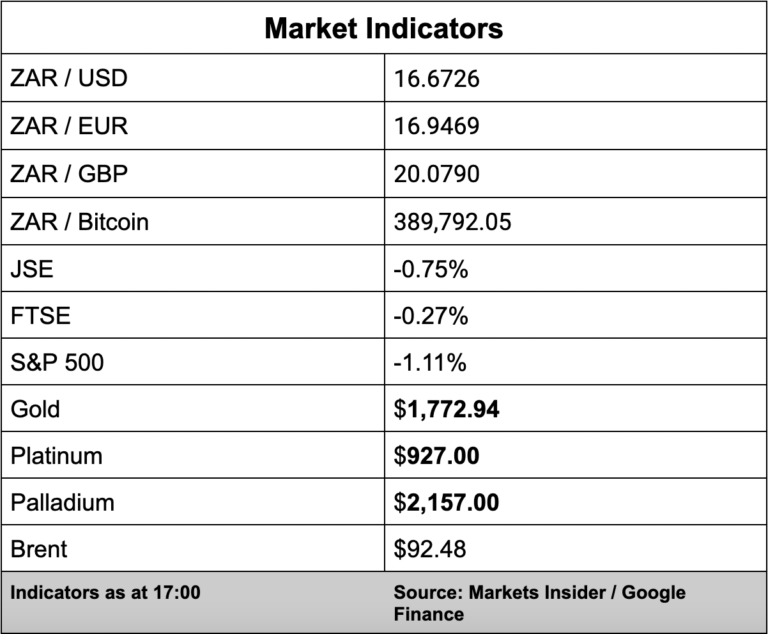

Brent crude oil fell to a six-month low on Wednesday and was trading at $91.90 a barrel around late morning but has since recovered some of those losses and is currently trading at $92.48 just over 0.3% down for the day.

Back on the JSE, the local bourse dropped 0.75% with the All Share Index closing on 70,967 points.

In company news, miner Sibanye-Stillwater (-5.87%) said it expected earnings per share and headline earnings per share to halve between 402 cents and 447 cents for the six months to the end of June compared with 843 cents during the first half of the previous year.

The decline will be between 47% and 52% with the company saying the decrease is due to several production problems as well as weaker commodity prices.

Reduced gold production from operations in the second quarter was due to a wage strike, which started on March 9 and was resolved on June 13.

Gold producer, DRDGold (-2.38%) said it will report a decline in earnings for the six months to the end of June as revenue declined while costs have increased. The group said headline earnings per share will decrease between 13% and 33%.

DRDGold is expected to publish its earnings report on August 24.

JSE heavyweight, Naspers (0.32%), said it wanted to start selling off shares in its subsidiary Prosus (1.65%) to start buying back its own shares.

“Subject to the requisite approval of the South African Reserve Bank (SARB) being obtained, Naspers intends to dispose of certain of the Prosus shares that it holds in order to continue to fund the repurchase of Naspers shares pursuant to the repurchase programme,” Naspers said in a SENS update.

Less than two months ago, Naspers and Prosus said they would begin offloading shares in Chinese tech giant Tencent to buy back their own shares.