Global markets tracked higher on Thursday with the focus shifting to the US Fed as it starts its annual monetary policy conference on Friday.

Investors will be keenly watching for Federal Reserve chairperson Jerome Powell’s comments and how much higher the Fed will hike interest rates this year if inflation keeps on rising in the United States.

European markets breathed a sigh of relief as Germany narrowly missed a contraction in its economy while Asian markets tracked US markets stronger overnight.

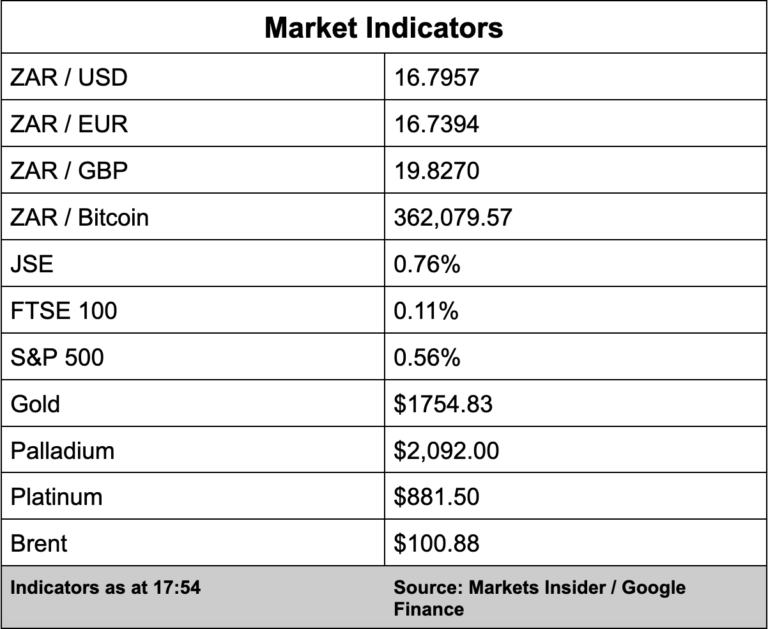

The local bourse added 0.76% with the All Share Index closing at 70,341 points.

There was another slew of company results released today on the JSE SENS news service.

Gold Fields (-1.25%) said its half-year profit was up by 29% and driven largely by higher metal prices and increased production. Headline earnings per share are up to $0.58 for the six months to the end of June compared to $0.45 a year earlier.

South32 (1.65%), which has a diversified metals portfolio in Australia, Southern Africa and South America said profit for the 12 months to the end of June increased to $2.6 billion, which is up from the $489 million the year before.

Sibanye-Stillwater (3.78%) profit slumped a massive 51% to just R12.3 billion, down from a record level last year. Its half-year profit performance is still the third largest on record. Weaker gold and platinum prices hampered the group while disruptions at its South African gold and US operations also had an effect.

Distell said its revenue was back above pre-pandemic levels with the liquor producer reporting revenue of R34 billion, an increase of 21% while headline earnings are up 37% compared to 2021.

Mobile network operator Cell C took a hit after major shareholder Blue Label Telecoms (-0.96%) reported a 5% decline in revenue to R13.4 billion at the end of May while it suffered a net loss before taxation of R2.3 billion.