Klarna Bank AB went through one of the most dramatic “down rounds” in history last month as some investors took fright at its costly global growth spurt. The Swedish fintech will reveal next week whether they’re right to worry.

(Bloomberg) — Klarna Bank AB went through one of the most dramatic “down rounds” in history last month as some investors took fright at its costly global growth spurt. The Swedish fintech will reveal next week whether they’re right to worry.

The buy-now-pay-later giant, familiar to Gen Z and millennials as a way to spread the cost of online purchases, was Europe’s biggest startup with a value of $45.6 billion last year. It’s worth $6.7 billion today. Klarna and its 150 million-and-counting customers are facing budget pressures as the firm prepares to publish its half-year results.

“Rising rates due to higher inflation and liquidity drying up has stressed the BNPL business model and actually tested it for endurance,” said Anton Alikov, founder of New York-based Arctic Ventures, which holds shares in Klarna. The $800 million that Klarna just raised may not be enough to get the firm to profitability, he added.

With financial markets in upheaval after Russia’s invasion of Ukraine and supply chains strained globally, many companies have decided against raising money this year. Klarna took the plunge as it seeks worldwide expansion along with more sustainable operating costs, having announced in May that it would jettison 10% of its workforce to brace for the “likely recession.”

Cash Burn

Before its fundraising, Klarna was burning through cash. Its reserves dropped by 7.3 billion Swedish kronor ($685 million) to 11.6 billion kronor in the first quarter. At that rate, even with its recent cash injection, the firm would run out by the end of 2022.

Administrative expenses were 4.7 billion kronor in the first quarter, while credit losses were 1.2 billion kronor, both up steeply and contributing to a 2.6 billion-kronor loss for the period.

“The two big problems for Klarna are credit losses and administrative expenses — employee salaries, offices — the cost of actually running the business,” said Chris Dinga, a payments analyst at GlobalData. “I don’t see how they can be profitable while these expenses are so high.”

Still, the company’s backers are confident in its prospects. British growth fund Chrysalis Investments — which first invested in Klarna in August 2019 — said the recent funding round “does not reflect Klarna’s progress” in the past three years.

The firm has built a “dominant market position in several territories” and now has the capital to reach profitability, Richard Watts, co-portfolio manager, wrote in a note to his investors around the time of the downround. In a note this week Chrysalis said it had written down its investment by 78% but remained bullish.

Klarna Chief Executive Officer Sebastian Siemiatkowski said after the fundraising that the company was profitable for the first 14 years of its existence, noting on Twitter that the company has invested for growth in the US.

Default Factor

As Europe and the US face sustained pressure on living costs, borrowers are continuing to spend and successfully repay their debts for now. However, there are some signs of potential distress, such as customers using interest-free loans for essentials.

Michael Taiano, a fintech analyst for Fitch Ratings Inc. said there will be more demand for buy-now-pay-later on everyday purchases. “It’s a dangerous game — you see your loan volume pick up but if unemployment ticks up, this becomes defaults and that’s going to be a challenge,” he said. “We expect consumer delinquencies to increase and a lot of BNPL tends to play at the lower end of the credit spectrum, which is just more vulnerable to defaults.”

Klarna’s chairman, Michael Moritz, said in July that the business was at its strongest since his investment firm Sequoia Capital first invested in 2010. He blamed other venture capitalists for acting in the “opposite manner” during the fundraising after initially supporting the sector. “Eventually, after investors emerge from their bunkers, the stocks of Klarna and other first-rate companies will receive the attention they deserve,” said Moritz.

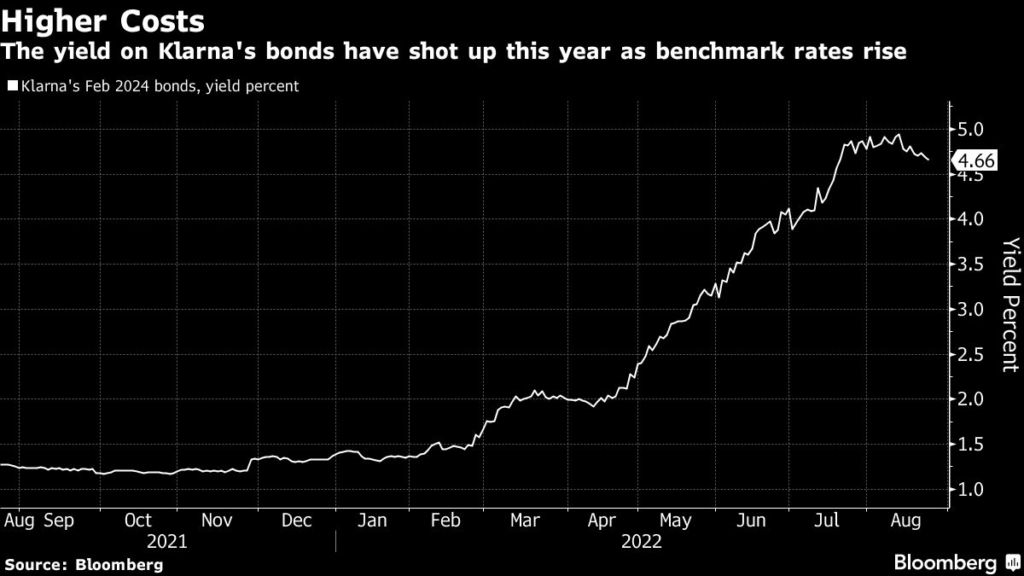

Others remain unconvinced that the buy-now-pay-later model will survive in its current guise, reliant on thin margins fuelled by cheap funding. Klarna offers interest free loans to customers and instead effectively charges the merchant anywhere between 2% and 4% — a decent margin when borrowing costs were on the floor. But in the past few weeks, the effective yield on Klarna’s February 2024 floating rate bonds approached 5%, according to data compiled by Bloomberg.

“They were able to benefit from a low interest rate environment and the cost of funding those loans was very, very low,” said Jeff Tijssen, head of global fintech at Bain & Co. “But rates have been rising quite significantly and they operate at razor thin margins. It’s fundamentally harder to build a profitable business that is sustainable.”

Klarna has cushioned itself from some of this risk by collecting deposits in savings accounts offered to customers in Sweden and German, which it can then use to fund credit. However, this backstop could also face challenges, in the form of more attractive rates offered by competitors as central banks raise benchmarks sharply to counteract inflation.

Meanwhile, the likes of JPMorgan Chase & Co. and Apple Inc. in the US and NatWest Group Plc, Barclays Plc and HSBC Holdings Plc are entering the market with similar products.

“The competitive landscape has changed dramatically,” said Tijssen. “If you’re a pureplay BNPL firm, the future is very, very challenging.”

What Bloomberg Intelligence Says:

Klarna, Revolut, Monzo and Starling epitomize the breadth of product offerings and growth, now slowing rapidly, that fintechs have delivered. Future fundraisings and updated business plans must focus less solely on growth and incorporate efficiency, with down rounds — when a company raises funds by selling shares valued lower than previous raisings — still likely.

Jonathan Tyce, senior analyst, European banks and payments

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.