(Bloomberg) — Bitcoin may be poised for another downward move if a slew of technical insights are on the mark.

(Bloomberg) — Bitcoin may be poised for another downward move if a slew of technical insights are on the mark.

The largest cryptocurrency by market value has retreated more than 50% this year and recently has been sitting in a range of about $19,000 to $25,000, contained by tightening monetary settings. It was little changed at about $21,566 as of 6:51 a.m. in London on Thursday.

Options data show some investors are paying a premium for protection against a possible fall below the lower bound of the trading range. Seasonal patterns, meanwhile, peg September as a testing month for the digital token.

Here are four charts that bode ill for the original cryptocurrency:

Option Demand

Traders are paying a lot more for protection below $18,000. Implied volatility skew shows that traders are willing to pay elevated premiums for deep out-of-the-money puts — the jump is particularly steep closer to the $15,000 strike, which has the second-highest concentration of puts for the September expiry.

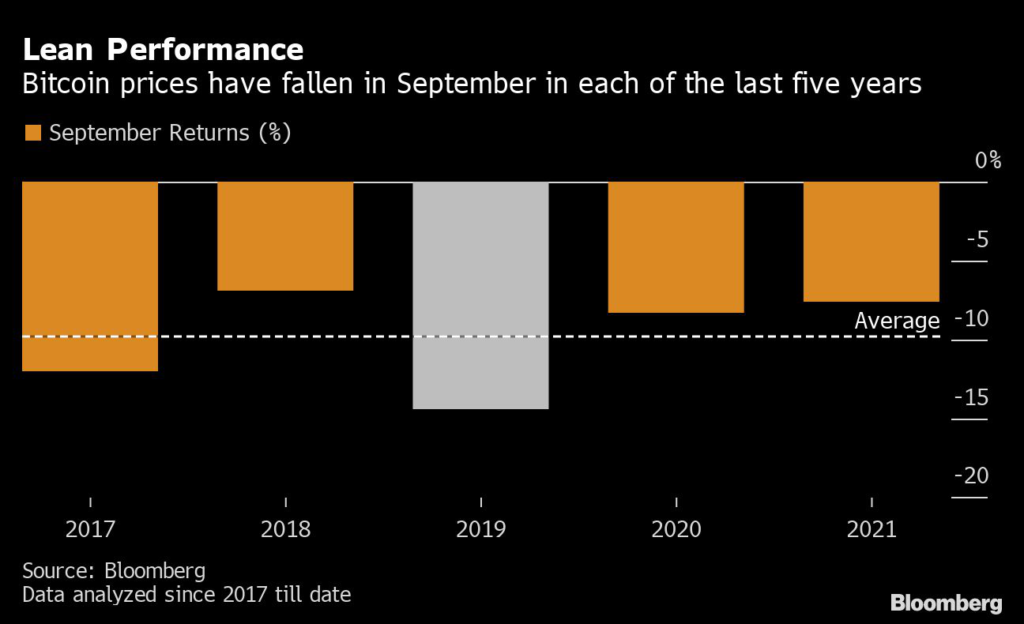

Seasonality

September tends to be the worst month for Bitcoin, seeing an average price drop of about about 10% over the last five years.

Open Interest

Data for options contracts expiring at the end of September show that $20,000 is the strike price with the maximum open interest, so a sustained break below there may force put sellers to hedge their positions, pressuring prices further and bringing the June lows back into focus.

Underperforming

Bitcoin has been lagging behind No. 2 token Ether, which recently got a lift from a coming software upgrade of the Ethereum network to make it more efficient. A ratio of the virtual coins’ prices is testing a zone of support, and a break below would suggest further Bitcoin underperformance.

(Updates prices from the second paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.