A sobering tone took over Wall Street after a rally that added $7 trillion to the stock market, with traders bracing for hawkish rhetoric from Federal Reserve officials at the Jackson Hole retreat later this week.

(Bloomberg) — A sobering tone took over Wall Street after a rally that added $7 trillion to the stock market, with traders bracing for hawkish rhetoric from Federal Reserve officials at the Jackson Hole retreat later this week.

Equities pushed toward their worst two-day rout since June, following a surge that drove the S&P 500 to its best start to a third quarter since 1932. Tech shares underperformed as Treasury 10-year yields topped 3% for the first time in a month. The Cboe Volatility Index, or VIX, soared. The move away from risky assets spurred further unraveling of the recent meme-stock frenzy. As the dollar rose, the euro succumbed to its lowest in two decades.

Jerome Powell’s speech on Friday will mark the highlight of the prestigious event in Wyoming’s Grand Teton mountains, which has been used by Fed chairs as a venue for making key policy announcements. He’s expected to reiterate the central bank’s resolve to keep raising rates to get inflation under control, but will probably stop short of signaling how big officials will go when they meet next month.

“He may try to send a clear message that even if they have a slower pace of rate hikes, that won’t signal a lower peak rate or that they will be quick to cut rates,” wrote Ed Moya, senior market analyst at Oanda. “After this week, Wall Street should not be surprised if Fed fund futures start pricing in rate hikes for next year. This could be the week many return from vacation and double-down on their bear-market rally calls.”

Hedge funds are unleashing record bets that the Fed will stick to its tightening script — as they rapidly position for higher interest rates in a key corner of the derivatives market. The cohort have placed a big short across futures referencing the official successor to Libor known as the Secured Overnight Financing Rate — which stand to benefit should Powell effectively rule out a dovish pivot.

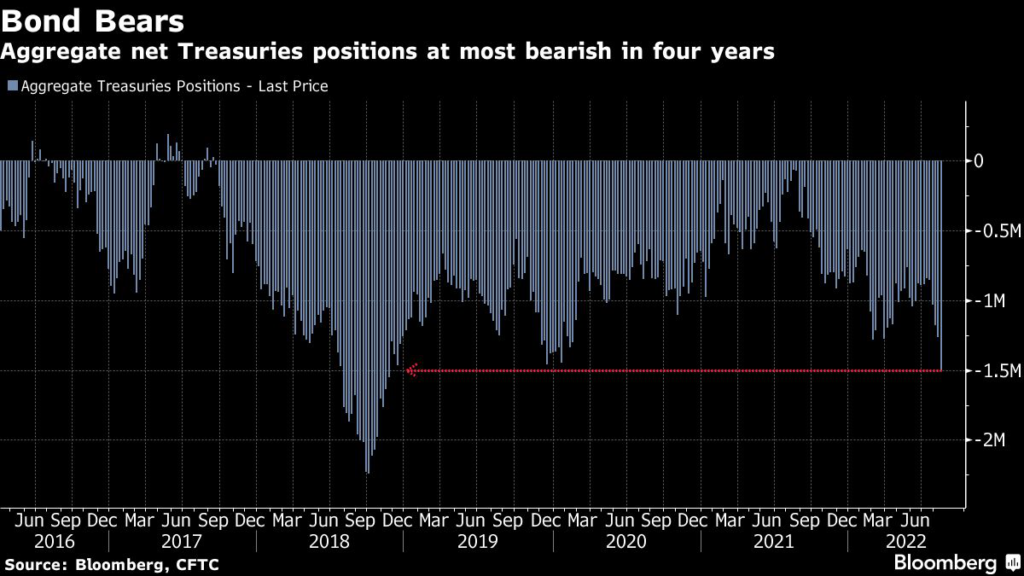

Meantime, bond bears are growing in confidence, taking heed of relentless messaging from Fed officials that the fight against inflation is nowhere near done. An aggregate gauge of net-short non-commercial positions across all Treasury maturities shows bearish bets have grown to the most since 2018, according to the latest data from the Commodity Futures Trading Commission.

Investors are also waking up to the looming acceleration of the Fed’s balance-sheet reduction. So-called quantitative tightening kicks into top gear next month, and will add to pressure on riskier assets which have benefited from ample liquidity. Strategists at Bank of America Corp. believe that the winding down of the central bank’s balance sheet could translate into a 7% hit to the S&P 500 next year, according to a note last week.

Read: Morgan Stanley’s Sheets Favors Cash as Bears Circle Equities

“With real rates still rising and prospects for 2023 rate cuts fading in the bond market, stock valuations look extremely stretched, especially if as we suspect, policy-driven economic slowing will prove an obstacle to currently optimistic 2023 earnings estimates,” Lisa Shalett, chief investment officer at Morgan Stanley Wealth Management, said in a note. “Stocks are overbought. Sit it out for now.”

Stocks and bonds are set to tumble once more even though inflation has likely peaked, according to the latest MLIV Pulse survey, as rate hikes reawaken the great 2022 selloff. Ahead of the Jackson Hole symposium, 68% of respondents see the most destabilizing era of price pressures in decades eroding corporate margins and sending equities lower.

As investors sought haven in the greenback, gold dropped for a sixth day. A stronger dollar and higher bond yields are bad for bullion as it pays no interest and is priced in the US currency. Oil slumped on the potential of more Iranian barrels entering the market alongside an expected slowdown in crude demand.

What to watch this week:

- US new home sales, S&P Global PMIs, Tuesday

- Minneapolis Fed President Neel Kashkari speaks at a Q&A session, Tuesday

- US durable goods, MBA mortgage applications, pending home sales, Wednesday

- US GDP, initial jobless claims, Thursday

- Kansas City Fed hosts its annual economic policy symposium in Jackson Hole, Wyoming, Thursday

- ECB’s July minutes, Thursday

- Fed Chair Powell speaks at Jackson Hole, Friday

- US personal income, PCE deflator, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 fell 1.6% as of 11:51 a.m. New York time

- The Nasdaq 100 fell 2.1%

- The Dow Jones Industrial Average fell 1.3%

- The Stoxx Europe 600 fell 1%

- The MSCI World index fell 1.5%

Currencies

- The Bloomberg Dollar Spot Index rose 0.6%

- The euro fell 1% to $0.9934

- The British pound fell 0.7% to $1.1748

- The Japanese yen fell 0.5% to 137.60 per dollar

Bonds

- The yield on 10-year Treasuries advanced five basis points to 3.02%

- Germany’s 10-year yield advanced seven basis points to 1.30%

- Britain’s 10-year yield advanced 11 basis points to 2.52%

Commodities

- West Texas Intermediate crude fell 0.9% to $89.92 a barrel

- Gold futures fell 0.8% to $1,749.40 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.