As central banks battle to rein in soaring inflation, stock markets across the globe mainly traded down on Friday with investors focused on further aggressive interest rate hikes from central banks.

AFP reports that unease on the trading floors has come from several issues, including China-US tensions, the Ukraine war, supply chain snarls and extreme weather across much of the northern hemisphere.

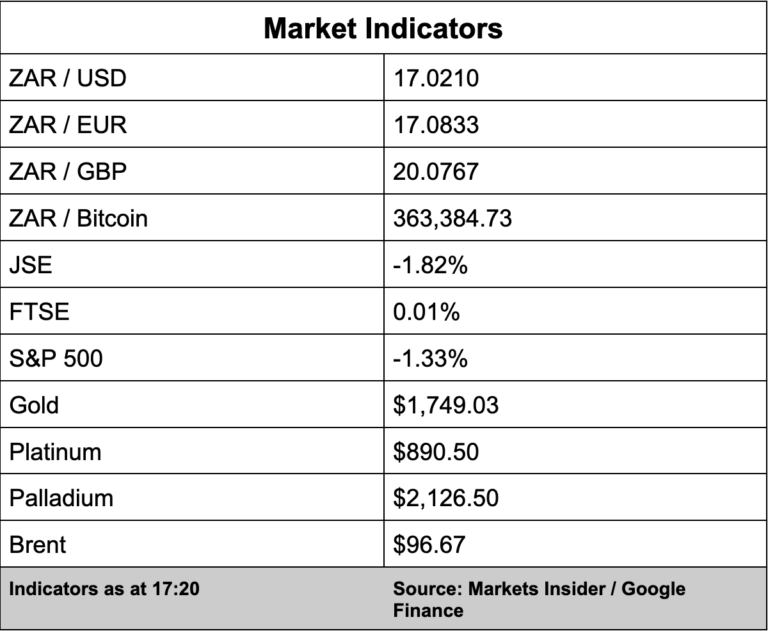

In the currency markets, the rand breached the R17/$ level on Friday afternoon with the local unit set close the week 5% down.

The rand faces a further challenge in the form of uncertainty over whether finance minister Enoch Godongwana will remain in his portfolio following a sexual harassment charge, which has plagued the minister all week.

The local unit is currently trading at R17.02/$.

Back on the JSE, the All Share Index slumped 1.82% to close the week on 69,719 points.

In company news, Standard Bank (-4.02%) posted record earnings during the first half of the year with the bank reporting a 33% jump in its headline earnings to R15.3 billion to the end of June.

The bank said revenue growth had exceeded internal expectations while increased transactional activity, strong trading performance and growth in the bank’s lending books saw non-interest revenue grow by 13% while net interest income increased by 15%.

Standard Bank’s overall revenue climbed by 14%.

Banking peers Absa (-2.73%), FirstRand (-3.59%), Nedbank (-3.52%), and Capitec (-1.87%) all closed in the red.

Restaurateur, the Spur Corporation (2.87%), said revenue had increased by 33% to R2.3 billion while sales at its franchise restaurants grew by 28%, which is slightly more than its 2019 pre-pandemic performance.

The flagship brand, Spur, which represents nearly 70% of its SA sales, increased sales by 30% for the six months to the end of June.