China stocks listed in the US surged by the most in more than two months as talks between both countries to avoid delisting of companies on the New York Stock Exchange ramp up.

(Bloomberg) — China stocks listed in the US surged by the most in more than two months as talks between both countries to avoid delisting of companies on the New York Stock Exchange ramp up.

The Nasdaq Golden Dragon China Index jumped as much as 6.5%, the most since June.

Bloomberg News reported regulators in China have told accounting firms to be ready to bring audit paperwork for US-listed Chinese companies to Hong Kong, where it can be reviewed by the US Public Company Accounting Oversight Board, a person who asked not to be identified as the discussions are private.

The

Shares of US-listed tech giants including Alibaba Group Holding Ltd., JD.com Inc. and Pinduoduo Inc. all rose at least 9% Thursday. Meanwhile, NetEase gained 5.1%, while electric-vehicle makers Nio Inc.

and Li Auto Inc. added 6.5% and 4.2% respectively.

The PCAOB declined to comment, while the China Securities Regulatory Commission and the US Securities and Exchange Commission didn’t immediately respond to requests for comment.

The Wall Street Journal has reported on this matter earlier.

“This is a fascinating development,” said Ed Moya, senior market analyst at Oanda Corp. “An official confirmation is needed but expectations were growing that this would get done as both countries are dealing with economic fragility,” he added.

Read more: US-China Talks on Delistings Advance With Hong Kong Inspections

Such a move would be a major step toward alleviating fears of mass forced delisting of US-listed Chinese stocks, something that has weighed on shares for more than a year.

Earlier this month, China Life Insurance Co., PetroChina Co. and China Petroleum & Chemical Corp. were among a group of state-owned companies that announced plans to delist from American exchanges.

Dow Jones reported on the news earlier.

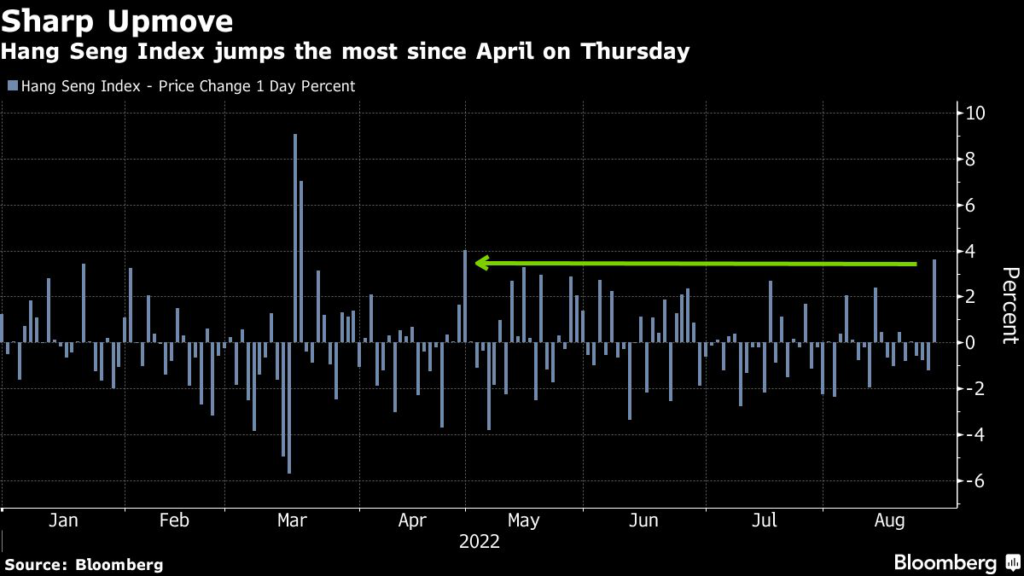

The rally in US trading follows what was the best day in nearly four months for Hong Kong’s Hang Seng Tech Index, which rose 6% on Thursday. That helped lead the city’s benchmark Hang Seng Index to a 3.6% gain, making it the best performer among Asia’s major equity gauges.

In addition to the Chinese government’s 1 trillion yuan ($146 billion) of support for the economy, traders cited short covering and an adjustment of positions ahead of Jackson Hole.

“Whether or not the rumor on an audit deal is true, Hong Kong shorts have pressed their bets in a light summer tape,” said Brendan Ahern, chief investment officer at Krane Fund Advisors LLC.

“We have been setting up for an epic short squeeze that is contributing to today’s move.”

Stocks in Hong Kong had slumped to the lowest in months this week, as global risk-off sentiment spread ahead of the Federal Reserve’s Jackson Hole symposium.

Concerns over China’s economic growth, with a deepening property crisis and power shortages spurred by a severe drought, had added to the gloom.

Following three days of losses, the Hang Seng Index was also looking ripe for a rebound to some market watchers based on various technical indicators.

The gauge was near “oversold” levels on monthly measures of the relative strength index, approaching the 30-threshold that’s never been reached in data going back to 1972. Morgan Stanley strategist Gilbert Wong said “the risk of short squeeze in China and Hong Kong equities is rising.”

(Adds details throughout, quote in ninth paragraph, updates pricing.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.